To read the full report on Tucson’s Multi-Family activity in Q4, click here.

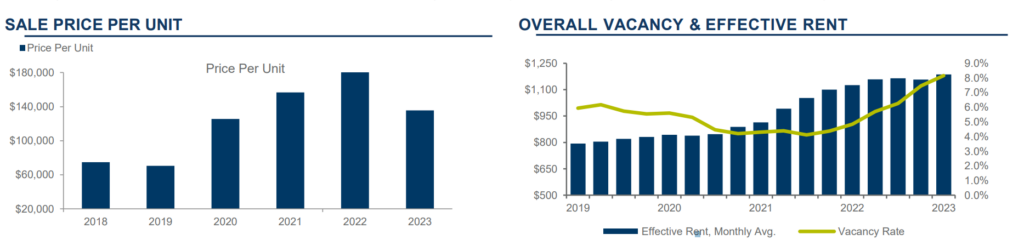

Tucson’s apartment vacancy increased to 8.16% in Q4 2023, a .70% increase from Q4 2022. Though this might raise alarm, notable improvement occurred across six of the submarkets showing strengths in certain areas. Inventory surged by an impressive 1,133 units, working to keep pace with a robust demand for housing. Sales velocity slowed drastically in Q4 of 2023 with only two sales occurring to properties over 40 units. There were three sales in the Multi-Family market for properties sized 20-40 units.

In the transition from Q3 to Q4, despite the challenges posed by high inflation and operational costs, the Tucson apartment market demonstrated resilience, most notably through a minimal rent decline, unlike most major MSAs. The minimal decline was approximately $9 from Q3 2023, marking a slight .75% change. Notably, the Southeast market ended 2023 as a standout, showcasing an impressive 48.16% year-over-year decrease in vacancy rates and meaningful rent growth of 14.27%. Leasing in Q4 slowed, per usual, due to holidays.

With Q4 revealing a continued disparity between sellers’ expectations and purchasers’ willingness to meet those demands, investment sales experienced a notable decrease, though this is typical during the holiday season. With inventory remaining at an all time low and demand remaining strong, this signifies a market with a resilient supply-demand dynamic despite temporary slowdowns in sales. As assets become available for sale, there will be investors ready to pursue. Most owners are hoping for interest rates to continue to decrease throughout the year meaning an appreciation in property values.