To read the full report on Tucson’s industrial activity in Q3, click here.

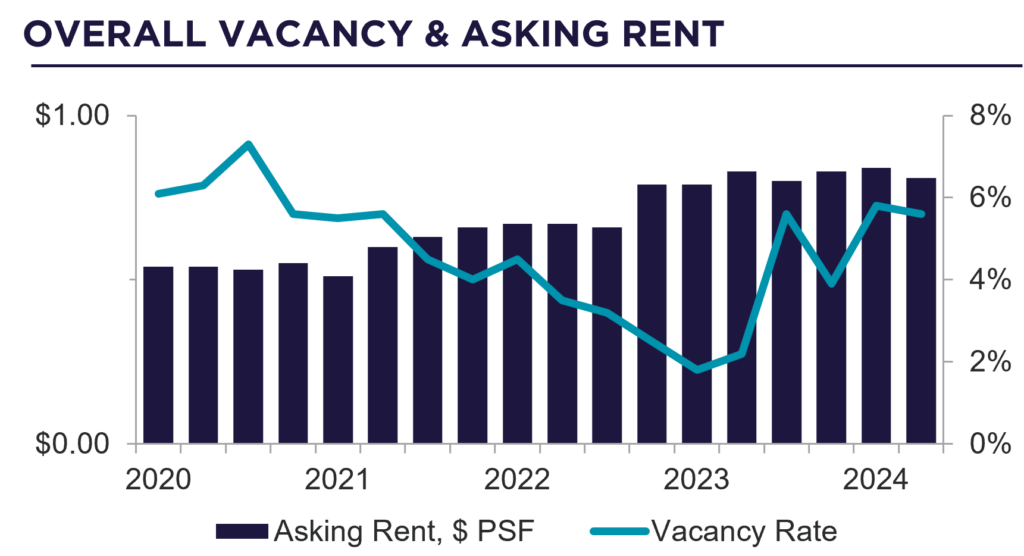

Tucson’s industrial market remained tight in Q3 2024 with a vacancy rate of 5.2%. With the limited vacancy in the market, the cost of new construction is pushing lease rates upward, with more pressure on spaces less than 20,000 square feet (sf).

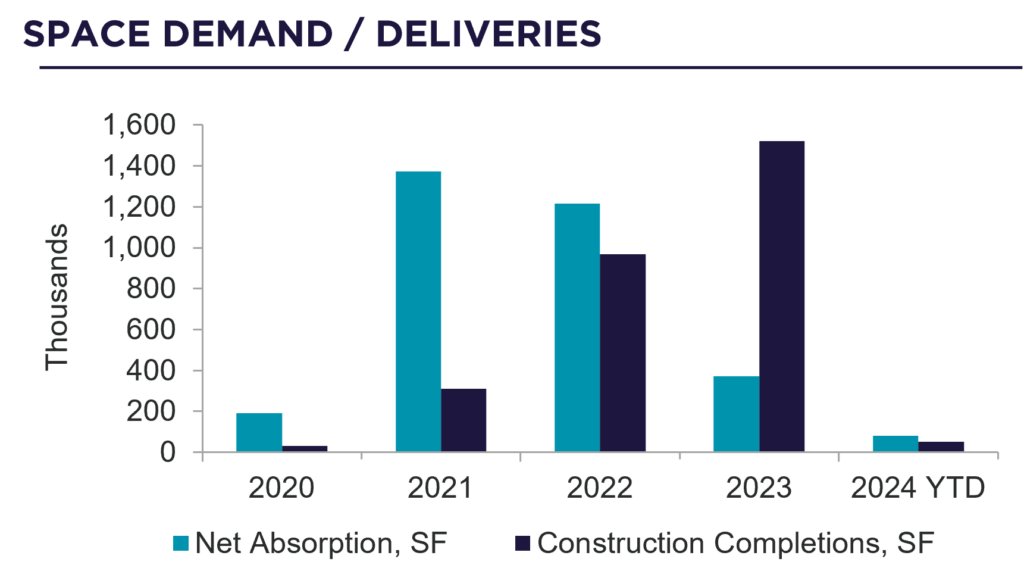

Construction activity is set to increase, with several developers preparing to break ground. During Q3, Lincoln Property Co. started construction on two buildings totaling 373,811 sf at their I-10 International project. Construction is slated to start in the fourth quarter for TPA on a 190,000 sf building in Butterfield.

The mining industry showed signs of expansion, potentially influenced by developments such as the Hermosa South mine. This sector’s growth is expected to drive absorption of land and buildings. Additionally, a logistics company and national home services/remodel company are seriously considering Tucson at this time.

Construction costs for industrial properties have stabilized, contributing to a predictable environment for developers. Despite low investment activity, upward pressure on sales pricing continues due to a scarcity of quality facilities on the market. The tight market conditions have led to slight rental increases for smaller spaces, while larger spaces have not seen significant changes in rates. Owners are facing challenges in finding replacement income if they sell their properties, further tightening available investment inventory and maintaining upward pressure on pricing across the Tucson industrial market.