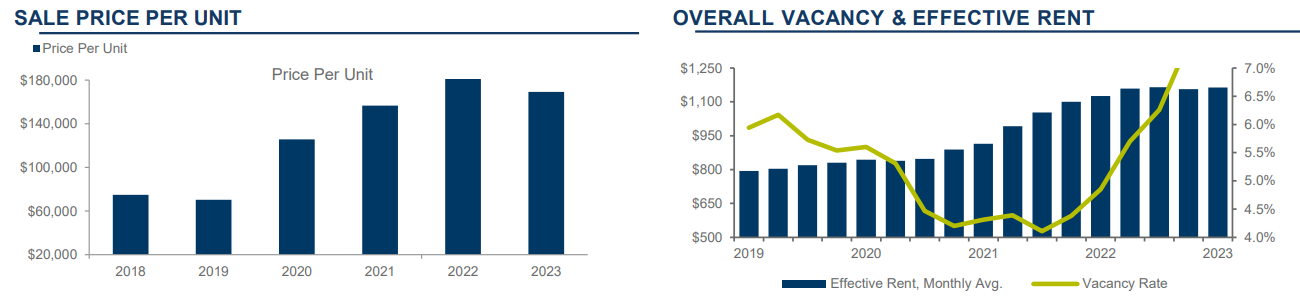

Tucson’s average vacancy rate increased by 0.03% to 7.49% in Q1 2023, representing a 2.64% decrease year-over-year. The Tucson market’s leasing activity slowed as the new year turned, but towards the end of the first quarter picked back up velocity. The average gross apartment rent without utilities increased by $7 (.61%) from Q4 2022 to $1,164 per unit/$1.53 per square foot (sf). Of completed transactions in the quarter, only one was larger than 40 units, an alarming sign of the drastic slowdown in sales volume in the 40+ unit market for apartments. The subject property, 52 units built in 2000, sold for $8,800,000 ($169,231 per unit/$188.03 per sf.)

To read the full report on Tucson’s multifamily activity in Q1, click here.

The beginning of 2023 saw slower leasing activity than expected. Managers are reporting lower demand for apartments across all submarkets. We attribute this to an adjustment to rapid rent inflation in Tucson, expected to pull back slightly throughout the remainder of the year. Apartment Insights reports on 15 submarkets, of which five recorded gross rents above $1,400/unit. From Q1 2022, Tucson’s average gross rent rose $38/month, a 3.37% increase. During the first quarter, gross rents increased in eight submarkets, with a high of $164 in Southeast Tucson (primarily due to one major, new luxury property) and a $49 increase in the Southwest submarket. Average gross rents fell in six submarkets, with the highest drop of $24 (-2.40%) occurring in the Flowing Wells submarket.

In the Tucson MSA, the available market supply of apartment units has increased, while the demand for those assets has softened. Potential buyers show concern over increasing interest rates and other economic factors. When evaluating the trends for 2023, there is a clear indication that overall vacancy is holding strong, which puts Tucson’s market in a competitive position for renters. Cited rent increase trends will continue as we enter Q2. Owners with pricing expectations based on activity in 2022 will need to adjust to current values and market conditions. While Q1 2023 saw considerably fewer sale transactions than the recent trend, we forecast an increase in the months ahead provided that the gap closes between sellers’ expectations and purchasers’ willingness to pay.