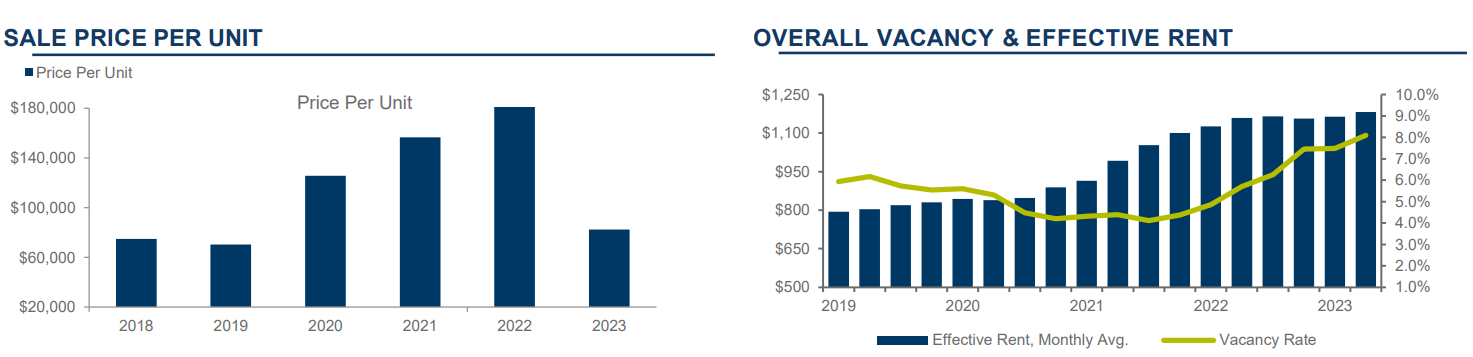

Tucson’s average multifamily vacancy rate increased 0.60% to 8.09% in Q2 2023, representing a 26.81% increase YOY. The Tucson market’s leasing activity slowed as the new year turned, but toward the end of the first quarter regained velocity. The average gross apartment rent without utilities increased $7 (0.61%) from Q4 2022 to $1,164 per unit/$1.53 per square foot (sf). Of completed transactions in the quarter, only two exceeded 40 units, which extended the Q1 2023 drastic slowdown in sales volume in the 40+ unit apartment market. The two properties sold for an average of $82,000 per unit and $154.93 per sf.

To read the full report on Tucson’s multifamily activity in Q2, click here.

The first half of 2023 saw slower leasing than expected, but as mid-year approached, the pace picked up. Managers reported that less favorably located buildings and those with inferior curb appeal were hit harder than their counterparts. This can be attributed to tenants doubling up with roommates or moving in with family and friends to save money. Apartment Insights reports on 15 submarkets, of which four recorded gross rents above $1,400/unit. From Q2 2022, Tucson’s average gross rent rose $23/month, a 1.98% increase. During the second quarter, gross rents increased in twelve submarkets, with a high of $41 in Tucson Mountain Foothills. The lowest average gross rent for Tucson was reported in the South-Central Tucson submarket at $972. Average gross rents fell in two submarkets, with the highest drop of $13 (-1.21%) occurring in the South Tucson/Airport submarket.

In the first half of 2023, zero transactions occurred for properties over 100 units. This trend is expected to continue as many owners and investors remain on the sidelines monitoring interest rates. Demand has softened as many investors have returned to their local market with pricing softening nationally. Demand still significantly outweighs supply as new inventory slowly reaches the market. Pricing adjustments have been tempered in Tucson relative to national averages due to low supply and a steady rental market. There were only 21 transactions from properties 10-100 units in Tucson for the first half of 2023.