In Q4 2025, Tucson’s retail market remained stable, with vacancy improving to 5.8%, reflecting steady tenant demand and tightening availability. Market fundamentals remained……

Dollar General’s Strong Earnings Highlight Strength in Value Retail

Dollar General’s recent earnings report exceeded expectations, signaling a growing consumer shift toward discount retailers due to economic uncertainty. The…

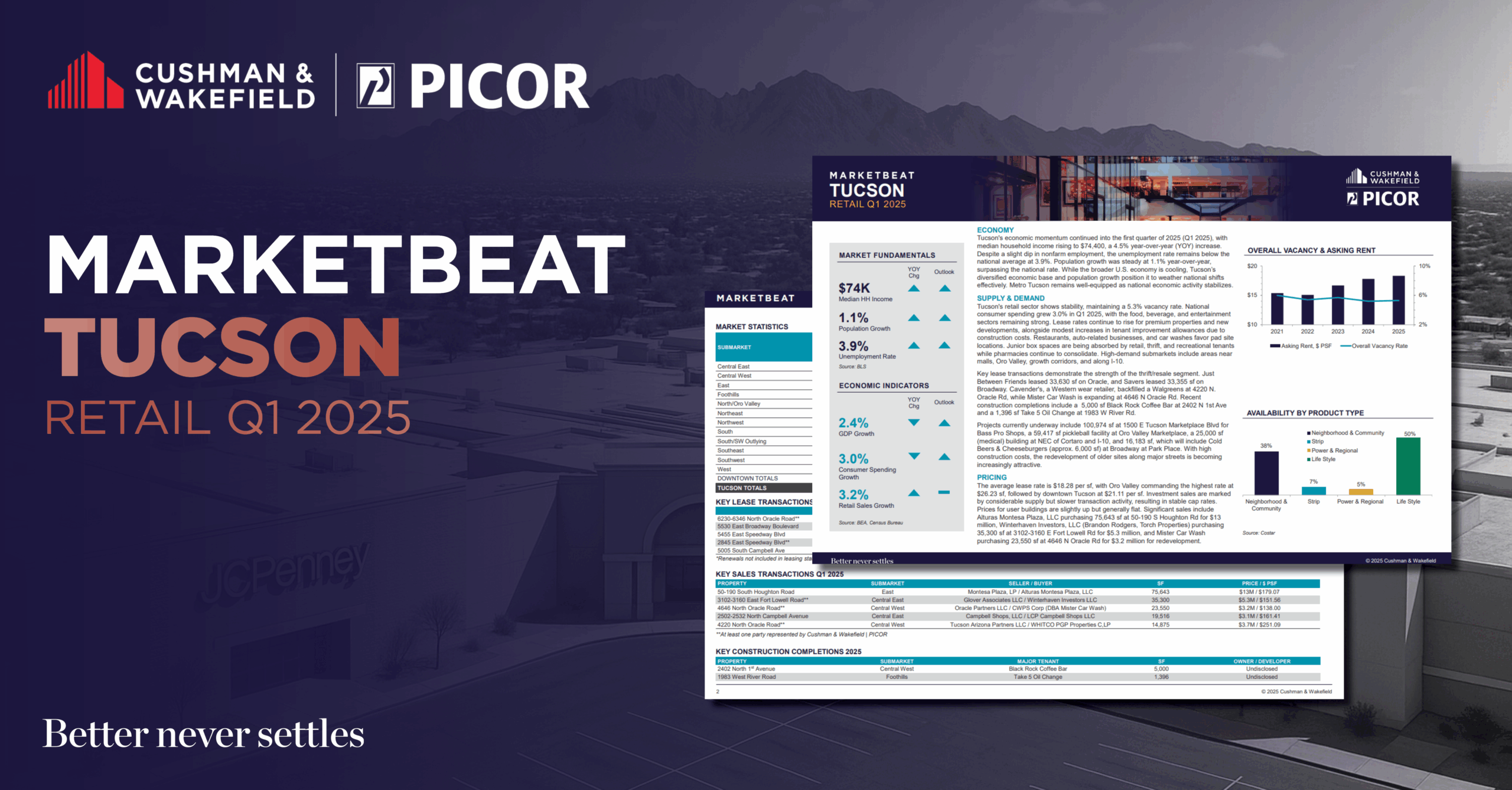

Tucson’s Q1 Retail Market Report: New Developments, Thrift Sector, and Redevelopments Drive Steady Growth

Tucson’s retail sector shows stability, maintaining a 5.3% vacancy rate. National consumer spending grew 3.0% in Q1 2025, with the food, beverage, and entertainment sectors remaining strong. Lease rates continue to rise for premium properties and……

Tucson’s Q4 Retail Market Report: Experiencing Growth in Spite of Big Box Closures

The Tucson retail market experienced a slight uptick in vacancy, reaching 5.8% in Q4 due to the closure of Big Lots and 99 Cent Only stores. Class A properties continue to command historically high lease rates, with rents in the mid $40.00 per square foot (sf) triple-net (NNN) range common for new construction and projected to rise further in the coming year….

Tucson’s Q3 Retail Market Report: Stability Despite Store Closures

To read the full report on Tucson’s retail activity in Q3, click here. The Tucson retail market remained stable in…

Big Lots, Big Loss – The Downfall of a Discount Retailer

Big Lots, a prominent discount retailer for furniture and home décor, is facing significant financial hurdles that have led to…

Tucson Q1 Retail Market Report: Consumer-Driven Resilience

To read the full report on Tucson’s retail activity in Q1, click here. In Q1 2024, the Tucson retail market…

Tucson Q4 Retail: Consumer Spending, Employment Growth, & Expansions – Including Bass Pro Shop

To read the full report on Tucson’s Retail activity in Q4, click here. The Tucson retail market in Q4 continued…

Clicks & Bricks: The Current Evolutionary Stage of Modern American Retail

Retailers no longer perceive a divide between online and in-person merchandising. They are combining both models for a customer-centric strategy….