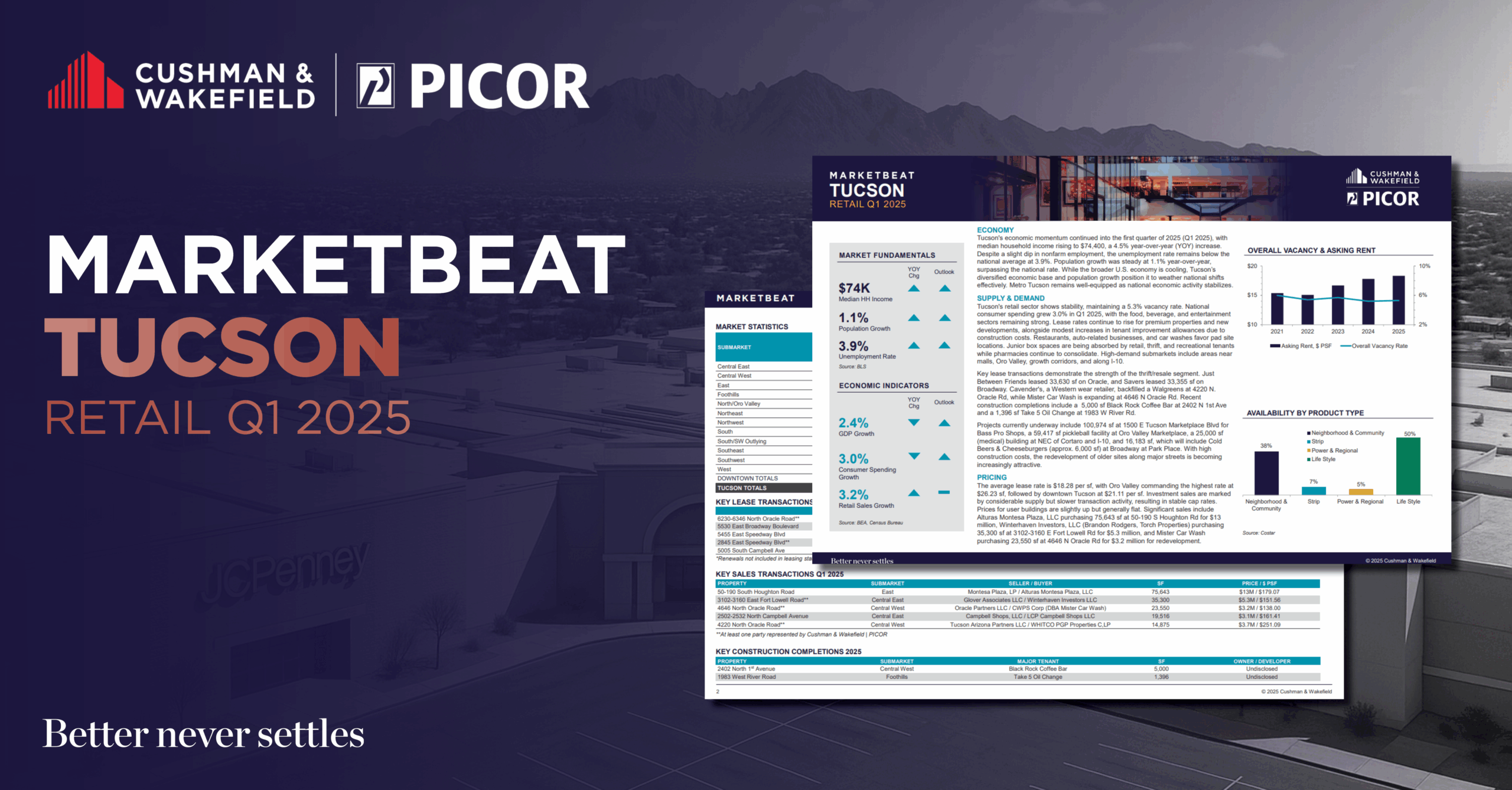

Tucson’s retail sector shows stability, maintaining a 5.3% vacancy rate. National consumer spending grew 3.0% in Q1 2025, with the food, beverage, and entertainment sectors remaining strong. Lease rates continue to rise for premium properties and……

