To read the full report on Tucson’s office activity in Q1, click here.

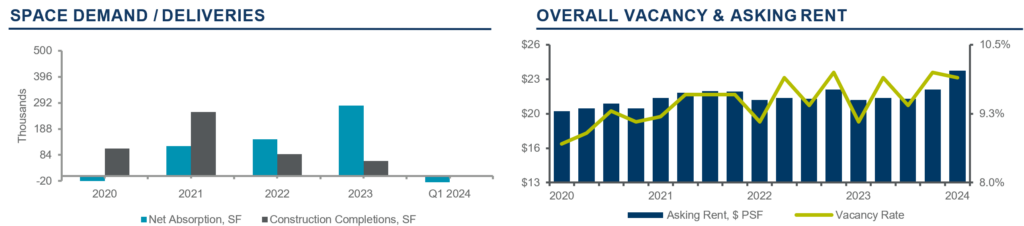

The vacancy rate in Tucson’s office market increased to 9.9% for Q1 of 2024, reflecting the gradual return of larger blocks of space to the market post pandemic as leases rolled over. Of note, medical office space remained in high demand and represented a significant portion of Tucson’s office market activity.

Med-spa facilities gained traction, with physicians and paraprofessionals seeking sites away from traditional medical centers. Landlords were strategizing ways to market large spaces, contemplating dividing properties into smaller units, or exploring alternative uses depending on zoning regulations. The Northwest and Foothills submarkets remained the most sought-after locations.

Significant leasing activity for the quarter included Broadpath Inc. leasing 21,881 square feet (sf) in Central Tucson, the American Red Cross leasing 12,312 sf in Central Tucson, a homecare provider securing a 10,927 sf space in Downtown Tucson, and Fiji Water Company leasing 10,644 sf in central Tucson.

Building sales remained surprisingly robust, especially for properties under 3,000 sf, unaffected by higher interest rates. Key sales in Q1 include Vertical Ventures purchasing a 141,501 sf building in Southwest Tucson for $24.5 million, Bourn Companies acquiring a 125,000 sf property in Central Tucson for $5 million, and Virtus Real Estate Capital purchasing a 60,160 sf office facility in Oro Valley for $12.7 million.

Construction costs remained high, compounded by delays in obtaining permits and lingering supply chain issues. However, notable projects like The University of Arizona’s new Arizona Public Media building broke ground with a 61,500 sf building located at the Tech Park at the Bridges. Additionally, a new 55,000 sf JTED building, housing medical training programs in partnership with the University of Arizona and Banner Health, is also set to be completed in Q2.

Asking lease rates remained stable, ticking up slightly from the previous quarter, with an average rate of $23.54 per square feet (psf). Notably, higher rates were quoted in the Foothills submarket at $28.36 psf. Conversely, more affordable rates prevail in the East and West submarkets, averaging around $17.00 to $19.00 psf, full service. Investment sales continued to thrive in Oro Valley and Central Tucson, with the average sale price consistent with the previous quarter at $148 psf.