Tucson’s multifamily market held relatively strong in Q3 2022, experiencing healthy transaction volume and pricing levels. With relatively low rental rates and attractive prices per unit, investors will be drawn to place capital in the rising Tucson multifamily market. With the local market years behind in the supply of rental inventory, it is primed to withstand any major dip and is in a promising position for the short and long term.

To read the full report on Tucson’s multifamily activity in Q3, click here.

To read the full report on Tucson’s multifamily activity in Q3, click here.

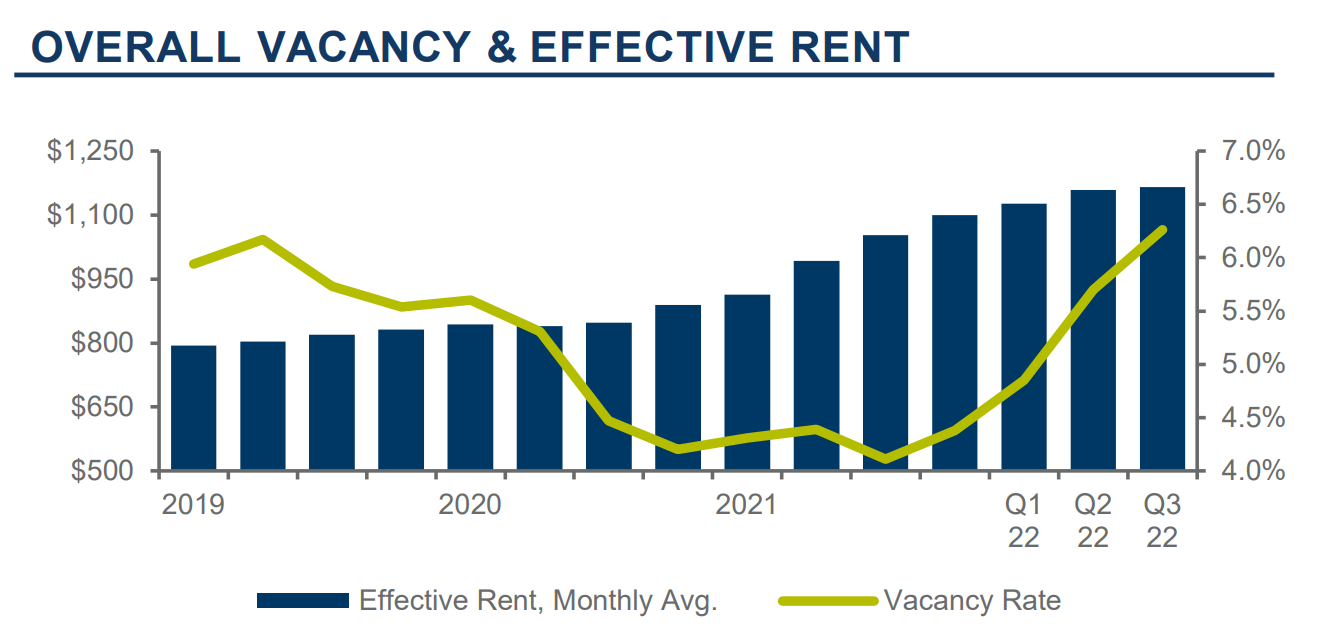

This quarter Tucson saw the average vacancy rate increase .49% up to 6.26% from the previous quarter, which is also a 2.15% increase YOY. During the third quarter, Tucson’s metropolitan area occupancy grew by 381 units as well as seeing the average gross apartment rent without utilities increase $6 (.52%) from last quarter to $1,165 per unit/$1.54 per square foot (psf). In reviewing transactions for properties with 40 or more units from last quarter to this quarter, the average price per unit increased by a dramatic $23,794 per unit and $35.96 (psf) to a total of $195,213 per unit and $289.96 (psf).

The City of Tucson has made a concerted effort to attract owners to work with Section 8 and other subsidized housing constituencies. Housing options for these individuals have diminished greatly as many recent apartment owners have renovated/repositioned properties and removed subsidized residents. Rents for these individuals have been adjusted to meet market rates with an approximate 30% increase from rates seen in 2020. The HUD Approved Fair Market Rate for a one-bedroom is $1,071 and a two-bedroom is $1,410. Tucson will continue to face housing issues due to the significant supply shortage for single-family rentals and multifamily units.

Tucson saw the first significant shift in the supply/demand arena in some time this quarter. Rising interest rates, increase in inventory, and market uncertainty have led to a decrease in the buyer pool and a softening of market value. Many investors are on the sidelines expecting that rates will continue to rise, and pricing will decline further in upcoming quarters. C&W | PICOR has recorded an approximate 40% drop in investor interest at the quarter’s end with a significant reduction in buyer inquiries. We expect inventory to continue to rise with many owners fearful of further pricing drops along with the impending maturity of numerous adjustable loans in the coming months.