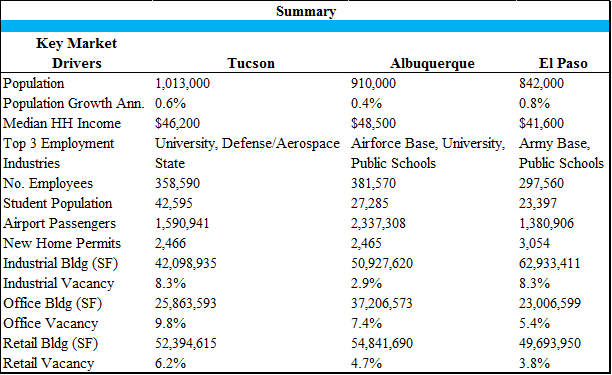

The purpose of this report is to show the strengths and weaknesses of Tucson, Arizona and its sister cities, Albuquerque, New Mexico and El Paso, Texas. The three cities are sisters since they have many commonalities including climate, population size, and each city having a military base and a university. The stats and data shown herein are used to illustrate the bigger picture and may not reflect exact figures.

Tucson, Arizona

Tucson is about 60 miles north of the US-Mexico border and about 100 miles south of Phoenix, Arizona. The metropolitan population is about 1.01 million but the 2010 US Census Bureau reports a population of 520,000. Major industries in Tucson include Defense/Aerospace, Healthcare, and mining. Tucson does have a minor league hockey team but the most followed teams are associated with the University of Arizona. The current real estate trends include the build-up of downtown with new office buildings, street-car, student housing, hotels, restaurants, and retailers. The recent announcement of Caterpillar building a 150,000 square foot office in downtown and hiring about 600 high paying jobs is anticipated to be an additional growth catalyst for the city.

There are other industries growing in Tucson, HomeGoods recently constructed an 800k square foot distribution facility, FedEx recently built a large distribution facility, and Comcast leased a large call center space. Potentially, there is a large copper mine to the southeast of Tucson, but this has been pending for several years, awaiting county, state, and federal permits.

An on-going issue with Tucson as well as the other two cities is having water availability. Tucson is currently heavily dependent on the Central Arizona Project (CAP) canal for water, which may be less available in the long-term. However, the water table is currently up from prior years. Other options will have to be visited in the near future in order for Tucson to grow at a sustained rate.

The major difference between Tucson and its sister cities is that it is in the shadow of a much larger city. The Phoenix metropolitan area is about 4 million people and has sports venues, a legitimate international airport, corporate industries, loop freeways, and a light rail line. This is both a benefit and a detriment to Tucson.

Albuquerque, New Mexico

Albuquerque is about 300 miles north of El Paso, 400 miles northeast of Phoenix, Arizona, 400 miles south of Denver, 450 miles northeast of Tucson, and 600 miles east of Las Vegas. The metropolitan population is about 910,000 and the 2010 US Census Bureau reports a population of about 546,000. Major industries in Albuquerque include Defense/Aerospace, Healthcare, and manufacturing.

Albuquerque is the hub for New Mexico and has a rich culture. The city has a strong central downtown core, four seasons, a minor league baseball team, and an indoor football team. Like Tucson, Albuquerque has a revitalized convention center known as Tingley Coliseum. Albuquerque is served by two interstates, also like Tucson. The city does have similar water issues as Tucson but the water table is up from past years due to active water conservation and reclamation efforts.

Albuquerque has a newer light rail line, traveling north-south through the city to Santa Fe, about 60 miles to the north. The light rail connects with the Albuquerque Airport, Belen to the south, and Santa Fe to the north. New retail and residential development is occurring on the west side of the city. The city generally grows to the west given the surrounding public lands and geography of the land to the north and east. The revitalization of downtown is continuing with a new arts district on Central Avenue, technology district with collaborative work space, and student housing. Albuquerque is also known to be welcoming towards the film industry.

El Paso, Texas

El Paso, Texas is about 300 miles south of Albuquerque and 300 miles east of Tucson. The metropolitan population of the city is about 830,000 and the 2010 US Census Bureau reports a population of about 650,000. Major industries in El Paso include manufacturing, cold storage, and call centers. The El Paso economy is largely based on how well and how safe Ciudad Juarez is at any time. El Paso also benefits from its vicinity to the border and despite its rowdy neighbor Juarez, El Paso is one of the safest cities in the United States.

