Cushman & Wakefield | PICOR held its Annual Awards Ceremony on January 29 at the Tucson Country Club to recognize…

Tucson’s Q4 Retail Market Report: Steady Tenant Demand and Low Vacancy

In Q4 2025, Tucson’s retail market remained stable, with vacancy improving to 5.8%, reflecting steady tenant demand and tightening availability. Market fundamentals remained……

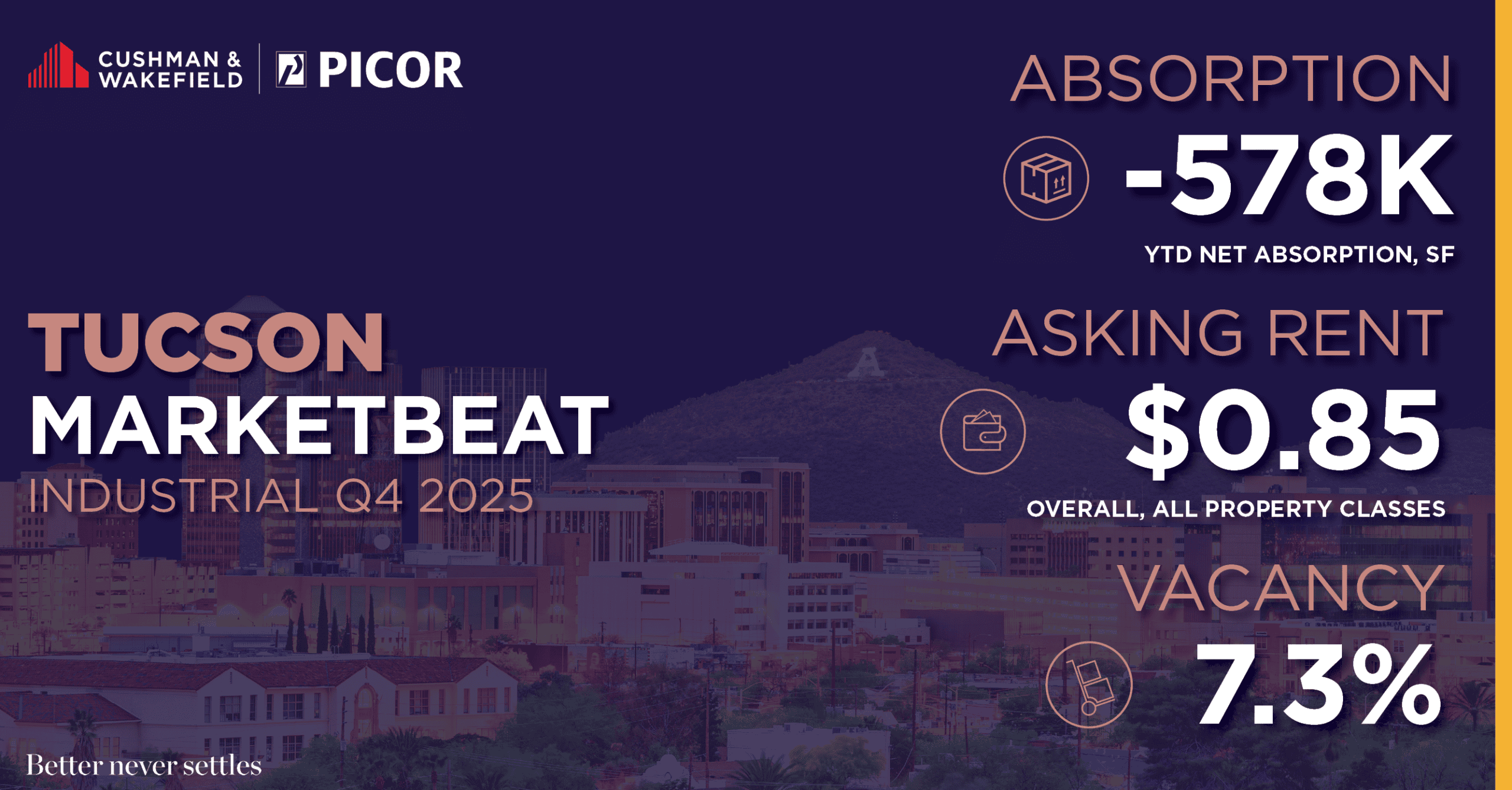

Tucson’s Q4 Industrial Market Report: Demand Steady as New Supply Elevates Vacancy

To read the full report on Tucson’s Industrial market activity in Q4, click here Tucson’s industrial market remained active in…

Props 418 and 419: Fix Tucson’s Roads and Transit for Half a Cent on the Dollar

On March 10, Pima County voters will decide whether to continue funding a regional approach to transportation improvements through Propositions…

Tucson’s Q4 Office Market Report: Healthcare Demand Fuels Absorption

In Q4 2025, Tucson’s office market showed modest improvement, with vacancy declining slightly as absorption increased relative to prior quarters. While overall vacancy remains above balanced levels, leasing momentum……

Tucson’s Q4 Multifamily Market Report: Vacancy Increases as Competition Intensifies

Tucson’s multifamily market demonstrated an increasingly cooling trend across the region. Vacancy rose to 9.56% driven by a measurable expansion in available units across multiple submarkets……

C&W | PICOR’s Kameron Norwood Honored as a BizTucson Next Gen Leader

Cushman & Wakefield | PICOR joins in honoring Kameron Norwood, Investment Sales & Leasing Specialist, as a BizTucson 2026 Next…

Cushman & Wakefield | PICOR’s Q4 2025 Top Transactions

As we ring in the new year, let’s look back on the last quarter of 2025. In Q4, Cushman…

Support Local or Tax Local? The Hidden Cost of Oro Valley’s Proposed Rental Tax

Oro Valley, just northwest of Tucson, is known for its stunning views of the Catalina and Tortolita Mountains and an…

PICOR Charitable Foundation Announces 2025 Pancake Breakfast Grant Recipients

On December 2nd, the PICOR Charitable Foundation volunteer grant committee sat down to read through the grant applications for this…