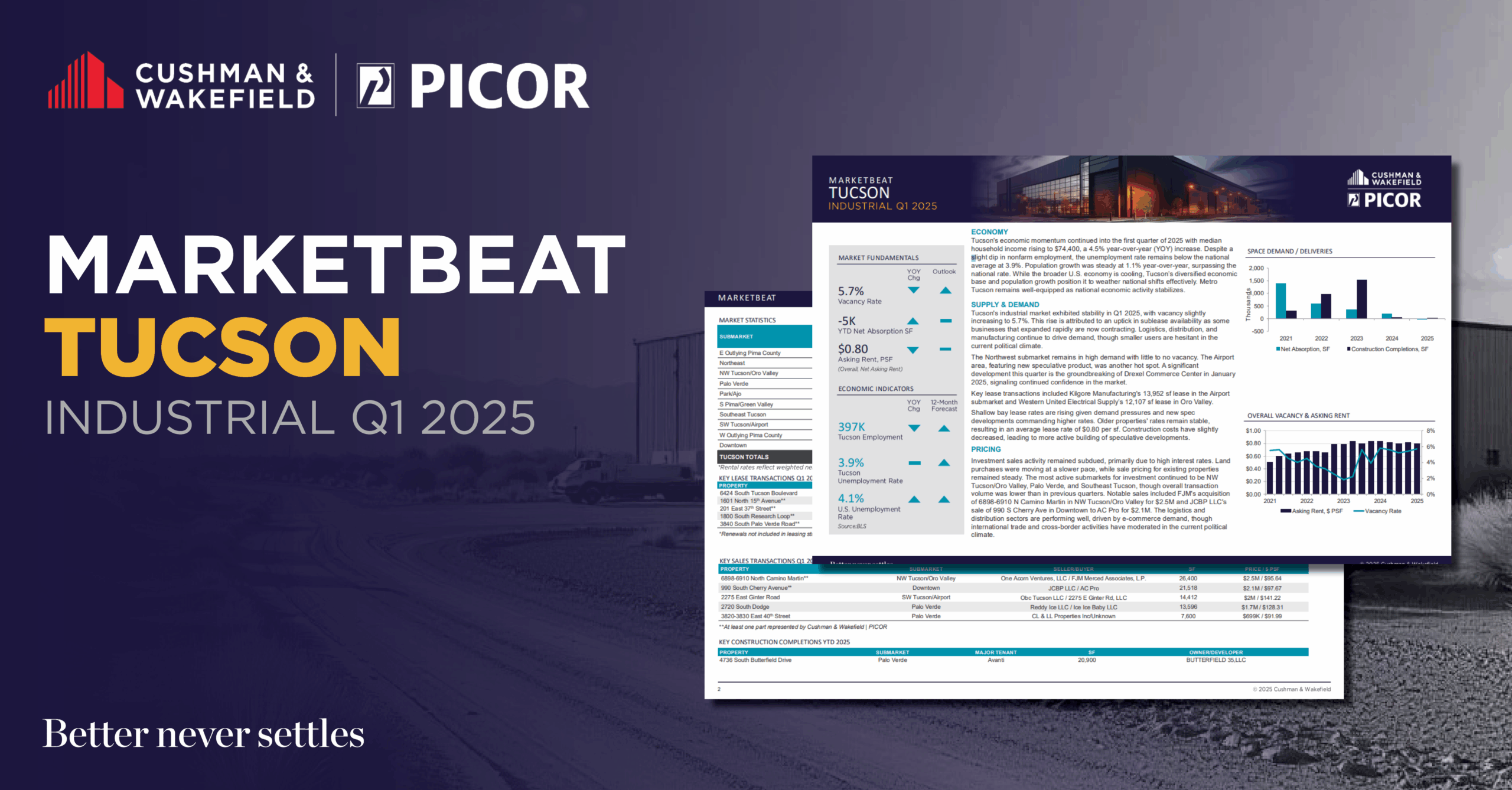

Tucson’s Q1 Industrial Market Report: Steady Demand Anchors Market as National Activity Slows

Tucson’s industrial market exhibited stability in Q1 2025, with vacancy slightly increasing to 5.7%. This rise is attributed to an uptick in……

Tucson’s Industrial Market: Steady as She Goes While the Nation Hits the Brakes

If you’ve ever watched a seasoned desert hiker pick their way through a rocky wash, you know the trick: keep your eyes up, move with purpose, and don’t panic when the trail gets rough. That’s Tucson’s industrial market in Q1 2025—…

Tucson’s Q1 Office Market Report: Healthcare Demand Continues to Drive Stability

In Q1 2025, Tucson’s office market experienced a slight uptick in vacancy, reaching 10.3%, indicating a modest but persistent upward trend. The availability of space is further influenced by 320,000 sf (square feet) of sublease space, reflecting……

Tucson’s Q1 Multifamily Market Report: Vacancy Rises and Seller Financing Sparks Investor Interest

Tucson’s multifamily market slowed incrementally in Q1 2025, with the average vacancy rate rising to 8.81%, up 0.58% from a year ago. Average sale prices reached $164,338 per unit and $189.09 per sqft, reflecting YOY increases of 91.74% and 83.66%….