To read the full report on Tucson’s multifamily activity in Q1, click here.

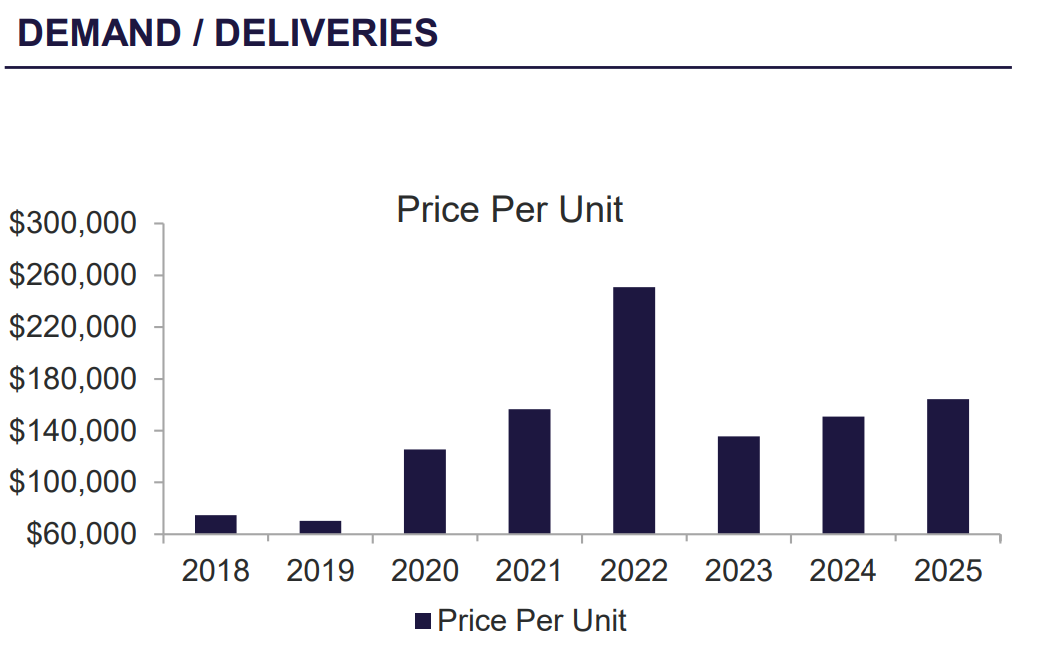

Tucson’s multifamily market slowed incrementally in Q1 2025, with the average vacancy rate rising to 8.81%, up 0.58% from a year ago. Average sale prices reached $164,338 per unit and $189.09 per sqft, reflecting YOY decreases of -9.3% and -11.5%. Market performance in 2025 is expected to closely mirror 2024’s. While larger investment activity was limited, with only one recorded sale of a 136-unit property, nine midsize assets (5–100 units) transacted during the quarter – with properties offering seller financing attracting significantly higher demand and pricing. When taken out to market, these deals often lead to multiple competing offers. Value-add opportunities continued to generate stronger interest than turn-key assets, a trend expected to remain consistent through year end.

