To read the full report on Tucson’s retail activity in Q3, click here.

The Tucson retail market remained stable in Q3 2024, with the vacancy rate holding at 5.7%. However, Q4 is expected to see negative absorption due to the recent and upcoming closures of several Big Lots, Conn’s, 99 Cent Only, Dollar Tree, and Sam Levitz Furniture, which will add more than 200,000 square feet (sf) of vacant space.

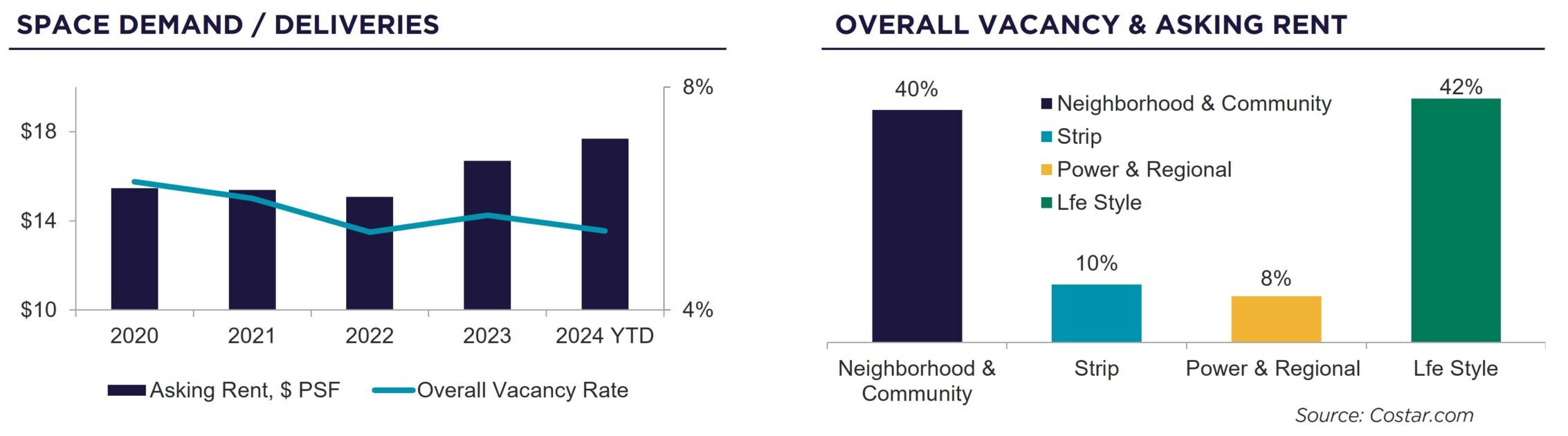

Lease rates continue to hold steady. We expect to see rates for larger spaces decline due to the increase in supply. The discount/dollar store sector appears to be overbuilt, while quick-serve restaurants, “medtail,” fitness centers, and “eater-tainment” venues demonstrate strong performance.

Current construction activity has tapered as many landlords and tenants are anticipating more competitive construction costs going into 2025. Home Depot opened its Houghton Rd store in September, and Fry’s Food and Drug opened in October at Gladden Farms.

Top lease transactions include Caliber Collision leasing 27,808 sf property on Oracle and Limberlost and Burlington leasing 21,580 sf at Broadway and Kolb. Top sale transactions include Litwin Management purchasing a 92,910 sf portfolio at Casas Adobes Plaza for $51M and Arileus Capital purchasing 36,784 sf on Broadway and Wilmot for $3.9M.

Investment sales volume has moderated. Flat pricing and mismatched seller-buyer expectations dominate the conversation, with the increased interest rates and cap rates to blame. Consumer spending is slowing, especially at discount stores. Food and beverage have been resistant to this trend. Adaptive reuse is gaining traction as a cost-effective alternative to new construction.