To read the full report on Tucson’s Multifamily market activity in Q3, click here

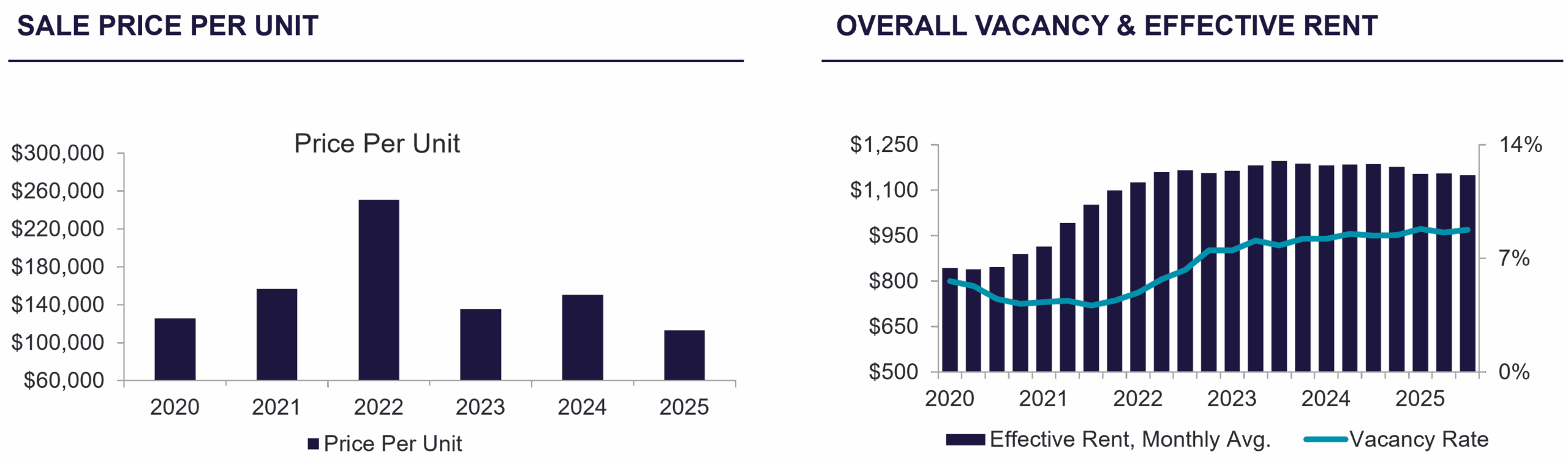

Tucson’s multifamily sales market saw a modest uptick in activity during Q3 2025. Ten arms-length transactions were completed with C&W | PICOR representing six of those transactions. Pricing declined sharply, with the average price falling to $112,747 per unit and $167.10 per square foot. The average year built for properties sold was 1979, highlighting a strong investor focus toward older, more value-add assets. Despite the drop in pricing, buyer interest remained concentrated in mid-sized, well-located assets, particularly those closer to central Tucson. Sales in the 5–100 unit range demonstrated the strongest investor demand for deals with seller financing, which continued to draw multiple competing offers and premium pricing. Larger institutional sales remained limited, mirroring a broader trend of investor caution amid elevated interest rates and economic uncertainty.

“Vacancy rates have risen to approximately 7.8%, largely due to continued new supply. Class A assets are feeling the most pressure, while Class B/C properties are generally performing better, especially with strong management and a focus on retention. Rents have largely leveled off, with some areas seeing softening. Many owners are offering targeted concessions rather than broad reductions to maintain occupancy and long-term value. Operating expenses are climbing, especially in insurance, maintenance, and utilities. As both a Property Manager and Insurance Agency Owner, I’ve seen firsthand how these rising costs are impacting investor returns. It’s more important than ever to review policies and plan ahead to protect assets and manage overhead.” – Sarah Haynie, 520-307-4384 JMD Asset Management

“In Q3 2025, Tucson’s multifamily market remained active, with purchase transactions ranging from stabilized assets to value-add opportunities, and student housing. Loan-to-cost ratios continued to improve, averaging 67.33%. Cap rates remained consistent from Q2, while interest rates showed signs of softening following a 25-basis point cut to the Fed Funds rate—which the treasury markets adjusted prior to the announcement. PFCU is currently pricing multifamily loans in the mid-to-high 6% range, depending on origination fees and fixed-rate terms. Underwriting challenges persist, particularly in securing insurance coverage at reasonable premiums. Despite these headwinds, Tucson’s fundamentals remain strong, supported by the I-10 corridor, the University of Arizona, and the potential $3.6 billion Project Blue data center.”- Robert Motz, 520-202-0672 Pima Federal Credit Union

As we enter the final quarter of 2025, the Tucson multifamily market is expected to remain quiet, with transaction activity slowing due to seasonal patterns and the impact of the upcoming holidays. Many investors are expected to stay on the sidelines through year-end, focusing on evaluating market conditions rather than executing deals. At the same time, listing activity continues to rise, with more sellers adjusting pricing to reflect current fundamentals, including elevated interest rates, higher expenses, and softening rent growth. While few transactions are anticipated in Q4, this period may serve as a key window for investors to track market shifts, identify potential opportunities, and prepare for a more active start in the new year.