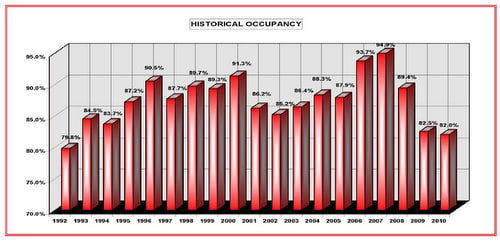

In 19 years tracking the Tucson industrial market, business park occupancies peaked in 2007 at 94.9%. What does the 2010 trough of 82.0% (second only to 1992 by a hair) tell us about the state of business expansion and contraction in the Tucson industrial sector, and is it a microcosm of national market conditions?

National trends hitting home

Answering the second question, Tucson’s industrial markets are impacted by national and international (Mexico) fundamentals such as inventory growth, manufacturing expansion, housing absorption, job growth and consumer confidence.

Business expansion and contraction

One key measure of the industrial market’s health is the relationship between business growth and contraction. Is our industrial market activity due to growth in business, demand for products or more closely related to growth due to reduction in expenses, workforce, and inventory reduction?

The pendulum swings

Where are we in this market cycle? Looking back 18 months to the depths of the recession, 95% of lease activity was contraction-related, with large companies leading the charge. Texas Instruments downsized from 280,000 sf to 100,000  sf, Unified Brands closed a 103,000 sf facility and consolidated to their Michigan plant, and Honeywell closed their 66,000 sf plant.

sf, Unified Brands closed a 103,000 sf facility and consolidated to their Michigan plant, and Honeywell closed their 66,000 sf plant.

Today we have shifted to about 70% contraction activity and 30% expansion, with the trend line moving in the right direction. Smaller firms are the first to expand, as even minimal hiring impacts space needs, while large companies still have shadow space to absorb.

We predict another 12-18 months to cross the 50/50 mark, moving closer to a balanced market between landlord and tenant. True balance would likely require a shift to approximately 65% expansion.

The upside

With a healthier shift toward industrial and manufacturing expansion, improvement in consumer demand, and increased job growth, lease rates will stabilize, and eventually increase as we approach a more expansion-oriented market. Tenants and Landlords should keep a close eye on which way this expansion/contraction pendulum is swinging.

Robert Glaser has 33 years experience in the Tucson real estate market. He has been with PICOR Commercial Real Estate for the past 25 years and is the firm’s Top Producer and a principal specializing in industrial real estate. Rob is recognized as one of the top in his field and is one of only three Tucson commercial brokers who hold both the CCIM and SIOR designations. He has a high level of expertise in business park sales and leasing, as well as industrial land and building sales. He is a past president of the Southern Arizona CCIM Chapter and Southwest Region SIOR Chapter.

Tucson real estate market. He has been with PICOR Commercial Real Estate for the past 25 years and is the firm’s Top Producer and a principal specializing in industrial real estate. Rob is recognized as one of the top in his field and is one of only three Tucson commercial brokers who hold both the CCIM and SIOR designations. He has a high level of expertise in business park sales and leasing, as well as industrial land and building sales. He is a past president of the Southern Arizona CCIM Chapter and Southwest Region SIOR Chapter.