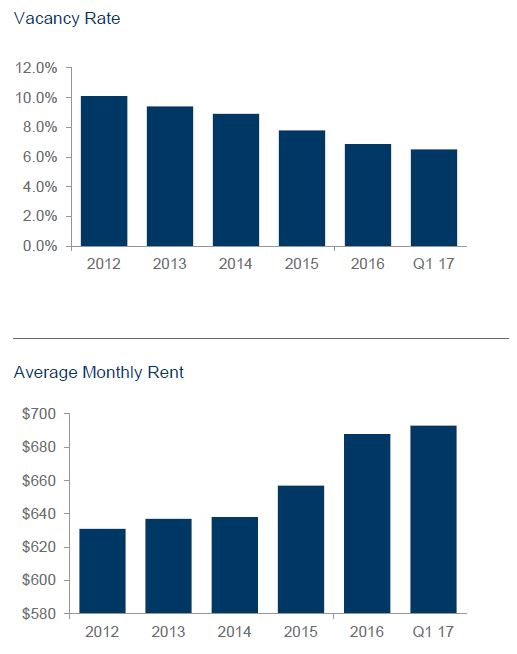

In Tucson’s apartment market, the vacancy rate for conventionally-operated, stabilized units decreased by 0.35% from the previous quarter, while improving 0.28% from one year ago to 6.52%. Eight of Tucson’s 15 submarkets experienced occupancy gains, with the greatest improvements occurring in Tucson Mountain Foothills (-2.12%) and South Tucson/Airport (-2.09%).

The Northwest Tucson submarket posted the lowest fourth quarter vacancy of 5.24%. The submarket with the second lowest vacancy was the Catalina Foothills at 5.45%, followed by East Tucson at 5.50%. The highest vacancy rate of 17.56% occurred in the Southeast Tucson submarket.

Overall net absorption in Q1 2017 increased by 472 units. Over a one-year period, Metropolitan Tucson experienced an 808-unit increase in absorption. Northwest Tucson saw the greatest improvement (252 units) while Southwest Tucson suffered the largest decline, with negative absorption of 47 units.

The average monthly gross apartment rent without utilities in Metropolitan Tucson was $693 per unit or $0.94 per square foot for the first quarter, representing a $5 or 0.73% increase from last quarter. Thirteen arms-length transactions over 40 units closed in Q1 2017. The average sales price was $42,065 per unit or $72.92 per square foot.

Outlook

The first quarter of 2017 continued to see increased investor interest in the Tucson marketplace. Numerous syndication groups entered the Tucson marketplace intending to build large portfolios over the next few years. Tucson remains one of the more attractive multifamily investment locations due to the increase in quality jobs and higher cap rates. Development of infill properties around downtown Tucson and University of Arizona has surged recently. Investors have been targeting well-positioned assets and fully renovating various properties. Rents have doubled and even tripled at some of these locations.

The first quarter of 2017 continued to see increased investor interest in the Tucson marketplace. Numerous syndication groups entered the Tucson marketplace intending to build large portfolios over the next few years. Tucson remains one of the more attractive multifamily investment locations due to the increase in quality jobs and higher cap rates. Development of infill properties around downtown Tucson and University of Arizona has surged recently. Investors have been targeting well-positioned assets and fully renovating various properties. Rents have doubled and even tripled at some of these locations.

{{cta(‘3aea6034-7e2d-42bc-950b-f65bd1ad4d92’)}}

ECONOMY

Arizona’s economy closely follows the national trend, calling for continued growth through 2017. Arizona expects continued gains in jobs, residents, and income at a rate exceeding the national average. Recent announcements by Caterpillar, Vector Industries, Raytheon, Comcast and Ascensus are strong indicators of this trend. Tucson is expected to add over 10,000 jobs in the period from Q2 2016 through Q2 2017. While focusing on past and current performance, businesses in the region will maintain a watchful eye toward broader factors such as regulatory policy, immigration, trade, value of the dollar, and potential federal tax reform. As a border state, positive trade relations with Mexico remain crucial to our economy. Finally, the impact of the new minimum wage ordinances recently passed in Arizona, among other states, will reveal a clearer picture of what to expect in the coming months.