To read the full report on Tucson’s Industrial market activity in Q4, click here

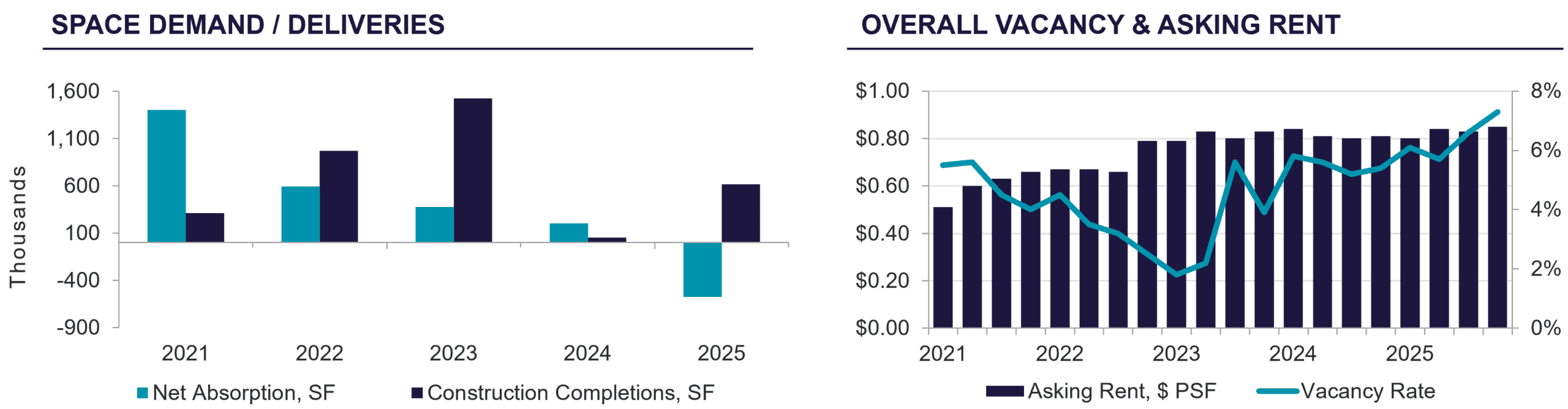

Tucson’s industrial market remained active in Q4 2025, though vacancy increased to 7.3% as new construction delivered. As a result, net absorption declined, driven primarily by the delivery of new space late in the quarter. Recent completions contributed to higher availability, while overall leasing activity remained steady. Demand continued to be supported by traditional industrial users, with a minor increase in value-add manufacturing and assembly activity.

Leasing activity featured several larger transactions. Border States completed an 81,962-square-foot (sf) lease at 763 E MacArthur Circle, while an additional 70,000 sf lease was executed at 6630 S Memorial Place, reinforcing demand for well-located distribution space. The Airport and Northwest submarkets remain the most active targeted by users seeking proximity to transportation infrastructure.

Construction activity included the completion of Lincoln Property Company’s two industrial buildings at 4501 E Los Reales, with 214,867 sf and 4401 E Los Reales with 158,944 sf. While Tucson industrial development continues, instability in labor and material costs challenge new construction, contributing to cautious project starts despite sustained tenant interest. E-commerce and logistics demand persisted, while international trade discussions gained momentum, suggesting potential future activity.

Lease rates and terms remained steady in Q4, supported by limited availability of functional space despite rising vacancies. Sale pricing also held firm, as constrained supply and depreciation benefits continued to support values. Land pricing increased in well-located areas, with owner-users outpacing investor demand, while investment activity remained muted. Single-tenant and sub 20,000 sf buildings, particularly those with yard space, attracted strong interest.