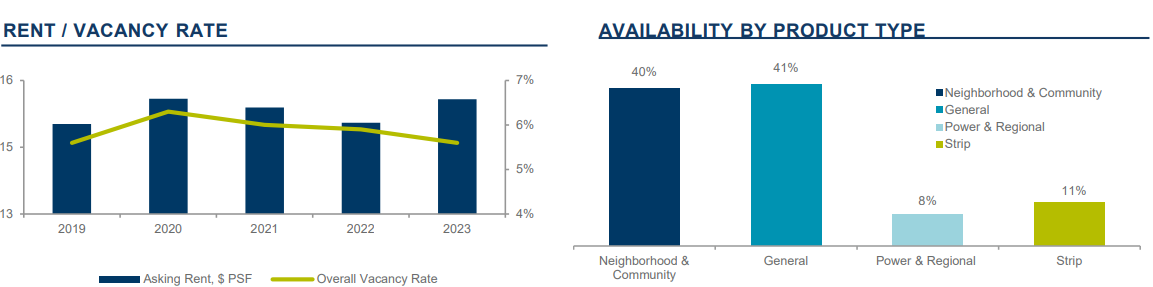

The Tucson retail commercial real estate market in Q2 showed steady signs of improvement, with continued absorption of 270,000 square feet (sf) over the past 12 months causing a decrease in the overall vacancy rate from 6.2% one year ago to the current 5.6%. This positive trend surpasses the previous 5-year annual average of 230,000 sf of positive absorption, indicating progress. However, local retail rates have increased by only 2.8%, still lagging behind the national average of 3.6%. The market has not yet reached a level that would stimulate speculative retail building and development. New building and development is further stunted due to inflated construction costs and high interest rates. Nationally, the vast majority (87%) of retail construction projects are pre-leased or built-to-suit.

To read the full report on Tucson’s retail activity in Q2, click here.

In Q2, Tucson’s retail commercial real estate market witnessed strong retail expansion in sectors such as entertainment, fitness/wellness, healthcare, and auto stores. There was also a notable demand for food and beverage establishments, particularly those with drive-thru and grab-and-go setups. Key lease deals included Suvida, a national healthcare provider, securing a 21,888 sf building in west Tucson, Planet Fitness acquiring an 18,125 sf space in the Foothills submarket, and Site 17 Event Center leasing 17,474 sf in downtown Tucson.

On the investment sales side, the Marriot Star Pass Resort & Spa set a new record with a $112 million sale, while Cottonwood Plaza sold for $9,086,003 in the Foothills submarket. The market is adjusting to a new debt environment, and as a result, the retail capital market activity remains slow, primarily due to outdated and unrealistic capitalization (cap) rates compared to the cost of available debt. A reduction in interest rates or forced sales of retail assets may be necessary to stimulate activity and create a convergence between cap rates and interest rates.

Despite a decline in 2022, retail rental rates have rebounded with a 2.7% increase compared to last year. Tucson’s rent growth is projected to continue, particularly in wealthier submarkets, commanding a 25% premium over the market average. Investment sale pricing has remained stagnant, with an average cap rate of 6.14% and an average sale price per square foot of $195 over the past twelve months.