Recent trends in El Paso include a downtown that is being revitalized with new hotels, housing options, mixed use developments and repurposing of buildings. There is also about a $97 million streetcar project that will run about 5 miles, from downtown to the university. The city is growing on the east and west ends with new residential and retail developments. There is also a proactive local developer who has been repurposing historic properties throughout the city. The area near Fort Bliss is also seeing new retail and residential development. El Paso is also ahead of the curve with regards to water treatment, as they recently completed and are utilizing a desalination plant. The water is drawn from the nearby Hueco Bolson. Overall, the market appears to be steadily growing and improving.

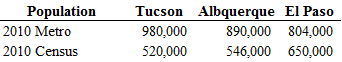

Population Statistics

The populations of the three metropolitan areas are similar. However, the 2010 census numbers are much lower. This is simply the result of city limit area. Tucson is 227 square miles, Albuquerque is 190 square miles, and El Paso is 256 square miles. All three cities are spread out, accounting for the large difference in metropolitan population versus census figures. The population of each city is shown in the following table.

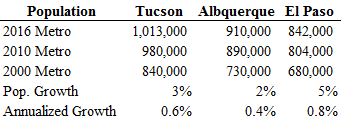

Population Growth

The populations of all three cities have grown by a small amount from 2010 to 2016. Albuquerque has grown at slow pace of 0.4% annually while Tucson and El Paso have grown only slightly faster at 0.6% and 0.8%. These three cities were growing at faster rates from 2000 to 2010, at 1.7% to 2.2% annually.

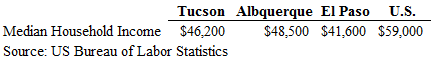

Median Household Income

The U.S. median household income is $59,000 in 2017. All three cities have a lower median household income than the national median. The positive sign is that all three cities have posted an increase in median house household income from three years ago. The lower wages are attributed to the vicinity to the border and inexpensive living costs. Unfortunately, there are also concerns with high rates of poverty in all three cities.

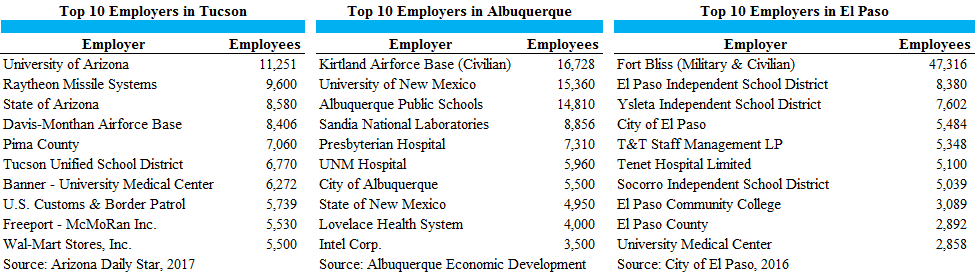

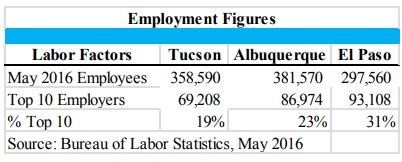

Top 10 Employers

The top 10 employers in Tucson account for over 69,000 jobs. In Albuquerque the top 10 employers account for almost 87,000 jobs, and about 93,000 jobs in El Paso. The Albuquerque figures are from 2013 but this is the newest available as they are reportedly working on new figures. A military base is one of the top 4 employers in each of the sister cities, and a State University is one of the top 10 employers in each of the cities. Government entities account for the majority of the jobs. Of the three cities, Tucson has the most private employers in the Top 10 with Raytheon, Banner, Freeport, and Wal-Mart. It is noted that Wal-Mart had about 7,500 employees in 2013 and has shrank to 5,500 employees in 2017. In addition, the Intel Corp. figure of 3,500 in 2013 is also much smaller 2017, by approximately 700 employees. On the other hand, El Paso has the largest number of public employers with Tenet Hospital Ltd being the only private employer in the Top 10.

The top 10 employers account for 19% of the total workforce in Tucson, 23% in Albuquerque, and 31% of El Paso’s. Albuquerque has the largest number of employees, followed by Tucson and then El Paso. This is a big shift from three years ago where Tucson had about 427,000 employees with Albquerque at 365,000 and El Paso with slightly more at about 302,000. Formerly, the number of employees correlated with the cities populations. Now it seems that Albuquerque has defied the odds and has a larger workforce per capita than Tucson, the larger city. The Tucson labor force is considered less risky than their counterparts since the top 10 employers account for the fewest number of total jobs.

