A bipartisan measure tucked into the 2017 federal tax law is providing a significant opportunity for investors to reduce their capital gains taxes while spurring economic growth in designated areas of Arizona.

The measure incentivizes investors to realize gains in relatively passive investments and reinvest them in active investments in lower-income areas that might otherwise be overlooked. The statute creates Opportunity Zones and allows for the establishment of Opportunity Funds, which invest in the Zones. Investors who realize gains and move them into Opportunity Funds can defer and reduce taxes on that initial realization. Additionally, those who keep their opportunity fund investment for 10 years will pay no capital gains on the second investment.

A COLLABORATIVE EFFORT

Under Governor Ducey’s direction, the Arizona Commerce Authority (ACA) led the statewide effort to determine Arizona’s qualifying low-income Census tracts for Opportunity Zone status. The ACA reached out to jurisdictions throughout Arizona, requesting recommendations of up to 25 percent of their qualifying tracts, plus one optional contiguous tract.

To qualify, a Census tract needed to have either a 20 percent or higher poverty rate or a median family income not exceeding 80 percent of the median for the state or metropolitan statistical area (MSA), whichever was higher.

“Contiguous tracts” were defined as being adjacent to a nominated tract and could not have a median family income exceeding 125 percent of the adjacent qualifying tract. States were allowed to choose 5 percent of their total nominated tracts from contiguous tracts.

Incorporated communities of 10,000 or more residents in Maricopa and Pima counties submitted recommendations to the ACA. The counties made recommendations for smaller towns and unincorporated areas. The other counties and tribes with qualifying tracts centered on their land were asked to make recommendations for their areas as well.

OPPORTUNITY ZONE CREATION

Each state’s governor nominated 25 percent of a state’s qualifying low-income Census tracts for Opportunity Zone status. Governor Ducey submitted Arizona’s nominations for 160 qualifying tracts and eight contiguous tracts, which were approved by the U.S. Treasury on April 8, making Arizona one of the first to receive the green light to move forward in taking advantage of this new program. Every county in Arizona has at least one Opportunity Zone.

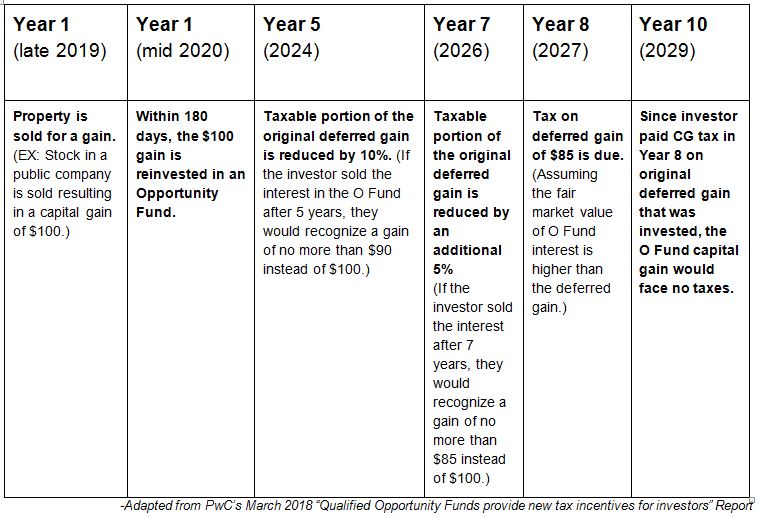

Opportunity Zones offer two substantial tax benefits to investors. First, investors can defer and reduce capital gains taxes on investment proceeds that are placed into qualifying investment vehicles –Opportunity Funds – within 180 days of realizing the gain. If the investment is left in the Opportunity Fund for five years, the taxable portion of the deferred gain is reduced by 10 percent. If it is left in for seven years, it is reduced by an additional 5 percent, resulting in a 15 percent total reduction in capital gains taxes owed on the original deferred gain.

The second benefit applies to the investment made into the Opportunity Fund. Investors can eliminate capital gains taxes on Opportunity Fund investments left in for 10 years.

Example Mechanics of the Opportunity Zones Incentive:

OPPORTUNITY FUNDS

To qualify for Opportunity Zone tax benefits, an investment must be made through a certified Opportunity Fund and the money invested in an Opportunity Fund must be a gain from another investment that is transferred into the Opportunity Fund within 180 days of realizing the gain.

Investors must invest through an Opportunity Fund, which must be structured as a corporation or partnership and certified by the Treasury. Investors can self-certify their Opportunity Funds by filling out a form (to be released in Summer 2018) and submitting it with their federal tax return.

To remain in compliance, an Opportunity Fund must have 90 percent of its assets in a qualified Opportunity Zone property, which is determined twice yearly. This puts pressure on fund managers to invest money quickly, as they will have only months to put the vast majority of the money to work. This may lead to funds taking in money in tranches or to the creation of multiple funds for even a single project.

If a fund does not comply with the 90 percent investment rule, a fine is levied in an amount equal to the excess of 90 percent of its aggregate assets over the aggregate amount of Opportunity Zone property held by the Opportunity Fund, multiplied by the IRS underpayment rate. The fine may be waived “due to a reasonable cause,” however, “reasonable” has not yet been defined yet by the U.S. Treasury.

In general, Opportunity Funds can be used to invest directly for profit in property and operating businesses. They can also invest in social utility projects such as affordable housing and medical facilities in underserved areas. They may also be used for investing in infrastructure projects. There are specific limitations, listed below.

