Vacancy in the Tucson retail market ticked down, ending 2015 at 6.6%, a familiar and stable range for over two years. Annual net absorption in 2014 at 467,000 square feet (sf) and 2015 at 452,000 sf lagged the previous three years, which averaged 719,000 sf per year. In addition to traditional retailers, medical users from practice groups to the market’s first standalone emergency department have embraced the visibility, traffic counts, parking, and affordability that retail corridors offer today. On the national level, creating an experience for the consumer beyond a simple product purchase differentiates successful omni-channel/ brick and mortar retailers from their online counterparts. The grocery sector remains dynamic, with the possible re-entry of Albertsons at Broadway and Houghton and expansion from Natural Grocers. Walmart’s unexpected announcement of U. S. store closures will not have much impact on a national level and will not affect the Tucson market. Tucson continues to be an expansion market for Walmart and other discount retailers.

Investment activity in 2015 was dominated by out-of-state buyers, largely from California, Colorado and Texas where significant cap rate compression due to low interest rates has occurred. Both single-tenant and multi-tenant NNN retail remain in high demand, and heavy activity has occurred on well-priced assets. At $250 million, sales volume in 2015 was just short of the total posted in 2014. The average price of $207.56 per sf was the highest in 10 years, influenced by the sale of Casas Adobes Plaza and a number of single-tenant NNN sales.

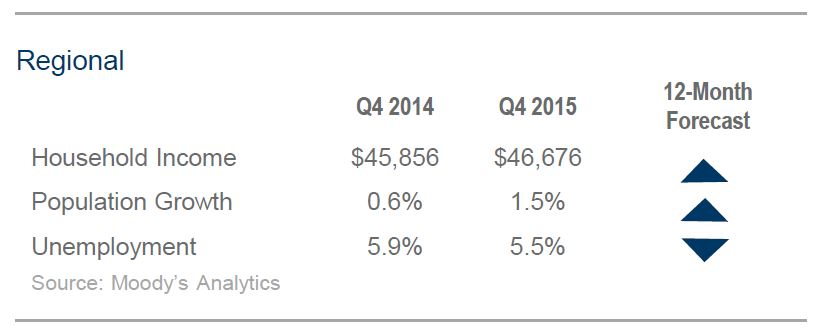

Economy

With 4,700 jobs gained over the first eleven months of 2015, Tucson’s employment picture continued to improve, but has room for additional growth to equalize with overall statewide employment statistics. Tucson has recovered 74.0% of recessionary jobs lost. Sector performance varied, with positive gains in professional and business services; leisure and hospitality, education and health care; financial activities; and information were largely offset by reductions in the other sectors, with the largest declines in state and local government.

Outlook

The three-year forecast for the Tucson region calls for modest growth in household income and the employment base, gaining momentum after the burn-off of fiscal drag and increased mobility nationally, allowing for increased in-migration. Healthcare demand will continue as a market driver, and we anticipate robust activity in Maricopa County to have a positive effect on the nearby Tucson market. More specific to retail, look for more fast-casual restaurants entering the market, as well as continued shakeup in soft goods chains, including JC Penney, American Apparel, PacSun and Sears. Tenants will continue to reshuffle and right size footprints to compensate for operational and competitive efficiencies.