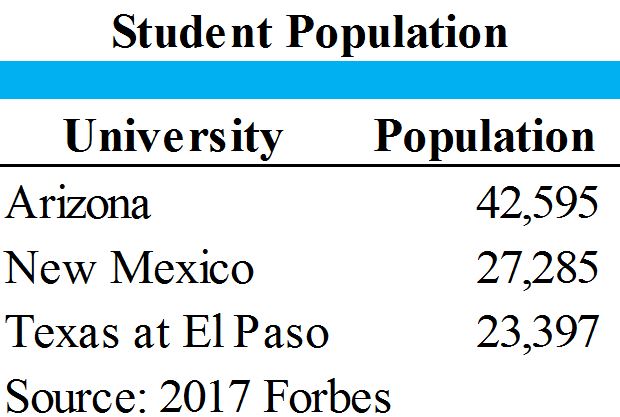

Student Population

All three cities have a State University with a significant impact on the local economy. The University of Arizona (UA) is the largest and has an impact on the local economy and politics. The University of New Mexico (UNM) and Texas at El Paso (UTEP) also have a significant positive impact on their respective communities. From four years ago, the UA has grown the most, while UTEP remained similar and UNM slightly declined. The table below shows the population of the three universities.

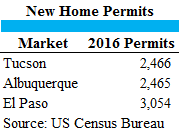

new home permits

The number of new home permits includes single family and multi-family residences. The three cities have about the same number of new home permits with El Paso showing a slightly higher figure. The amount of new permits shown by each city shows a steady but sustainable growth rate.

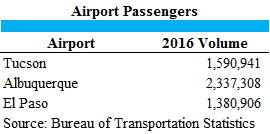

Airport Statistics

The three airports vary greatly in arrival/ departure statistics. The main reason Albuquerque’s traffic volume is much higher is that the city is distant from surrounding metropolitan areas. Albuquerque also receives a greater amount of volume from tourists traveling to nearby cities in the northern part of state, including Santa Fe and Taos. Tucson posts smaller figures since it is close to Phoenix’s airport, which has more travel options and often offers lower prices. The airport traffic statistics are shown in the following table.

Building Type Breakout

Next, I will discuss the industrial, office, and retail markets for each city. This is important in illustrating each community’s strengths and where they can improve.

Industrial

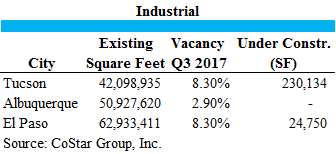

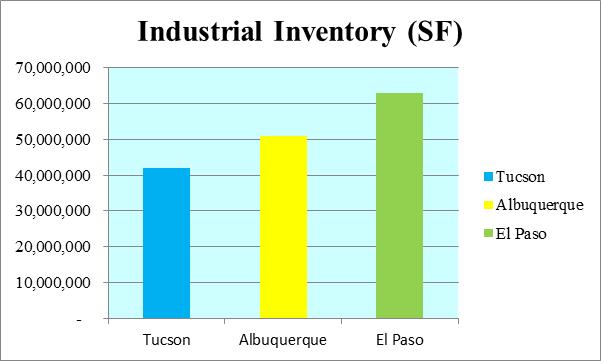

The industrial market is a good indication of manufacturing, production, distribution, and supply of a particular market. As shown in the table and graph below, El Paso has the largest industrial market. This is primarily due to the city’s location along the US-Mexico border. Albuquerque has the second largest industrial market. The reason for this is that the Albuquerque is distant from surrounding cities. Therefore, it is more desirable geographic location for the distribution hubs and supply centers in between larger cities in the western United States, such as Los Angeles, Denver, Phoenix, and Oklahoma City. Tucson has the smallest industrial market which is primarily due to Phoenix being 100 miles to the north with a larger population, airport, and vicinity to surrounding cities. However, Tucson’s industrial market has grown the most in the past three years with about 2.2 million square feet of new space versus about 330k square feet in Albuquerque and 1.05 million square feet in El Paso. The vacancy rate in all three cities has significantly declined, especially in Albuquerque which was 7.8% in 2014 and is now below 3%. The vacancy in Tucson dropped from 11.3% in 2014 to 8.3% in 2017, while El Paso’s rate dropped from 12.1% to 8.3%.