OPPORTUNITY ZONE BUSINESS

Opportunity Funds have three options for investing in a qualified Opportunity Zone business. Funds can purchase Qualified Opportunity Zone stock, a Qualified Opportunity Zone partnership interest or a Qualified Opportunity Zone business property.

An Opportunity Zone business is described as “a trade or business” in which:

- Substantially all of the tangible property owned or leased by the taxpayer is qualified Opportunity Zone property, and

- More than 50 percent of total gross income is derived from active conduct of such business, and

- A substantial portion of the intangible property of such entity is used in the active conduct of any such business, and

- Less than 5 percent of its assets are invested in nonqualified financial property

An Opportunity Zone business cannot be a golf course, country club, massage parlor, hot tub facility, sun tan facility, liquor store, racetrack or “other facility used for gambling.”

QUALIFIED BUSINESS PROPERTY

A Qualified Business Property must have been acquired by the qualified Opportunity Fund by purchase after Dec. 31, 2017 and “during substantially all of the Opportunity Fund’s holding period, substantially all of the use of the property was in a qualified Opportunity Zone.”

The original use of the property must begin with the Opportunity Fund or the fund must “substantially improve the property.” This presents some challenges for investing in existing businesses that were operating and using property before the Opportunity Fund considered investing. U.S. Treasury guidance is awaited on issues related to this challenge.

The property is considered “substantially improved” if during any 30-month period following acquisition, “there are additions to basis that equal the adjusted basis as of the beginning of such 30-month period.” This means, essentially, that an Opportunity Fund will have to spend as much money improving a property as it spent acquiring it. This may be a challenge for some renovation projects, less so for new-build projects.

Numerous related-party provisions apply. Notable among these is that companies cannot purchase from themselves via Opportunity Funds.

QUALIFIED OPPORTUNITY ZONE STOCK

Qualified Opportunity Zone Stock must be obtained during its original issue for cash. The corporation from which the stock is obtained must be a qualified Opportunity Zone business when stock was issued or be organized to be one. During “substantially all” of the fund’s holding period for the stock, the corporation must qualify as an Opportunity Zone business.

QUALIFIED PARTNERSHIP INTEREST

A Qualified Opportunity Zone Partnership Interest must be obtained from the partnership for cash. The corporation from which the interest is obtained must be a qualified Opportunity Zone business when interest was acquired or be organized to be one. During “substantially all” of the fund’s holding period for the interest, the partnership must qualify as an Opportunity Zone Business.

WHAT’S NEXT FOR OPPORTUNITY ZONES?

Although all states and territories have had their Opportunity Zones approved, there are still several areas remaining for the U.S. Treasury to provide guidance to states, including but not limited to:

- Defining types of partnerships and corporations that may be used to form Opportunity Funds.

- Whether there will there be a “ramp-up” period for investing before the 90 percent deployment and other rules apply.

- Definitions for “substantially” and “substantially all” in many parts of the statute.

- Establishing rules to ensure a fund has “a reasonable period of time to reinvest the return of capital from investments in qualified Opportunity Zone stock and qualified Opportunity Zone partnership interests, and to reinvest proceeds from the sale or disposition of qualified Opportunity Zone property.”

- Establishing guidelines for what happens if an Opportunity Fund-backed company get sold or goes public, creating a realization for the fund in less than 10 years.

- Must the money be reinvested in an Opportunity Zone?

- What will the tax implications be?

- Defining the best options/methods for investing in existing operating businesses in Opportunity Zones.

- Defining the best options/methods for investing in rental housing such that it counts as active conduct of a trade or business.

- Establishing rules to prevent abuse.

- What does “original use” mean?

The ACA already has hosted two educational forums on Opportunity Zones and will continue to host additional forums to prepare communities and potential investors to take full advantage of the program.

Copyright TREND Report. For more information on TREND Report, visit http://trendreportaz.com/ or contact Publisher, Lucinda Smedley.

Shawn Neidorf, SVP, Research, oversees efforts related to opportunity zones and opportunity funds for the Airzona Commerce Authority. She has been with the ACA for five years. Previously, she was a public-opinion pollster and a reporter and editor focused on government and finance. She has doctoral and master’s degrees in economic and organizational sociology from the University of Illinois at Chicago and a bachelor’s degree in journalism from the University of Illinois at Urbana-Champaign. She can be reached at shawnn@azcommerce.com.

Shawn Neidorf, SVP, Research, oversees efforts related to opportunity zones and opportunity funds for the Airzona Commerce Authority. She has been with the ACA for five years. Previously, she was a public-opinion pollster and a reporter and editor focused on government and finance. She has doctoral and master’s degrees in economic and organizational sociology from the University of Illinois at Chicago and a bachelor’s degree in journalism from the University of Illinois at Urbana-Champaign. She can be reached at shawnn@azcommerce.com.

ADDITIONAL RESOURCES

- ACA Opportunity Zones info

- ACA Opportunity Zones map

- S. Treasury’s CDFI Opportunity Zones resources

- Economic Innovation Group’s Opportunity Zones resources

- Enterprise Community Partners’ Opportunity Zones page

- Council of Development Finance Agencies (CDFA) Opportunity Zones info

- Local Initiatives Support Corporation (LISC) Opportunity Zones fact sheet

- PriceWaterhouseCooper’s “Tax Insight” issue on Opportunity Zones/Funds

- Bloomberg Tax/Tax Management Real Estate Journal’s February 2018 Opportunity Zones article

- Bloomberg Tax/Tax Management Real Estate Journal’s July 2018 Q&A style update on Opportunity Zones