To read the full report on Tucson’s office activity in Q3, click here.

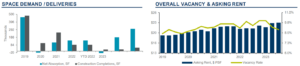

The Tucson office market is gradually rebounding post-pandemic, with the vacancy rate decreasing from 9.4% to 8.9% compared to the previous quarter. However, the presence of 2.8 million square feet (sf) of available inventory remains a concern, primarily due to office users reevaluating their needs considering hybrid and remote work models. Medical users continue to drive the Tucson office market’s growth.

Investment sales have remained stagnant, with prevailing cap rates mostly around 8%. Notably, a significant transaction featured a 5% cap rate, as Banner Health’s University of Arizona Cancer Center at 3838 N Campbell sold for $134,000,000, $366.73 per sf. Over the past year, the Tucson office market saw $87.6 million in investment sales, with rising interest rates and economic uncertainties posing challenges. Private buyers and owner/user deals are the primary drivers of activity.

Lease terms are now extending to five-year durations, with a decrease in one two-year lease terms compared to the previous year. Demand remains strong in submarkets with strong household income, for example, the Downtown submarket which has a 1.08% vacancy rate.

Office construction activity in Tucson remained low, but two notable projects were underway in the third quarter. Houghton Crossings Professional Plaza at 7375 South Houghton offered 8,400 square feet of mixed-use space in Rincon Valley, while Townsend Medical at 2121 North Craycroft provided 30,000 sf of Class A medical space, set for completion in June 2024. Even though construction activity remained low, Tucson avoided oversaturation, helping maintain competitive prices in the Tucson office market.