Office

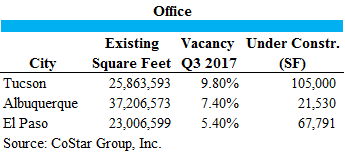

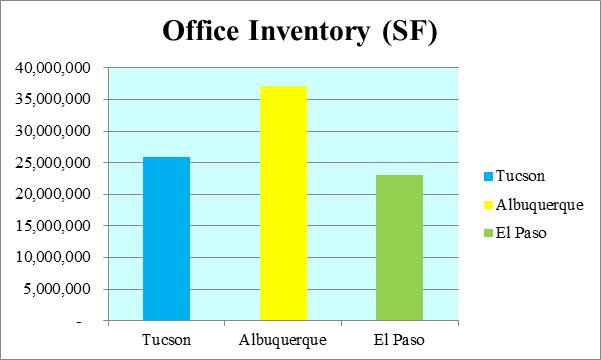

The office market represents the corporate and small business market, financial strength, and production of a city. Albuquerque has the largest office market of the three cities. Once again, this is due to Albuquerque serving as a hub for New Mexico. Tucson has a smaller office market and this is due to Phoenix serving the large corporations in the region. El Paso has the smallest office market with most jobs in the area going to the industrial markets. However, El Paso’s office market has grown the most in the past three years with about 1.67 million square feet of new space versus about 1.54 million square feet in Tucson and 61k square feet in Albuquerque. The vacancy rate in all three cities has significantly declined, especially in Albuquerque which was 11.3% in 2014 and is now at 7.4%. The vacancy in Tucson dropped from 12.8% in 2014 to 9.8% in 2017, while El Paso’s rate dropped from 7.5% to 5.4%.

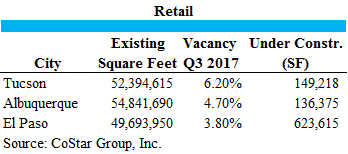

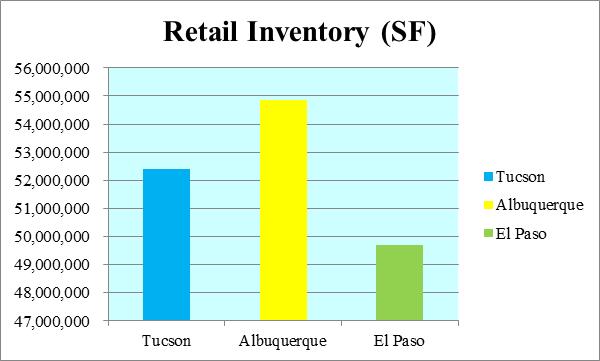

Retail

The retail market represents expenditure income, tourism, and also the contributions related to the retirement and student populations. It is noted that there is a large influx of shoppers from Mexico seeking higher end products and a ‘shopping experience’ in all three cities but primarily El Paso and Tucson. Albuquerque has the largest retail market of the three cities. Once again, this is due to Albuquerque serving as a hub for New Mexico. Tucson has a similar sized retail market and this is due to Tucson’s vicinity to the US-Mexico border, and large retirement and student populations. El Paso has a smaller but similar sized retail market, this is due to El Paso’s vicinity to the US-Mexico border. However, El Paso’s retail market has grown the most in the past three years with about 4.06 million square feet of new space versus about 2.59 million square feet in Tucson and 1.21 million square feet in Albuquerque. The vacancy rate in all three cities has declined with Albuquerque showing the largest drop of 1.8%. The vacancy in Tucson dropped from 6.6% in 2014 to 6.2% in 2017, while El Paso’s rate dropped from 5.1% to 3.8%.

