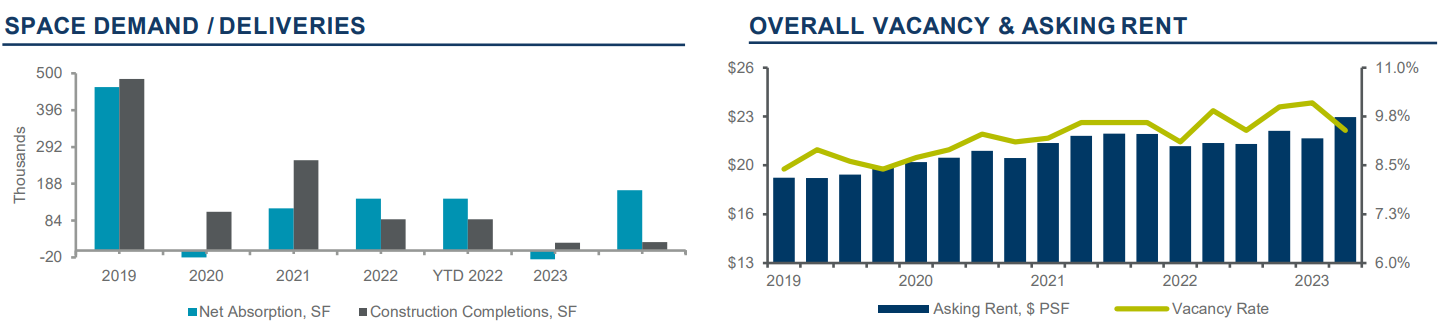

The Tucson office market is steadily recovering from the pandemic, with tenants adapting to changing dynamics such as hybrid scheduling and condensed workforces. The Tucson office market shows small improvements from the previous quarter, with the vacancy rate dropping to 9.4%, however, the current 2.7 million square feet (sf) on the market still warrants attention. The market conditions offer tenants increased options and leverage in negotiating lease terms and allowances.

To read the full report on Tucson’s office activity in Q2, click here.

While office investment sales have declined, triple net leased medical properties remain a promising segment, commanding higher sales prices per sf due to the strong presence of medical users driving sustained demand. The Foothills submarket is thriving for office investments, while the Central Business District in Downtown Tucson is working on regaining demand.

The industry faces challenges from inflation and supply chain issues, resulting in increased prices for new construction projects. Rising interest rates further impede new development. Despite these challenges, two noteworthy construction projects are underway in Tucson: a 16,137 sf medical building in Oro Valley, estimated for completion in July 2023, and a 14,593 SF medical office in Central Tucson, set to be completed by September 2023. These projects reflect the significant demand from medical users that are driving the office market. Leasing activity in Tucson remains popular within the range of 1,500-3,000 sf, and there remains an influx of behavioral health practices due to available government funding.

The average lease rate for Tucson office space is $21.30 per square feet (sf) representing a slight increase of $1.42 psf from Q1. This positive trend indicates the stability of rental prices. Among the submarkets, the Foothills area has the highest asking rent of $28.24 psf, closely followed by the Southwest submarket at $27.62 psf. On the other hand, East Tucson offers the lowest rate at $15.61 psf. In terms of investment sales, office properties have an average sale rate of $186 psf. Notably, the focal point of investment sales has predominantly been in central Tucson.