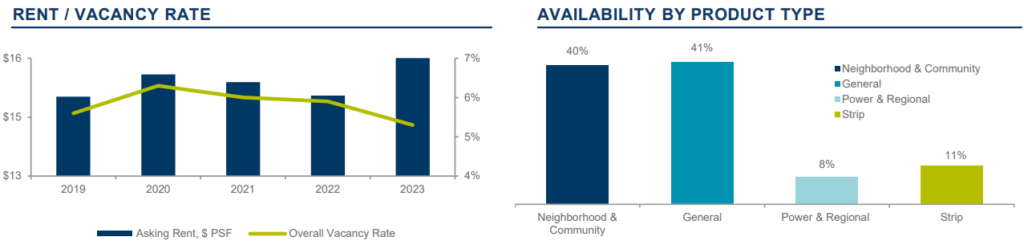

The Tucson retail market in Q3 continued to exhibit signs of stability, with the vacancy rate remaining unchanged at 5.6%. Amid consistent occupancy reflecting steady market conditions, nine out of 13 submarkets experienced positive absorption during the quarter, indicating healthy demand for retail space.

To read the full report on Tucson’s retail activity in Q3, click here.

Despite lingering uncertainty in the broader economic landscape, the Tucson retail sector demonstrated resilience. Notable trends in user types included ongoing expansion in food and beverage operators, while medical-related uses and health and wellness concepts remained active. Consumer spending continued apace, a positive indicator for tenants and retailers.

Marana and Vail continued to experience rapid retail development to keep pace with growth in residential rooftops, retailers’ top driver. The Foothills submarket remained robust, characterized by limited vacancies and high demand. Notable sales included a 13,291 square foot (sf) suite in Craycroft Retail Plaza in the South submarket which sold for $1.05 million/$79.00 per square foot (psf). Another sale was a 12,390 sf suite within Grant Center in the Central East submarket, trading for $3.45 million/$136.01 psf.

Speculative new construction remained minimal primarily due to persistently high construction costs. The majority of development projects were driven by user-specific needs, primarily involving restaurant and drive-thru pad concepts, which continue to expand.

The average lease rate stands at $16.58 psf, which has risen consistently, especially in the more sought-after submarkets, such as the North/Oro Valley submarket which has a rental rate of $20.76 psf, and the Southwest submarket which has a rental rate of $20.66 psf. Investment sales pricing was also relatively stable, but off-corner property pricing may decline by year-end and into 2024, with hard-corner sites retaining their high demand and value. In this environment of higher cost of debt, cap rates have increased and the investment market has cooled. Class “A” property lease rates held steady at approximately $20.00 psf, while Class “B” lease rates likewise reflected minimal change.