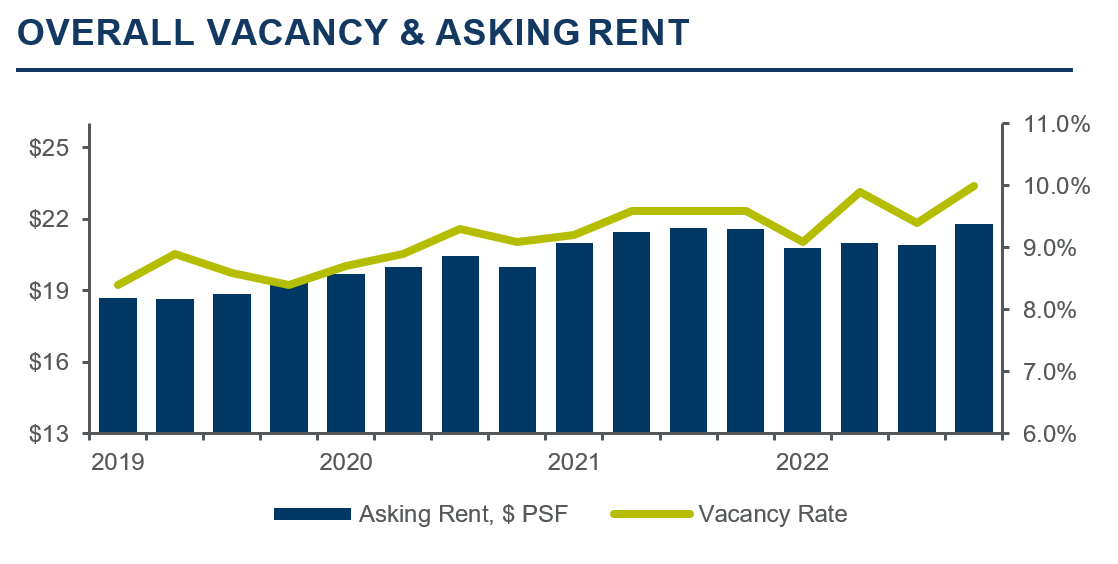

Throughout 2022, the Tucson office market was challenged by post-pandemic disruption to work patterns and reconsideration of

layout and use of space. The office vacancy rate rose slightly to 10.4% on the total available inventory of 28,887,249 square feet

(sf). The Refinery at the Tech Park was completed, adding 120,000 sf to the market; otherwise, healthcare and ancillary medical

practices continue to be the largest driver of new activity.

To read the full report on Tucson’s office activity in Q4, click here.

With employers working through hybrid models for their workforces, many businesses are considering smaller spaces upon lease renewal. Work from home has particularly challenged call center/telemarketing users and is only worsening as leases come up for renewal with a reduced in-person workforce. Available large blocks of space suitable for office, back office, and call center uses equal about two million sf and will likely increase.

While investors continued seeking viable opportunities, rising debt costs put a damper on speculation. Given the higher interest rate environment, seller financing is growing in popularity, and some owners are willing to carryback financing to get deals done. The owner occupancy sector differed, as businesses constructing purpose-built facilities bit the bullet and borrowed to move projects forward. Overall sales volume for 2022 was up 3.6% YOY to $177.4 million, but well below the volumes seen in 2019 and 2020.

The busy Foothills submarket has been able to drive rates up, but otherwise rental prices in Tucson remained stable. Many owners have also been creative in utilizing incentives to move transactions forward. The overall average asking rental rate in Tucson is $21.79 per sf with the highest average of $29.34 in SW Tucson and the lowest of $11.34 in SE Tucson. The average price per sf sold in 2022 was up significantly over 2021 from $149 per sf to $190 per sf.