To read the full report on Tucson’s industrial activity in Q1, click here.

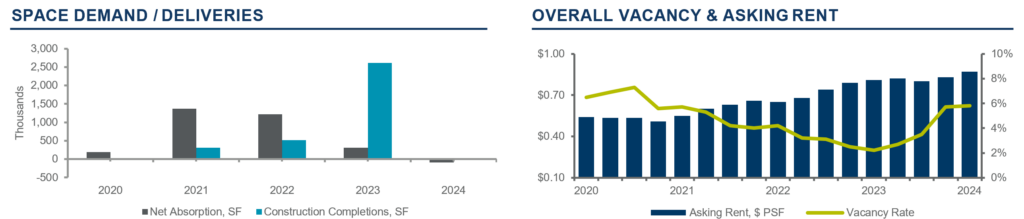

In Q1, Tucson’s industrial sector continued to perform strongly. Leasing activity remained robust, driving a 3.6% increase in rental rates, reaching an average of $0.84 per square foot (sf). Notable leasing activity occurred in the Airport, Palo Verde, and Southeast submarkets. However, despite substantial new construction deliveries in Q4, the vacancy rate remained tight at 5.8% across a total inventory of 51 million sf.

Construction highlights featured The Campbell Landing projects in the Airport Submarket were also delivered, consisting of four 10,000 sf buildings.

Key lease transactions featured Belden Inc leasing a 302,443 sf building at Tucson Commerce Center, the ILS Company securing a building of 115,000 sf at the Tucson Commerce Center, along with Pool & Electric Products leasing 53,767 sf in Southwest Tucson. Sale highlights included two purchases by a records management company, a 38,631 sf manufacturing building for $2.5 million and a secondary warehouse building for $1.9 million. In addition, a logistics provider purchased a 26,800 sf truck terminal in Oro Valley for $1.8 million.

Tucson’s appeal to e-commerce and logistics tenants continued apace due to its strategic location near international trade corridors and key markets. Nearshoring trends also contributed positively, with collaborations between Tucson and neighboring Mexican cities driving economic benefits on both sides of the border.

Despite an overall slowdown in investment sales, local investors remained active, especially in key submarkets like Northwest Tucson/Oro Valley, Palo Verde, and Southeast Tucson. Limited supply, bolstered by rising rental income, could drive up prices in investment sales due to strong demand. If interest rates rise, this will likely raise cap rates and hold back price increases. Nonetheless, property owners enjoyed significant income growth in their industrial investment assets, with user buildings also seeing price increases in Q1 2024.