Tucson’s office market remains stable, yet far from dynamic, due in large part to limited job creation. In addition, health care uncertainty (preceding the Supreme Court decision) and the impending presidential and congressional elections have contributed to a cautious business climate. Some meaningful growth continues in Tucson’s health care sector, with economies of scale, more favorable locations, and proximity to health care centers fostering movement.

Signs of Life in the Lease Market

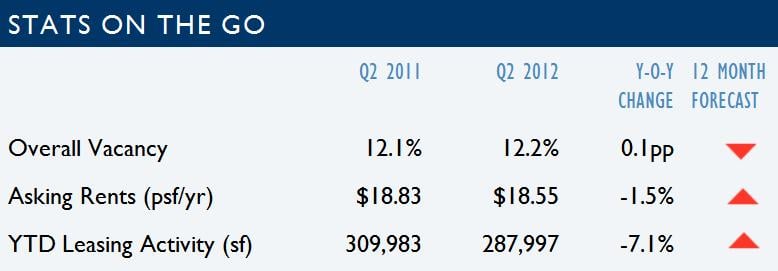

Statistically, overall vacancy remained fairly stable, ending Q2 2012 at 12.2%, versus Q1 2012 rate of 12.1%. Absorption was flat at a negligible negative 23,347 square feet (sf).

Lease activity was dominated by renewals and relocations to upgrade quality of space and location. Often those moves represented downsizings to more efficient space, driven by technology and reduced headcount or consolidations. The pendulum still swings toward the tenant, with abundant concessions in the market to attract occupiers.

As a bellwether of a turning tide, asking rents ticked up across submarkets and class of space for the first time in 10 consecutive quarters. Further support for continued improvement in the market is demonstrated by a relatively strong pipeline for both new and renewal activity. Again, activity is strongest in the medical sector.

Construction of Tucson Medical Center’s West Pavilion will open 77,000 sf of on-campus medical office building space to the Tucson market. The Tucson Orthopedic Institute relocation to the West Pavilion will create opportunities for health care groups to locate directly on this critical care campus.

Investment Market Remains Elusive

Tucson office and medical office properties still do not sell under traditional investment criteria in this climate of gradual recovery. Most investor sales are driven by distress, namely short sales and auction activity. We do note a few small user buildings in escrow and a recent sale of shell space at $127.50 per square foot (psf) that will occupy at approximately $190 (psf) total after interior improvements.

Outlook

Fundamentals have ceased deteriorating and are showing very gradual improvement. With completion of the FBI’s 84,353-sf building west of downtown, the expected vacancy of their leased space in 1 South Church will occur in the third quarter. Tucson Modern Streetcar line construction continues between downtown Tucson and the University of Arizona. Expect short-term pain followed by development opportunity and activity along the route, which has already begun. Thanks to approval of the Main Gate (University area) overlay zone, the path has been cleared for additional student housing density, a significant driver for broader activity.

For more information on the Tucson office market, please contact PICOR Principals Rick Kleiner, Tom Knox, or Tom Nieman or visit our website to search properties and learn more about PICOR’s office and medical office services.

Data source: CoStar Group