To read the full report on Tucson’s office activity in Q4, click here.

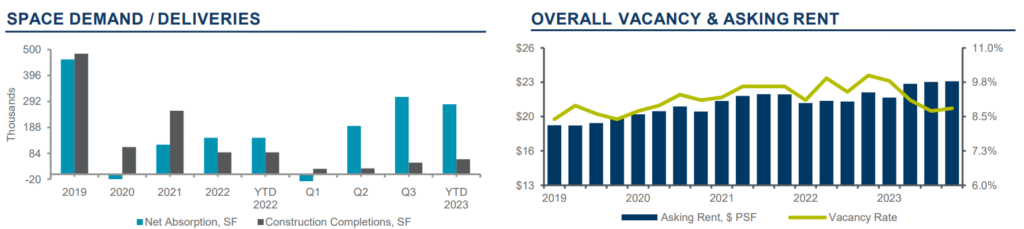

Despite overriding economic uncertainty, the Tucson office market was active during Q4. The medical sector continued to be a bright spot within the market. Overall sentiment anticipated a strong year-end, creating optimism amid the headwinds. The vacancy rate remained relatively unchanged at 8.8%, attributed to the surplus of available office space. Factors influencing market trepidation included inflationary pressures, interest rates, and the upcoming election.

The conversion of large call centers into high-demand properties such as industrial spaces is a noteworthy trend, however, only an option for those properties with original construction that allows such conversion. Limitations include the structure of the building, along with zoning, building codes, location, and unexpected hurdles that come with converting a structure that was designed for a different intent. With call center activity reemerging in some larger markets, the resurgence of requirements in Tucson in the 25-50K square foot (sf) range could be in sight.

Behavioral health uses witnessed a slowdown, but the medical market remained vibrant, with expansions evident across various Tucson submarkets, including Foothills, Central, and Northwest. Notable leasing transactions included Saavi Services for the Blind securing 22,168 sf at Pima Medical Institute, and Rincon Research leasing 19,103 sf in Joesler Village. Investment sales faced challenges due to interest rates and limited high-quality offerings, yet medical properties continued to attract attention, even to the extent of land purchases to build to specifications. Banner Health’s sale of three medical office properties to Vanbarton Group for $19.5 million and the Vantage West Annex Building’s $2.15 million sale to Centria Autism stood out as major transactions.

Lease rates generally remained constant, averaging $22.84 per square feet (psf), with the Foothills submarket in high demand with limited inventory, while East Tucson held the most affordable average lease rate at $14.89 psf. Landlords, in response to the competitive market, continued to offer incentives like free rent, substantial tenant improvement allowances, and relocation support. Investment sales remained popular in North Tucson/Oro Valley and Central Tucson, with the average price reaching $140 psf.