By Rob Tomlinson

The Trend Report, April 2024 Edition

Our retail landscape continues to evolve as we increasingly discover the benefits and drawbacks of online shopping. As we proceed along this evolutionary course, certain retail product sectors have resisted the surge of online sales, reflecting the limitations of online shopping and the enduring allure and the necessity of in-person shopping experiences. While the grocery segment stands out as an “internet-resistant” retail sector, many other consumer goods and services also demonstrate the ongoing demand for brick-and-mortar locations. It is essential for retail real estate professionals, investors, and developers to understand which product types and retailers are less susceptible to online encroachment and are more likely to withstand the trajectory of online consumer goods sales. This understanding will help asset managers and leasing professionals target tenants with long-term stability, allow investors to underwrite retail properties more effectively, and assist in retail investment decisions.

The Biggest Drawbacks of Online Shopping (Image courtesy of the TREND Report. Original Source: BrizFeel)

Specialty stores, such as home improvement centers, garden stores, and luxury goods outlets, have proven resilient. Home improvement and garden stores offer a tactile shopping experience that online platforms cannot replicate. The ability to see, touch, and even smell products, coupled with expert advice from staff, enhances the value proposition of these specialty stores. Similarly, luxury goods outlets provide an exclusive shopping experience characterized by personalized service and immediate gratification, making them less susceptible to online competition.

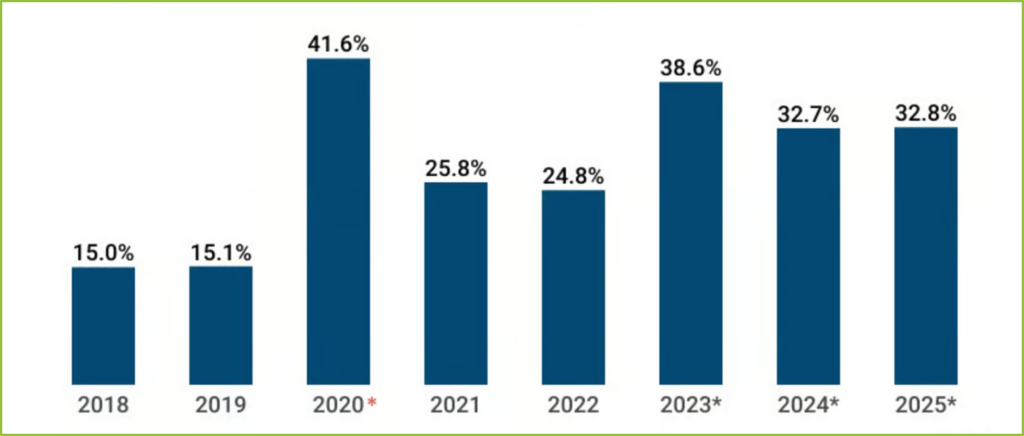

While online grocery sales surged during the pandemic, consumers are largely returning to physical stores, driven by the tactile experience of selecting fresh produce, baked goods, and meat/poultry items. The Produce News (Craig Levitt, October 12, 2023) reports that post-pandemic online grocery sales declined more than three percent in September 2023. Levitt points out that “September was the lowest order rate since the Covid-19 pandemic disrupted grocery shopping patterns. While September’s order frequency remains above pre-Covid-19 levels, it was only about 14 percent higher than what was posted in August 2019” (pre-Covid). Brick Meets Click additionally reported that “The U.S. online grocery market finished February with total monthly sales of $7.9 billion, down 10.5% compared to 2023, according to the most recent Brick Meets Click/Mercatus Grocery Shopper Survey fielded February 28–29, 2024.” Overall, online sales of grocery items comprise just 11.2-13% of all grocery sales. While this percentage may change over time, the current indications are that grocery sales will depend on brick-and-mortar locations for a long time.

Moving from anchor tenancy to inline and pad users, the below retail product classes and tenant classes have shown little online encroachment, further diversifying the retail landscape:

- Coffee Shops: Independent coffee shops and boutique cafes often offer a unique atmosphere and experience that cannot be replicated online. Customers value the ambiance, social interaction, and fresh, personalized, beverages.

- Boutique Fitness Studios: Specialty fitness studios offering classes such as yoga, Pilates, spin, or martial arts typically provide a personalized experience and sense of community that online workouts cannot match.

- Local Bakeries and Pastry Shops: Artisanal bakeries and pastry shops offer freshly baked goods and unique treats that appeal to customers seeking quality and local authenticity.

- Specialty Bookstores: Independent bookstores focusing on niche genres or rare books provide a curated selection and personalized recommendations that attract avid readers and collectors.

- Pet Grooming and Supplies Stores: Small pet grooming salons and boutique stores offering specialized pet supplies cater to pet owners seeking personalized care and unique products for their furry companions.

- Art Galleries and Studios: Local art galleries and studios showcase the work of emerging artists and host exhibitions, workshops, and events that encourage community engagement and support for the arts.

- Craft Breweries and Taprooms: Microbreweries and taprooms offer craft beer enthusiasts the opportunity to sample unique brews, participate in tastings, and engage with brewers in a social setting.

- Gift Shops and Specialty Retailers: Quirky gift shops, artisanal craft stores, and specialty retailers offering handmade goods and unique finds appeal to shoppers seeking one-of-a-kind items and personalized gifts.

- Vintage Clothing Stores: Retro and vintage clothing boutiques offer a curated selection of timeless apparel and accessories, catering to fashion-conscious individuals looking for unique style statements.

- Local Restaurants and Cafés: Small, independent restaurants and cafes provide diners with a culinary experience that extends beyond just food, offering ambiance, hospitality, and community connections that online food delivery services cannot replicate.

Grocery eCommerce Annual Growth *2023-2025 Projections * March 11, 2020: World Health Organization declares global pandemic

(Image courtesy of the TREND Report. Original Source: Statista)

Today’s retail marketplace demonstrates physical stores’ enduring appeal and value in certain sectors. While online shopping offers some convenience, it cannot fully replicate the multifaceted experience of in-person shopping. While many routine purchases of common products do well online, the online retailing space cannot replicate the value of personal experience needed with a more specialized or personalized product. Moreover, online retailers cannot provide the level of advice and attention that a brick-and-mortar retailer can. When considering a retail tenant, ask yourself, “How easily can this tenant’s product offering be replicated online?” If an online purchase of that product seems to be a stretch, then that is the tenant you want in your retail center.

Rob Tomlinson has been a commercial real estate broker since 1996. His work on a wide variety of commercial projects coupled with his education in Urban Geography, Site Analysis, and Land Use Planning gives him a wealth of experience in the development process. He can be reached at rtomlinson@picor.com