As the recovery slowly continues and the dust settles, we are seeing some clear and notable patterns. While overall Tucson vacancy rates have climbed from an all-time low of 3.1% in 4Q 2005 to a high of 8.8% in 1Q 2011, not all properties have fared equally. As landlord requirements on credit have loosened and occupancies see a shift from national to local tenants, a consistent “flight to quality” has occurred. Tenants are moving from mid-block, unanchored shopping centers to anchored–largely corner–properties, creating a dichotomy in occupancies and lease rates for these two distinct types of centers.

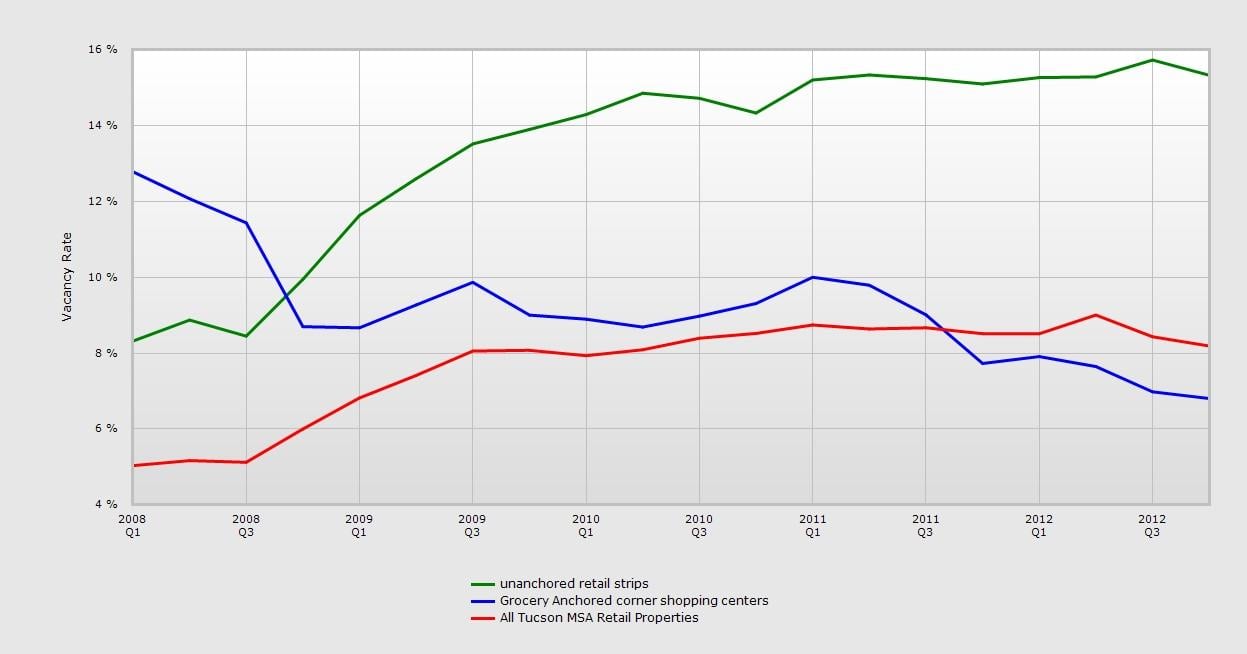

Fig.1 Comparison of Vacancy Rates: Overall Retail Vacancy VS Anchored Shopping Centers & Unanchored Strip Centers 2008-2012As shown above, unanchored strip centers are posting a 15.3% vacancy, while grocery-anchored centers are enjoying a vacancy rate of only 6.8%. This represents a major shift over the past three years. At the end of 3Q 2008, anchored centers were 11.8% vacant and unanchored strips held at 8.6%. Pre-recession, unanchored strips were the natural choice for local retailers, due to lower rent demands and easier landlord qualification based on credit history and overall financial condition. During that period, landlords of anchored centers had higher rent and credit expectations and a pronounced preference for national tenants with name and credit over local “mom and pop” stores.

WHY THE PERFORMANCE SHIFT?

- Availability: Since the height of the real estate market in 2007, space has became available in the higher quality centers due to national chain bankruptcies and other retail store closings; creating enhanced availability.

- Lease Rates: Grocery-anchored centers have been forced to reduce lease rates in an effort to stave of lenders. Landlords have had to accept smaller returns and lenders have been forced to accept lower debt coverage ratios as well.

- Credit Qualification: Along with these lower lease rates, landlords have had to accept tenants with less attractive balance sheets and credit histories. For many, “any tenant is better than no tenant” and tenant type and class has been relaxed as well. Landlords that would not previously lease to non-traditional tenants such as medical offices, churches, and charter schools have had to reconsider these policies.

- Survival of the Fittest: Tenants maintaining sales during the recession have seen many competitors fall by the wayside. As the market thins, coveted consumer dollars are awarded to surviving retailers. While not a true windfall, this augmented cash flow has allowed local tenants to improve locations and visibility into centers previously out of reach.

The result? A “flight to quality” out of mid-block strips and into grocery-anchored centers by strong local and regional retailers. Unanchored strips have desperately slashed lease rates in an effort to compete (Fig. 2 below). Nevertheless, the superior visibility, foot traffic, and overall credibility of anchored shopping centers have stymied the efforts of smaller strip landlords to retain tenancy. Until vacancy rates in anchored centers drops into the 3% range, unanchored, mid-block shopping centers will continue to struggle.

Fig 2 Comparison of Asking Lease Rates: Overall Market Retail Asking Rates vs. Anchored Shopping Centers and Unanchored Strip Centers 2005-2011

WHAT CAN I DO IF I OWN AN UNANCHORED SHOPPING CENTER?

- Keep your rates competitive. In a tough battle, do all you can to make your property financially attractive. Vacancy costs more. In addition to aggressive, competitive, rent pricing, also address pass-through expenses (NNN Charges). To the tenant- rent and NNN charges are all the same; they are property cost. Appeal your taxes, whittle away at landscaping and maintenance costs, and aggressively bargain with contractors. Low NNN Charges will help to keep your tenants solvent and your property occupied.

- Keep your existing tenants. Attend to tenant needs; manage and maintain your property and curb appeal. Numerous landlords would like to take your tenants from you. Make the concessions that you can- vacancy is very expensive in this market.

- Hire a good broker. Putting a sign up and posting on Loopnet or CoStar is the minimum, not the total effort. Your broker needs to actively call prospective tenants. He/she needs to be creative and aware of changes in the marketplace that can improve your position. They must have good relationships with other brokers to attract new tenants.

.jpg) Rob Tomlinson has been specializing in retail property sales and leasing with C&W | PICOR since 2005. Experience with assemblages coupled with education in Urban Geography, Site Analysis, and Land Use Planning has helped him to add value to challenging sites. A CCIM Candidate and International Council of Shopping Centers (ICSC) member, Rob has countless hours on land use commissions and committees and public/private development efforts.

Rob Tomlinson has been specializing in retail property sales and leasing with C&W | PICOR since 2005. Experience with assemblages coupled with education in Urban Geography, Site Analysis, and Land Use Planning has helped him to add value to challenging sites. A CCIM Candidate and International Council of Shopping Centers (ICSC) member, Rob has countless hours on land use commissions and committees and public/private development efforts.