To read the full report on Tucson’s multifamily activity in Q1, click here.

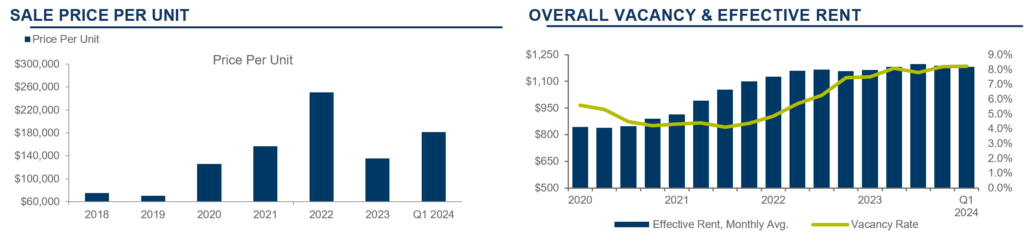

Tucson’s apartment vacancy increased to 8.23% in Q1 2024, up 0.74% from Q1 2023. While this might prompt concern, significant progress was made in six of the submarkets, highlighting strength in specific regions. Inventory increased by 365 units, striving to match the strong demand for housing. However, Tucson’s sales velocity slowed considerably in Q1, with only one sale recorded over 100 units. Conversely, ten multifamily sales transacted for properties sized between 5 and 100 units. The average price per unit for all sales in Q1 equated to $181,212.

“The rental market in Tucson experienced a lull at the beginning of the year but has been steadily rebounding. Affordable renovated units remained in the highest demand. Setting appropriate unit prices is crucial. Many managers are opting to pause rent increases and prioritize the retention of high-quality tenants. Overall occupancy rates across the portfolio remained consistently high, hovering around the mid-90 % mark.” – Michelle Goldberg, Fort Lowell Realty & Property Management

In the first quarter of 2024, the market had one transaction occur for properties over 100 units. This trend is expected to continue as many owners and investors remain on the sidelines monitoring interest rates, the outcome of the presidential election, and the overall state of the economy. Demand continues to outweigh supply as properties taken to market receive multiple offers with strong terms. Assets in which the seller can provide Seller Financing have proven to demand significant demand and higher pricing and we expect this to continue throughout the remainder of the year.