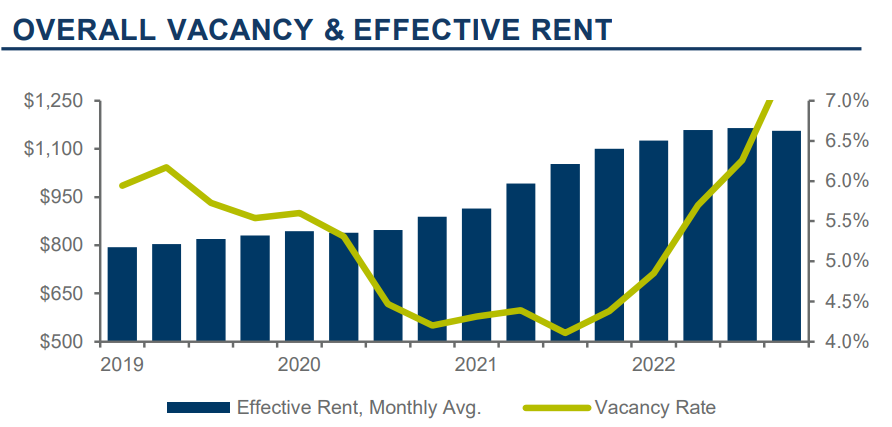

In the fourth quarter, Tucson saw the average vacancy rate increase 1.20% to 7.46% from the previous quarter, which is also a 3.08% increase year over year (YOY).

To read the full report on Tucson’s multifamily activity in Q4, click here.

The Tucson market’s occupancy declined correspondingly by 520 units, while the average gross apartment rent without utilities decreased $8 (.69%) from Q3 2022 to $1,157 per unit/$1.53 per square foot (sf). In reviewing transactions for properties with 40 or more units in consecutive quarters, the average price per unit increased by a dramatic $57,893 per unit and $11.83 per sf to a total of $250,944 per unit and $293.23 per sf.

The end of 2022 saw a decline and slowdown in the rental market. Units being marketed at pre-adjustment rental numbers are slow to lease. This softening in rents results from the market changes and renters exercising caution financially to not stretch outside of their means. In surveying local managers, many cite Q4 as the slowest leasing quarter in Tucson since 2019. Units which would previously have leased within days are now taking weeks or months to lease. The City of Tucson is still working to fill the need to place affordable housing tenants. Subsidized rents are only slightly below market rents with the goal of enticing owners and managers to fill vacancies with lower income tenants. Going forward in 2023 and beyond, Tucson will likely experience softer YOY rent increases than in recent years.

Supply and Demand in the Tucson MSA has completely flipped from the beginning of 2022. Owners who had pricing expectations based on property values in the first half of the year have had to adjust to the new reality if they wish to move their product in this market. For multiple reasons, Q4 2022 saw considerably fewer transactions than in previous quarters. First, interest rates for commercial apartment building investment have increased nearly 300 basis points in a 12-month window. Second, softening in the rental market has caused more cautious underwriting and projections by buyers when evaluating deals. Third, each year, regardless of the market’s strength, a seasonal slowdown is experienced during the holidays. In 2023, the market will likely cool and

require closing the gap between seller’s expectations and purchasers’ willingness to pay.