The Trend Report, July 2025 Edition

Over the past year, Tucson, Arizona’s retail commercial real estate market has continued to demonstrate remarkable resilience and adaptability in the face of broader economic uncertainty. Increasing levels of conflict around the world, talk of massive trade tariffs, and rapid governmental and economic change have all had their impact on the economy, but the local retail real estate market continues to innovate and evolve. Between Q1 2024 and Q1 2025, the city experienced steady demand, strategic redevelopment, and sectoral shifts that reflect both national trends and unique local strengths. As other metros faced volatility in retail fundamentals, Tucson has remained a balanced market driven by population growth, rising household incomes, and strong submarket performance.

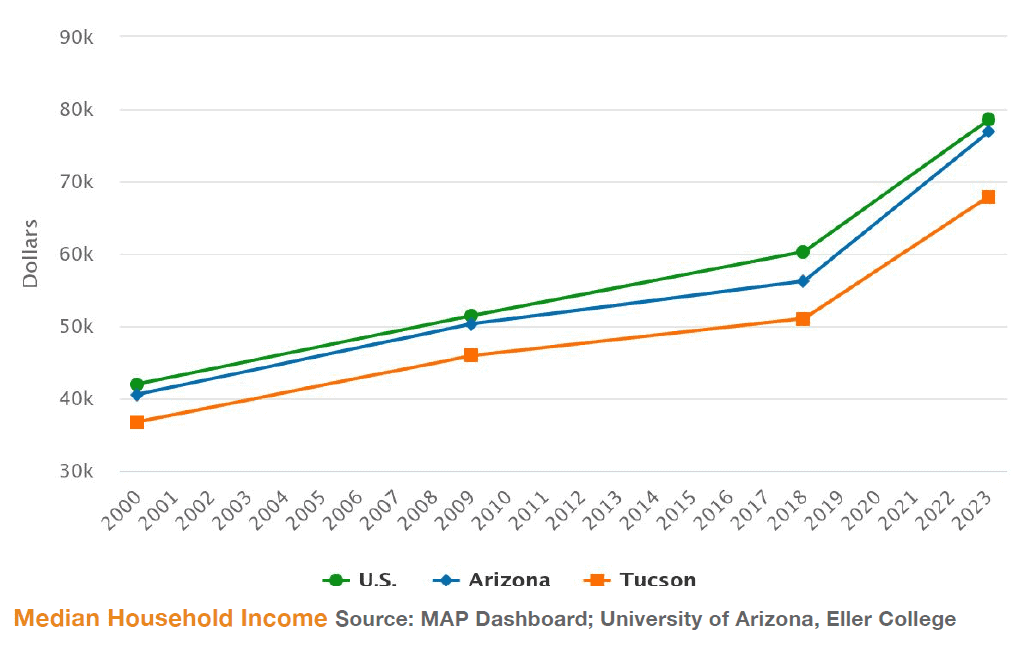

Tucson’s retail sector has benefited from an improving economic landscape throughout the past year. Median household income increased by 4.5%, reaching an estimated $74,400 by early 2025; up from $67,929 in 2023 (U of A MAP Dashboard). Although non-farm employment slightly declined in early 2025, the city’s unemployment rate remained low at 3.5% (Data Commons), below the national average of 4.2% (Bureau of Labor Statistics). Population growth stood at 1.1% annually, continuing a multi-year trend of steady in-migration that has fueled consumer demand and encouraged retail development.

This stable economic base has helped Tucson weather the broader national economic cooling observed in the second half of 2024 and early 2025. Tucson’s economy—rooted in healthcare, defense, education, and logistics—has helped insulate the city from some of the retail market shocks seen elsewhere.

Throughout the year, the retail vacancy rate in Tucson hovered around the 5.6% range, dropping in Q1 2025 to 5.3%. This rate suggests a healthy balance between tenant demand and existing supply. New retail space options are limited due to the lack of speculative construction and development because of the high costs of construction (labor and materials). National consumer spending rose by an estimated 2.4–2.9% (Deloitte & U.S. BEA) through 2024 and into 2025, with Tucson’s food, beverage, discount, and experiential sectors capitalizing on the trend.

Over the past 12 months, the market has seen strong leasing activity, particularly in high-traffic corridors such as Oracle Road, Broadway Boulevard, and areas adjacent to I-10. Restaurants, car washes, automotive services, and secondhand retail have remained active. Notably, junior box spaces—those between 10,000 and 40,000 square feet—have become more attractive to non-traditional retailers, including fitness centers, thrift chains, and indoor recreational uses.

National consolidation trends have impacted the local pharmacy segment, leading to closures of several Walgreens and CVS locations. However, this has opened opportunities for backfilling, as seen in Cavender’s Western Wear occupying a former Walgreens site at 4220 N. Oracle Road and Archwell Health taking over the Walgreens at Speedway Boulevard and Craycroft Road.

