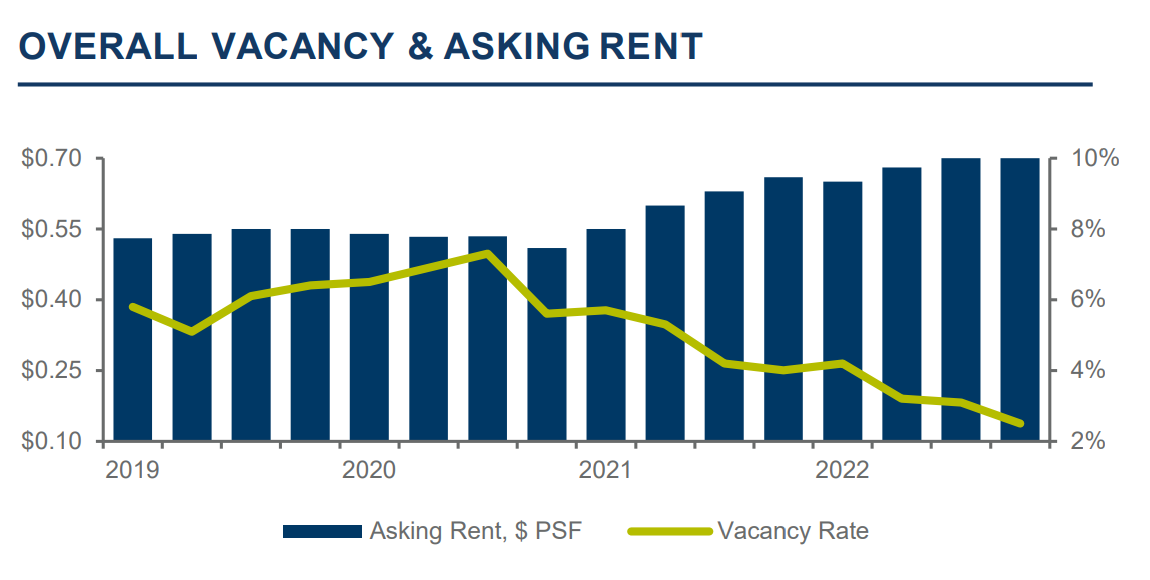

The Tucson industrial market remained stable at year end, with market-wide vacancy approaching a historic low of 2.5%. Net absorption in Q4 was estimated at 590,980 square feet (sf), about half in newly constructed projects. Demand is being driven primarily by logistics, distribution, manufacturing, and the cannabis industry.

To read the full report on Tucson’s industrial activity in Q4, click here.

To read the full report on Tucson’s industrial activity in Q4, click here.

Despite the low vacancy rate, only two new developments broke ground; Southern Arizona Logistics Center at Tangerine and I-10 with a proposed total of 1.7 million square feet (msf), and Tucson Commerce Center at Valencia and Alvernon with a proposed total of 780,000 sf. Land sales remained slow due to lack of inventory and rising construction and financing costs. Several notable investment sales transactions closed this quarter, notably the Amazon delivery station at I-19 and I-10 sold at a 4.3% cap rate, and the Destechbuilding at 410 E. Irvington Rd conveyed as a sale-leaseback at a 5.9% cap rate. Sion Battery, TuSimple, and American Battery Factory (ABF) have announced expansions and new projects in greater Tucson. Sion will add 111,000 sf to their existing plant, creating 150 new jobs by 2026. TuSimpleis adding 35,000 sf to their facility. ABF has selected Tucson as the site of their first giga factory in the United States with 2.0 msf under roof and an investment of $1.2 billion. Rainbird is also under construction with a 100,000 sf expansion to their Tucson facilities.

Lease rates continued to achieve historic highs. The average lease rate quoted for new construction was $0.80 per square foot (psf), and existing buildings were averaging $0.65-0.70 psf. Because new construction won’t deliver until the latter part of 2023 and construction costs remain high, pressure on rates for new and existing industrial property will continue throughout 2023. Given the extremely low inventory of buildings for sale or lease, pricing will continue to inflate in 2023, as construction costs rise and timelines are extended. Investment sale inventory is limited, as owners are enjoying record cash flows and challenged to locate alternate investments. Land sale activity is healthy with prices rising as buildable site inventory has greatly diminished in the recent years. Constraints previously mentioned include construction costs and relatively high cost of debt.