The Tucson office market, like many others around the nation, is inching closer toward recovery. National economic forces continue to impact the speed of Southern Arizona’s return to health, most notably anemic job creation, gas prices, and concerns over the national debt.

Specific to our region, the departure of homebuilders and allied services, many of whom left the market or consolidated offices in Phoenix, put a great deal of office space on the market during the downturn.

Leasing Update

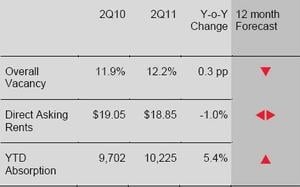

In Tucson’s office market of 23.2 million square feet (msf), fundamentals indicate we are at or approaching the low point in occupancy and rent deflation. While total market vacancy dipped slightly to 12.2% from the first quarter (12.0%), asking rents remained essentially flat across all classes. Segregating class A space, quoted rents declined another 2.0% and vacancy also slipped, pointing to a healthier market in the class B and C buildings.

The healthiest submarkets, those with single digit vacancy, include Southeast, Southwest, Downtown, and Green Valley/South. With too much speculative space built and standing empty, the Northwest submarket has hemorrhaged the most, reporting a 29.8% vacancy.

Our brokers report a noticeable uptick in activity over the first quarter, with medical office space representing the strongest market sector. The pendulum still favors the tenant in lease negotiations. Concessions to attract new tenants typically include one month free rent per year of the lease, and build-out allowances are higher.

Aggressive landlords know keeping tenants is key and, while offering lower rents, aim for shorter lease terms to allow for future upside.

Investment Focus

Sales activity has increased measurably over the first quarter with a 98% increase in square footage sold quarter over quarter. Notably, there was higher investor sales activity than user purchases, primarily due to the sale of the 125,000 square foot (sf) building at 5411 E. Williams Blvd.

Although some buyers wait on the sidelines for more distressed purchase opportunities, lenders continue to work hard to keep borrowers in place. The occasional asset moves via foreclosure and trustee’s sale, but no significant inventory or sizeable portfolios are expected to turn over.

Outlook

Federal government sector activity in the market includes significant requirements for DEA, Social Security and FBI, either consolidating in existing buildings or as new construction requirements.

Continued demand for health care fueled by an aging population, longer life spans, and active seniors bodes well for providers in our region. Tucson Medical Center has broken ground on a 207,000 sf 4-story surgery pavilion to be completed in late 2013.

Talk of planning and zoning along the Tucson Modern Streetcar route may spur development opportunities benefitting the city’s core, while continued promotion of Tucson as “Solar City” and growing credibility in the biosciences arena bode well for economic development efforts over the longer term.

Visit PICOR’s website for this and other market sector 2Q11 MarketBeat reports in printable PDF format with market statistics and construction and occupancy trends.

PICOR Commercial Real Estate’s Office Brokerage Division members average 25 years of industry experience. Our team offers tenant and landlord representation and represents businesses and individuals in office building acquisition and disposition. Contact PICOR: We inspire results.