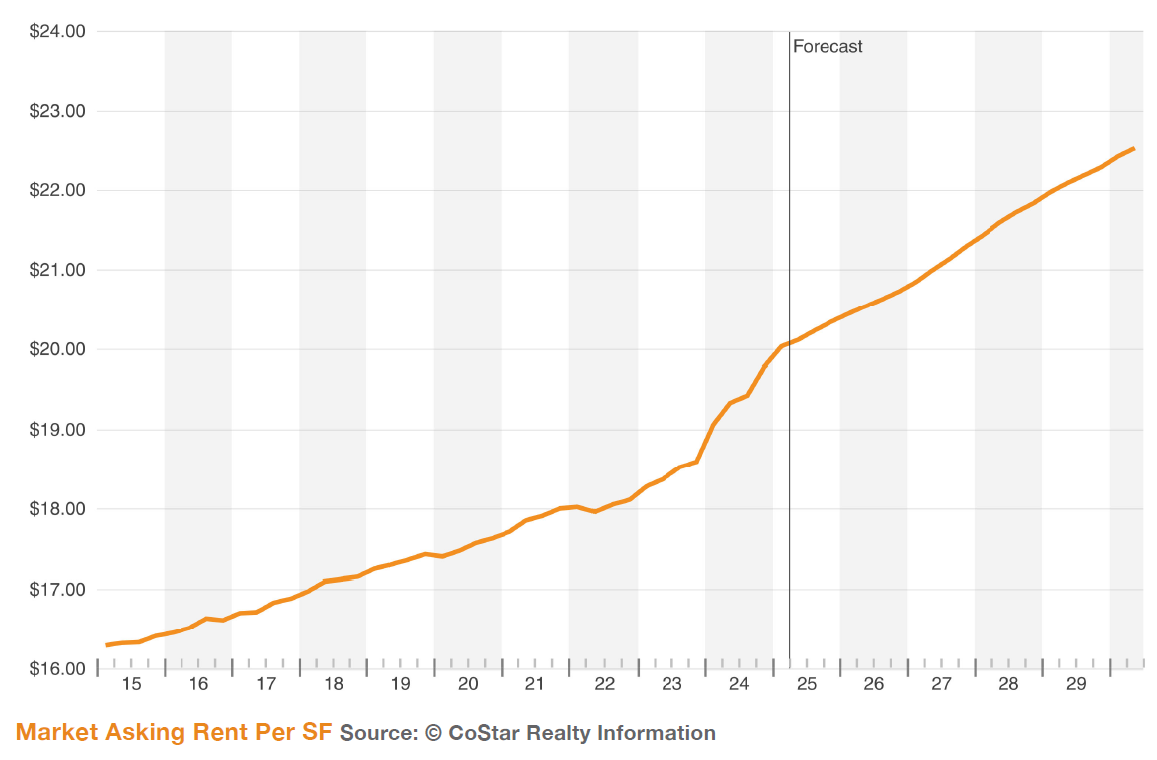

Despite elevated construction costs, developers have pushed forward with select projects that meet pent-up demand in underserved areas and reactivate previously under-utilized sites. These new construction projects are overwhelmingly build-to-suit drive thru restaurants. Very little speculative retail shop space building has occurred in recent years as construction costs have driven rents up above market demand.

Larger-scale projects underway signal optimism for Tucson’s longer-term retail environment. These include a 100,974-square-foot Bass Pro Shops at 1500 E. Tucson Marketplace Blvd, a 30,000-square-foot pickleball facility at Oro Valley Marketplace (former Best Buy), a 150,000 sq ft Fry’s Marketplace in Gladden Farms, and an expansion to 160,000 sq ft of the Walmart at Wetmore and 1st Ave.

In addition, the redevelopment of aging retail centers and free-standing retail buildings has gained traction as a response to construction cost inflation. Older properties along arterial roads like Speedway Boulevard, Grant Road, and Campbell Ave are being reimagined for mixed-use, medical, and boutique retail/restaurant applications. This shift illustrates a trend toward urban infill and adaptive reuse, where developers seek premiere sites and potentially faster permitting timelines while mitigating construction costs.

Retail lease rates have shown moderate growth across Tucson in the past year. As of Q1 2025, the average asking rent was $20.03 per square foot (up from $19.06 per square foot in Q1 2024), with high-performing submarkets such as Oro Valley commanding $26.23 per square foot and downtown Tucson at $21.11. Rents have been particularly strong for new construction, drive-thru buildings, and spaces in grocery-anchored centers.

Investment sales activity, while slower in volume, remains stable in pricing. Cap rates have held steady as investors find value in long-term fundamentals. The market has seen an increase in local and regional buyers seeking stabilized assets with long-term leases. Notable transactions include the $13 million purchase of Montessa Plaza (75,643 square feet) at S. Houghton Road by Alturas Montesa Plaza, LLC, and the $5.3 million acquisition of a 35,300-square-foot retail center at E. Fort Lowell Road by Winterhaven Investors, LLC.

Among the retail categories, the thrift/resale and deep discount retail sector has shown growth with Savers signing into the former Conn’s at Broadway and Craycroft, Daiso opening in Tucson Premium Outlets, and Once Upon a Child opening in 6,026 square feet at Monterey Village. This is a vigorous response to rising consumer demand for affordability and sustainability.

Experiential retail, including entertainment and recreational uses like pickleball and indoor play spaces, has also expanded in Tucson as landlords seek tenants that drive foot traffic. The new Padel Alley opening at 5943 E Speedway and Roadies (part of Roadhouse Cinemas) opening a 35,000 square foot family entertainment center in the former Bed, Bath, and Beyond at Grant and Swan are indicative of this trend.

Over the past year, Tucson’s retail commercial real estate market has evolved from stability to strategic transformation. In an era marked by economic caution and shifting consumer expectations, Tucson stands out for its adaptability, solid fundamentals, and forward-looking development. As 2025 progresses, Tucson is well-positioned to continue its momentum—driven by a growing population, demand for experiential retail, and an increasingly desirable investment landscape.

Rob Tomlinson has been a commercial real estate broker since 1996. His work on a wide variety of commercial projects coupled with his education in Urban Geography, Site Analysis, and Land Use Planning gives him a wealth of experience in the development process. He can be reached at rtomlinson@picor.com.