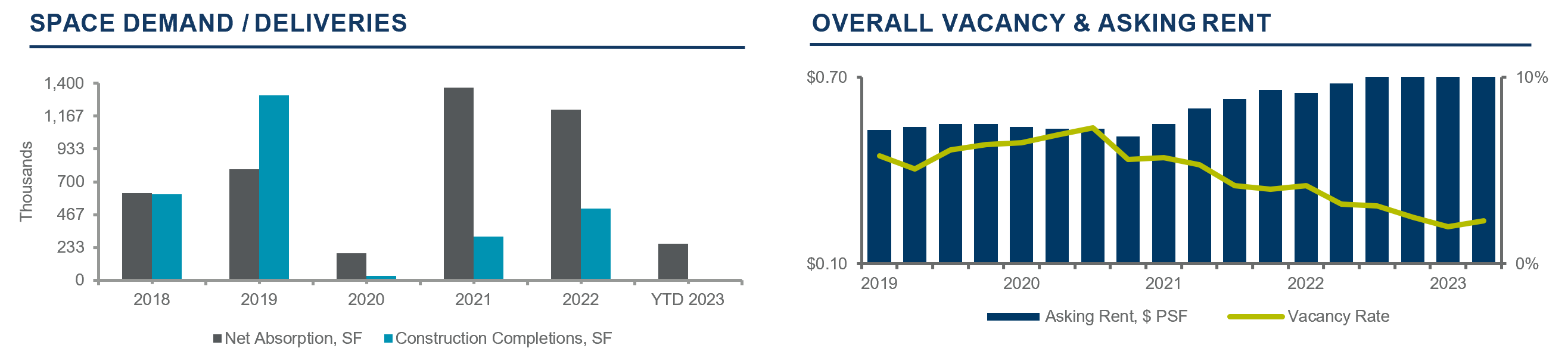

During the second quarter of 2023, the Tucson industrial market remained healthy and resilient and was not impacted by economic downturns as severely as other markets. The vacancy rate experienced a slight increase, reaching 2.3% year-to-date (YTD) with positive overall absorption of 252,944 square feet (sf). Tucson continued to face high demand with limited inventory while rising construction costs posed challenges for new development. Despite these obstacles, the number of new leases grew with a YOY increase of approximately 1.8%.

To read the full report on Tucson’s industrial activity in Q2, click here.

During Q2, the Tucson industrial market remained healthy and resilient and was not impacted by economic downturns as severely as other markets. The vacancy rate experienced a slight increase, reaching 2.3% year-to-date (YTD) with positive overall absorption of 252,944 square feet (sf). Tucson continued to face high demand with limited inventory while rising construction costs posed challenges for new development. Despite these obstacles, the number of new leases grew with a YOY increase of approximately 1.8%.

Manufacturing and distribution centers, particularly in submarkets like Southwest Tucson/Airport, Northwest Tucson/Oro Valley, Southeast, and Vail, were the dominant users of industrial space. Pricing pressures and labor shortages tempered construction activity. Notable projects under construction included the Southern Arizona Logistics Center with 946,935 sf in NW Tucson/Oro Valley, the Tucson Commerce Center with 786,240 sf in the SW Tucson submarket, and 187,452 sf in Southeast Tucson.

The market saw increased sale transactions during Q2, with RedSwell, LLC purchasing a 26,830-sf building at 3151 E Drexel for $2.5 million as an investment property. West Valley Investment Group purchased a 21,578-sf property on 4705 S Coach Drive for $2.8 million. Additionally, a private sale concluded with the buyer acquiring a 14,900-sf property on 4302 E Tennessee St for $700,000 for their own use.

Pricing for existing buildings in the Tucson industrial market trended upward due to strong demand and limited availability. Lease rates for certain property types recorded gains as high as $0.30 per sf per month compared to those in the previous quarter. Additionally, lease terms for smaller spaces have been expanding to 3–5-year durations. The average sale price remains at a notable $100 per sf. Despite challenges related to inventory scarcity and construction completions, the market remained healthy, with high demand, increasing lease and sale rates, and low occupancy levels. Industrial property investments, particularly in manufacturing and distribution centers, remained attractive and promising. The market continued to draw interest from corporate national groups, driven by post-pandemic growth.