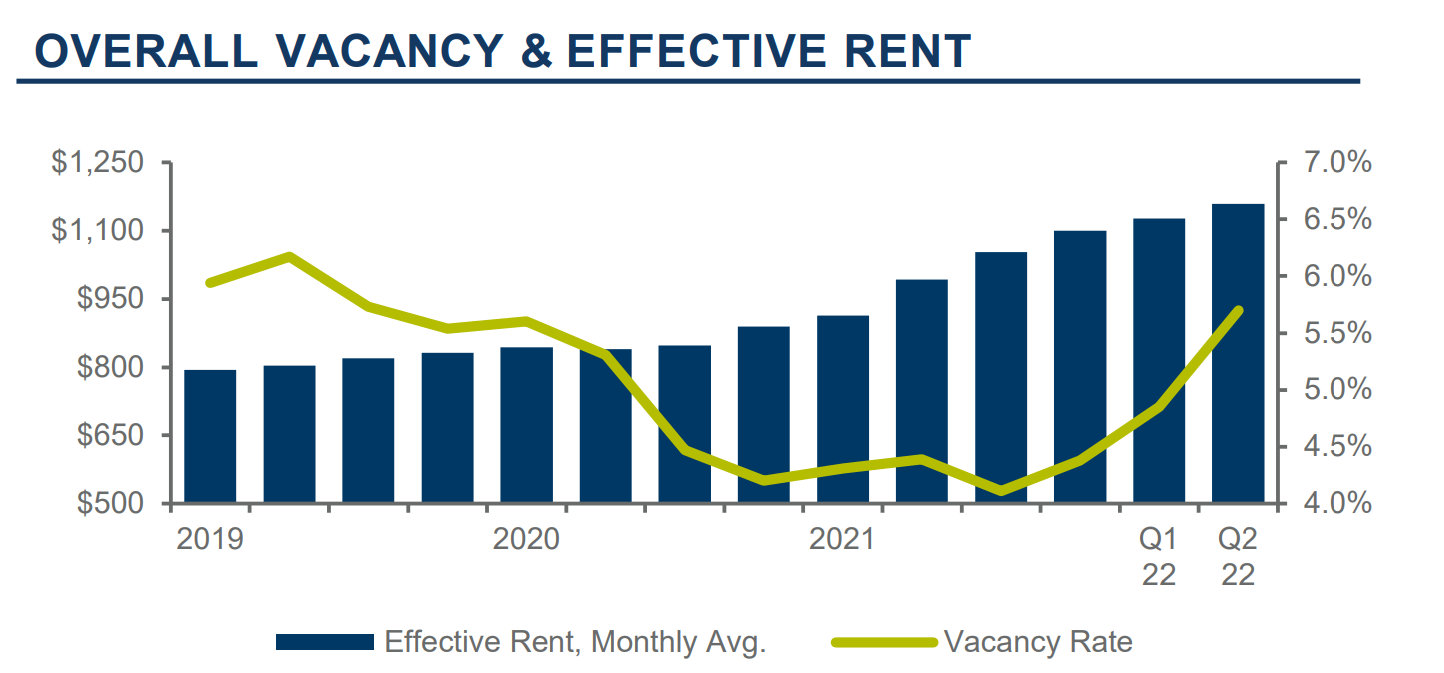

Throughout Q2 2022, the Tucson market remained relatively strong compared to other one million plus population markets.

To read the full report, click here.

The region has experienced an increase in interest rates and a slight decrease in transaction volume, as indicated by the extreme narrowing of the spread between interest rates and cap rates. This change in the market is expected to result in purchasers

underwriting more conservatively, as rental growth will likely slow. Despite this, the Tucson market should remain strong as many investors are eager to purchase property before highly-anticipated rate increases occur.

The demand for multifamily properties in Tucson over recent years has been incredibly high with its emergence as a desirable second market. Due to its high cap rates and lower price per unit sales prices, Tucson has seen an uptick in investors moving into the region from inflated markets like Denver, Los Angeles, and Phoenix. Supply has remained constant throughout the quarter, but change is anticipated for the second half of the year with increase in inventory and adjustment of cap rates. We forecast a slowing in rental growth but believe the Tucson market is well-positioned because of its ability to handle any dip due to a previous lack of rental inventory.