Conclusions

The three cities serve a similar demographic population, with military personnel, students, and retirees. The communities are similar in size and unsurprisingly have a similar sized industrial, office, and retail markets. All three cities have a downtown that is under revitalization, a civilian transportation system that was recently completed or under construction that runs on rails, and are actively managing water concerns. The markets are considered to be in a period of slow but steady growth. By statistic figures, Albuquerque appears to be in the best geographical position and has capitalized on its strengths. Albuquerque has low vacancy rates across the three property types analyzed but has also been the slowest to add inventory. Albuquerque also has the highest airport volume and median income of the three cities. Overall, Albuquerque benefits from being the hub of New Mexico, good weather, and having low vacancy rates for the three major property types. Tucson has done a good job of catering to the university market. Because Tucson is the largest of the three cities and has the largest university of the three cities, it has the potential for a more educated community. Tucson benefits from its vicinity to the border, and could benefit from its vicinity to Phoenix, especially if we had a connecting light rail system. Tucson could serve as a warehousing market for Phoenix companies or offer minor league sports and training programs to support the professional teams in Phoenix. Tucson could improve on catering to industry and collaborating with Phoenix. Tucson could offer tax incentives, political cooperation, and improved infrastructure to cater to existing and potential employers. Tucson has the great potential for growth with a large population base and student population but suffers from being in the shadow of a larger city. El Paso appears to have captured the US-Mexico border business such as cold storage and retail, while catering to large manufacturers and call centers to grow local jobs. The city’s safety is also appealing for growth and existing citizens. Overall, El Paso has capitalized upon its location along the US-Mexico border, its large military base and is well positioned in the market.

All three cities are similar, with each having their own strengths and weaknesses, but are overall comparable metro areas. There is a long-term trend for all three cities that could be concerning in the future. The growth rates for all three cities have slowed down from 2000-2010 levels. Some smaller to mid-size cities have been left behind some larger metropolitan areas since the economic recession in 2008-2011. Larger metropolitan areas such as Washington D.C., Orlando, Dallas, Austin, Denver, Atlanta, Seattle, Phoenix, and San Francisco have been growing at a much higher rate in the past few years. These larger metropolitan areas attract young professionals because they offer more job opportunities, amenities, and greater variety. This trend could change, as these three sister cities offer sunny weather, affordability, outdoor activities, and are less likely to be impacted by natural disasters. These three cities are currently but could market their strengths better to attract younger talent.

Summation of Sister City Key Comparison Take-Aways

Recommendations

The three sister cities may already be in the process of following these recommendations but there is no harm in repeating them. The cities could coordinate with one another and build alliances to serve a network for manufacturing and distribution. In order for a city to be appealing, the fundamentals come into play. This includes having a safe and clean place to live, good education, and strong youth programs. A legislation and political system that is cooperative with the community and surrounding communities is also key for all three cities.

The cities could also have water issues going into the future so this could be an opportunity for the cities to team up. The cities will likely be reusing (not recharging) their water in the future so the sooner the infrastructure is in place, the better. El Paso appears to be ahead of the other two cities in this regard, but it is still better to have a diversity of water options. Another option would be to pipe in water from an area with a surplus of water. The cities could invest on a pipeline structure together.

Lastly, these sister cities could offer better infrastructure. The core in each city would benefit from underground electricity lines, public transit systems, adding more efficient routes, and nicer roads. All three cities benefit with a high amount of sunny days. Solar energy on a large scale has been in-progress for the sister cities, but will continue to grow with public support. By building and expanding their fiber optic and wi-fi networks, the overall value of the city would increase. Most cities typically have an area where government offices are centrally located and another area where corporate employers are located. As such, both areas would benefit from such services. This type of infrastructure is required by most corporate employers before locating to a city. Therefore, these cities would be more appealing to employers to relocate.

The purpose of this analysis is to show the strengths and weaknesses of the three cities. The primary goal is to help achieve an improved quality of life for each. The secondary goal is to have a long-term sustainable future and to grow demand in the region. Growth is typically perceived as a positive thing. However, growing smart with a long-term plan serves a greater purpose and provides even greater benefits to a region.

Ajay S. Madhvani is owner of AM Valuation Services, PLLC and has been a commercial real estate appraiser since 2004. Ajay has experience in commercial property types including multi-family, industrial, retail, office, residential subdivisions, land, tribal land, self-storage, and several other types of commercial real estate. Ajay has also performed large project appraisals throughout the southwest United States.

Ajay S. Madhvani is owner of AM Valuation Services, PLLC and has been a commercial real estate appraiser since 2004. Ajay has experience in commercial property types including multi-family, industrial, retail, office, residential subdivisions, land, tribal land, self-storage, and several other types of commercial real estate. Ajay has also performed large project appraisals throughout the southwest United States.