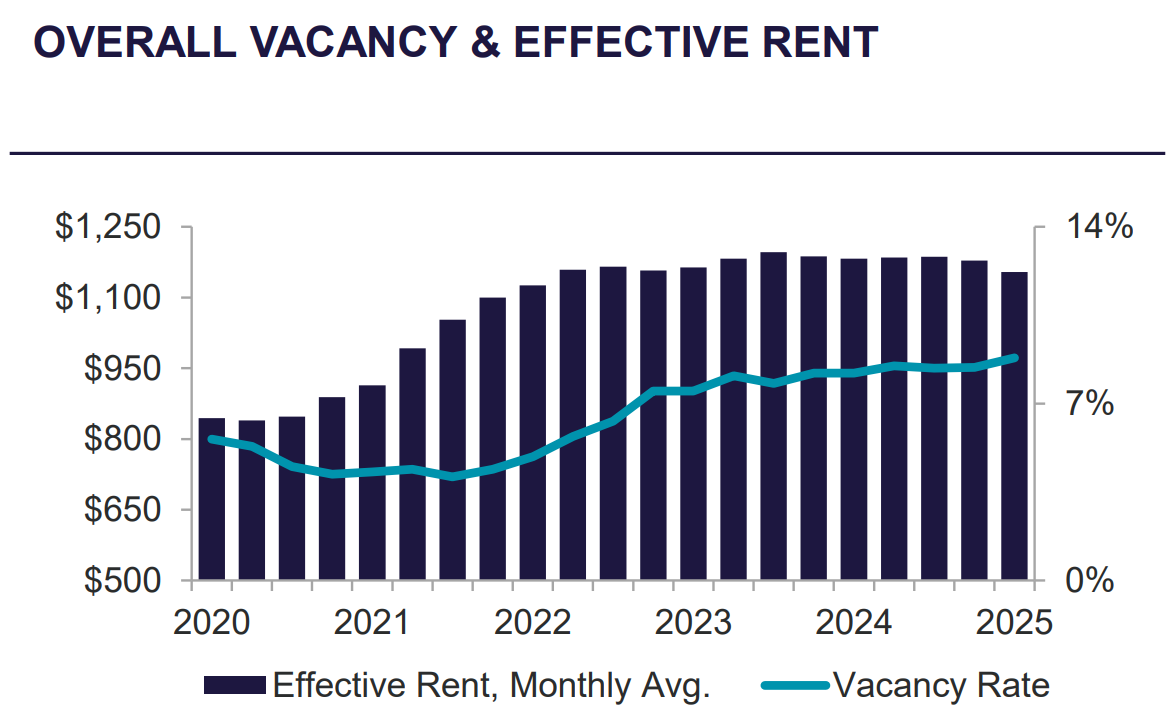

Most submarkets experienced rent decreases in Q1 2025, with Northeast Tucson the exception (increasing $14 per month). Catalina Foothills recorded the lowest vacancy rate with 6.98%, while South Central Tucson (-0.31%) and North Central Tucson (-0.14%) saw the most improvement. Average monthly gross rent dropped $24 from last quarter and $28 YOY to $1,154 per unit. This has been the largest dip since Q3 of 2022. Concessions rose to $38 per unit, up $6 from last quarter and $20 YOY, up from both last quarter and the previous year, signaling ongoing pressure on landlords to compete for tenants.

“The lending market continues to deal with interest rate volatility as treasuries continue their roller-coaster ride. Freddie Mac and Fannie Mae continue to lend despite the uncertainty and are the preeminent leader for conventional multifamily loans (stabilized assets with loan sizes over $5 million), with pricing today as competitive at 135 150 bps over the into UST for the right deals. Debt funds and banks will be active in asset and but the rate uncertainty will cause lenders to be more conservative and focused on sponsor strength. For private capital deals Freddie Mac’s SBL program is currently pricing deals in the 6.25% – 6.50% range, and we have seen non-bank balance sheet lenders offer competitive pricing and sizing off interest-only DSCR metrics to help stretch proceeds and compete with the agencies. Expected Fed cuts in 2025 may soften multifamily rates slightly, but expect lender spreads to widen in the event that treasuries decrease for as long as the uncertainty in the market persists.”

– Kevin Prouty, 520-323-5120 Debt & Finance

The Tucson Multifamily market outlook for the remainder of 2025 is in flux. We expect to see closed transactions and sale comps coming out at cap rates near 7% on a conservative proforma, a sizable increase over 2024. Financing challenges will continue throughout the year as economic uncertainty continues. Federal tariffs and the correlated volatility in the stock market may be good for real estate, as investors look to put capital into a more stabilized asset. Transaction volume will continue to remain low in the 100+ unit institutional sales market, mainly due to the drastic delta between interest rates and seller acceptable cap rates. The rental market has rebounded slightly with less time on the market and concessions needed to be offered to fill vacancies. Property owners with little to no debt on their asset are seeing success by offering seller financing to buyers. Offering this to the market increases the value of the property and generates triple the investor interest.