To read the full report on Tucson’s Industrial market activity in Q3, click here

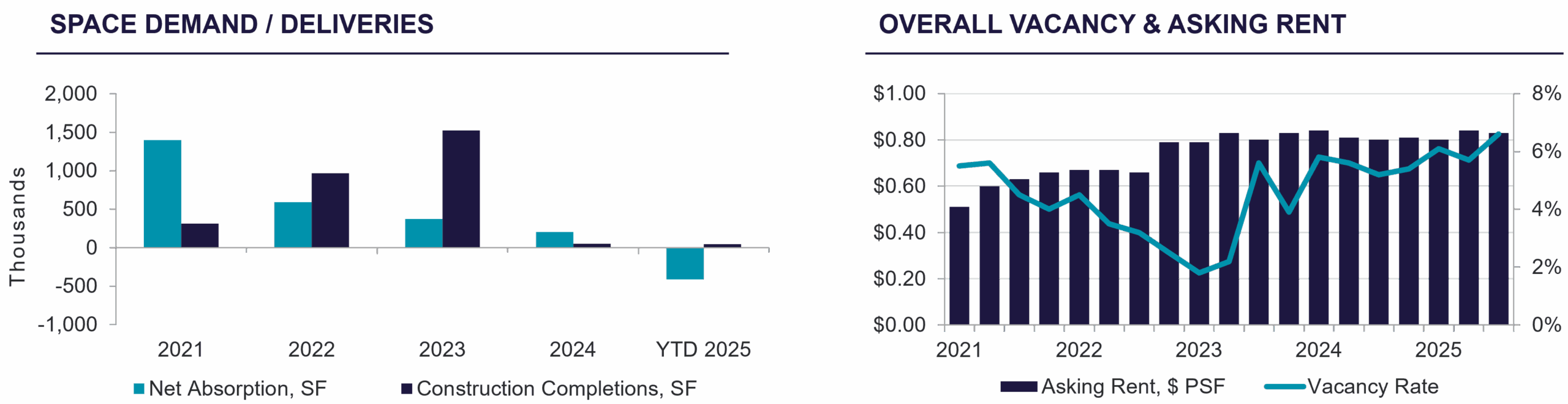

Tucson’s industrial market remained firm in Q3 2025, though vacancy edged up slightly to 6.6%. Construction activity stayed active with 906,855 square feet (sf) underway, primarily concentrated in the Airport submarket, which continues to lead leasing. Despite new development, demand across traditional industrial sectors remains healthy, while clean energy users have slowed.

Top leases this quarter included Werner Aero with 30,000 sf at 845 East Ohio Street, Stevens Equipment Supply with 24,822 sf, and Lennox Industries Inc. with 11,166 sf – reinforcing steady absorption in established submarkets. No major construction completions occurred during the quarter, but speculative projects are expected to add vacancy as they deliver through early 2026.

Leasing and user demand prevailed, strongest in the Airport and Northwest submarkets. E-commerce and logistics users maintained moderate growth, supported by a healthy pipeline expected to meet local distribution and warehouse needs. Nearshoring discussions persisted but have yet to yield commitments. User and investor sales activity show solid fundamentals but face supply challenges, putting downward pressure on volumes.

Average asking rents held at $0.83 per square foot (psf) per month, consistent with Q2 as developers balanced cost pressures against tempered demand. Construction pricing fluctuated month to month with volatile material and labor costs. High interest rates and cautious underwriting continue to challenge pricing and deal structures, but limited supply of quality assets supports form valuations and longer lease terms. Single-tenant buildings with yard space remain highly sought after, bolstering rent stability.