To read the full report on Tucson’s multifamily activity in Q2, click here.

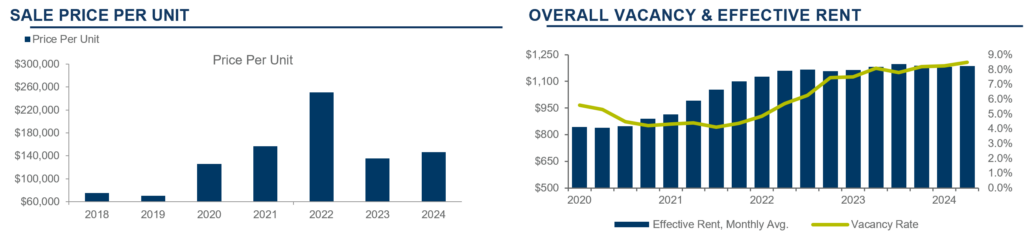

Tucson’s apartment vacancy increased to 8.48% in Q2 2024, up 0.25% from Q1 2024. While this might prompt concern, significant gains were achieved in six of the submarkets, highlighting strength in specific regions. Inventory increased by 141 units under pacing the strong demand for housing. Sales velocity remained steady for properties under 100 units with most offerings receiving multiple offers. In Q2 2024, no transactions occurred for properties over 100 units. This was expected following significant slowing over the last year for sales of 100+ units as many owners and investors stay on the sidelines monitoring interest rates, the outcome of the presidential election, and the overall state of the economy. Tucson’s demand continues to exceed supply as properties priced correctly and taken to market quickly receive multiple offers with strong terms. Most buyer demand leaned toward value-add properties over turn-key assets for more favorable upside and spread between cap rate and interest rates.

“The current market focus should be on retention and owners making sure properties are standing out vs others by addressing any deferred maintenance issues, curb appeal, and upgrades as needed to keep up with the market. Prospects have more options to choose from vs previous years as the market is correcting itself slowly. The amount of rents and increases captured during covid era have settled and currently renewals are being kept at the same rate. Any increases tend to be around 2 – 5% if increases were not aggressive during the crazy market a couple years ago. When tenants move out the captured rates may stay where they were previously or potentially $50 – $100 less per month depending on the area and product provided. Renters are willing to spend more on units that have more amenities such as in unit washer/dryers (or hookups), yards, off street parking, updated interiors, etc. Investors should consider converting swamp coolers over to HVACs when possible to keep up with the prospect’s desires. HVACs or mini splits tend to help lesson vacancy time vs similar products that offer swamp coolers on the market.” – Chris Meehan, Fort Lowell Realty & Property Management

“Reviewing loan production for the first quarter of 2024 was surprising when comparing it to the last five years of loan funding. Pima Federal Credit Union closed just north of 14mm in Q1 with eight transactions, six purchase requests and two refinances. This total production was only outpaced in volume and loan dollars in 2021, which was a staggering 22.44mm. Purchase requests showcase investors with demand in properties located near the University, and B class inventory. Cost of funds has impacted loan dollars; however, investors have adjusted their expectations for high LTV loans. Typically, down payments are around 40%, depending on the asset. Currently, we have eight transactions in process for Q2, five are purchase money requests and three are refinances. We anticipate an increase in refinance requests for the remainder of 2024, for the first time outpacing purchase requests. Inventory remains tight in Tucson, with little coming to market (or chatter of opportunities). Demand for multifamily remains high, however, there is still a gap between seller expectations and buyer expectations. Tucson’s multifamily market fundamentals are strong. Its affordability compared to the Phoenix market is one of the key drivers. Affordability in conjunction with a limited supply leads to a more stable market.” – Robert Motz, Pima Federal Credit Union

The outlook for the Tucson multifamily market remains neutral for the second half of the year. For current owners, management control and retaining quality tenants will be of utmost importance to ensure strong asset performance amid the headwinds. Capital does not seem to be of concern for most investor groups, but the overall perception of the market remains in a “wait and see” status. The upcoming election, uncertainty with interest rates, and limited supply will continue to make 2024 a relatively stagnant market for larger assets. Sub 100-unit complexes will see a slow, consistent pace of supply with significant interest from buyers. Properties that have a value-add opportunity will continue to sell quickly due to limited availability.