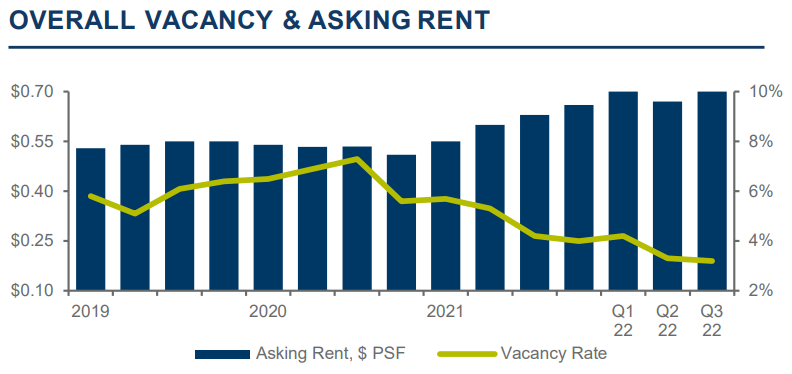

In the third quarter of 2022, the vacancy rate for industrial space for lease in Tucson is at a record low of 3.2%. Even with the addition of 2 million square feet (msf) of new construction, the available inventory is lagging behind growth in the economy.

To read the full report on Tucson’s industrial activity in Q3, click here.

The demand from the burgeoning cannabis industry is closely followed by strong demand in the manufacturing, mining, and logistics sectors. The number of manufacturers showing strong interest in Tucson and Southern Arizona is at a record high, much of which is considering relocation from California. Companies considering relocation to Phoenix or Texas are now including Tucson on their list of desirable locations. The increased appetite for domestic manufacturing space is a trend and strategic opportunity for the region. Demand for industrial space has vacant call center operators and building owners contemplating conversion of built-out office space into industrial uses. Although expensive, conversion would add to the industrial inventory and solve the problem of call center operations moving to at home work, post-pandemic. Sale volume moderated in Q3 to $38.6 million after a strong Q2 of $65.6 million, due to a lack of available investment properties, not buyers’ interest.

Lease rates for the significant Q3 transactions ranged from $0.69 to $0.72 per square feet per month (psf), typically with three percent annual escalations. In the Tucson industrial investment market, year-to-date average cap rates have fallen to 6.2% from the previous year’s 7.4% with the average sale price psf at $104, closely following a record high in 2021. Notable Q3 leases include HomeGoods at 6700 South Pella Drive for 236,700 sf, with a three-year renewal at $0.72 psf per month with 3% annual escalations. Bekins leased 43,680 sf at 6818 South Country Club Road in a five-year lease starting January 1, 2023, at $0.73 psf with 3% annual escalations. Maya Tea leased 33,150 sf at 2861 North Flowing Wells Road in an expansion of their current space beginning January 2023 at $0.69 psf per month. Significant Q3 sales include 109,229 sf at 5580 South Nogales Highway sold for 7.3 million; 112 acres at Tangerine & I-10 for $4,250,000 for a spec development project; a multi-tenant building at 4275 South Santa Rita, for $3,350,000 and a single tenant building at 955 West Grant for $2.95 million.