The Trend Report, May 2025 Edition

If you’ve ever watched a seasoned desert hiker pick their way through a rocky wash, you know the trick: keep your eyes up, move with purpose, and don’t panic when the trail gets rough. That’s Tucson’s industrial market in Q1 2025—steady, sure-footed, and quietly outpacing the national pack, even as the broader U.S. market stumbles over a few loose stones.

A Market That Knows Its Terrain

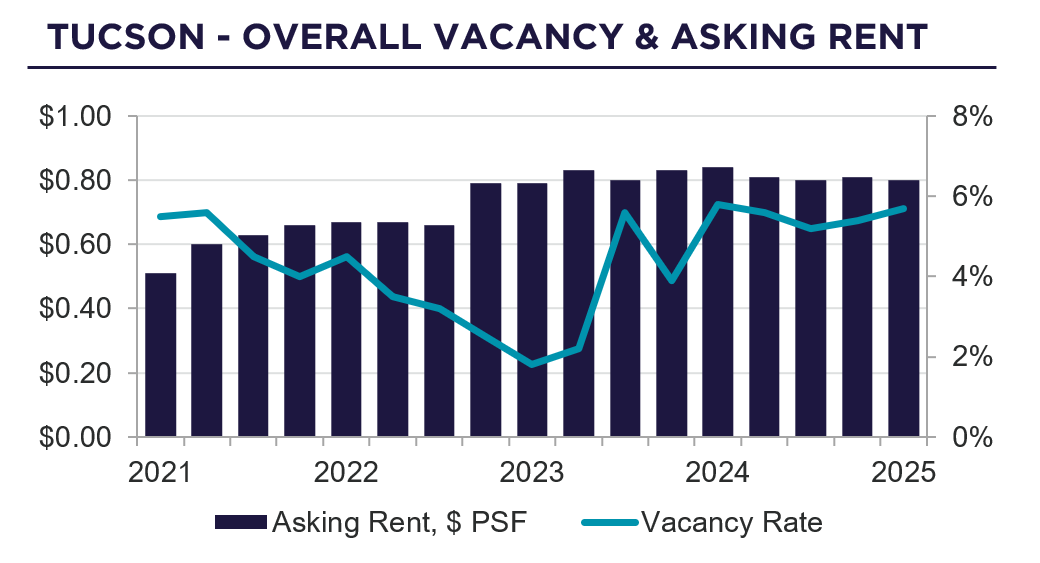

Let’s set the scene. Across the country, the industrial sector is cooling off after a post-pandemic sprint. National vacancy rates have crept up to 7%, and developers are hitting the brakes on new projects, wary of overbuilding. But Tucson? We’re still moving forward, just at a more measured pace. Our vacancy rate ticked up to 5.7% — a modest 30-basis-point rise from last quarter, but still well below the national average. It’s like Tucson’s market is driving a reliable pickup while the rest of the country is trying to wrangle a sports car on a gravel road. What’s behind this resilience? For starters, Tucson’s industrial backbone—logistics, manufacturing, and distribution—remains strong. Even as some businesses that expanded too quickly are now subleasing space, demand from key sectors is keeping the market balanced. The Northwest and Airport submarkets, in particular, are still hot tickets, with little to no vacancies in the Northwest and new speculative projects drawing attention near the airport.

Vacancy, Absorption, and the Tale of Two Markets

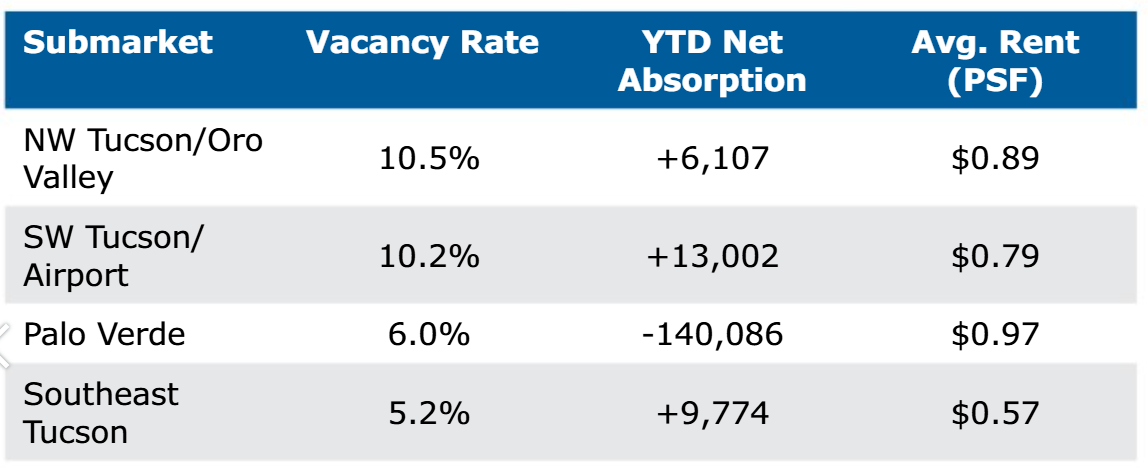

Here’s where the numbers tell a story. While the U.S. saw net absorption of 23.1 million square feet in Q1, Tucson’s net absorption dipped slightly into the red at -5,230 square feet year to-date. That might sound like a stumble, but it’s more of a pause to catch our breath. The Northwest Tucson/Oro Valley and SW Tucson/Airport submarkets posted positive absorption—6,107 and 13,002 square feet, respectively—showing that the right product in the right place still moves. Meanwhile, average asking rents in Tucson held steady at $0.80 per square foot, below the U.S. average of $0.84. Tucson’s affordability is a magnet for smaller manufacturers and distributors, even as new buildings near the airport command up to $0.97 per square foot. It’s a bit like shopping for a house: you can get a lot more bang for your buck here, especially if you’re willing to look beyond the brand-new builds.

Construction: Building for Tomorrow, Not Just Today

Nationally, the industrial construction pipeline shrank by 36% year-over-year, and Tucson followed suit with just 20,900 square feet of new deliveries in Q1, all in the Palo Verde submarket. But don’t mistake caution for stagnation. With 341,842 square feet under construction—including the much anticipated Drexel Commerce Center—Tucson is still betting on its future as a cross-border logistics hub. It’s a bit like planting saguaros: growth takes time, but the roots are deep.

Submarkets: Each With Its Own Personality

Tucson’s industrial landscape is a patchwork of distinct neighborhoods, each with its own vibe:

The Airport submarket is the rising star, landing new leases like Kilgore Manufacturing’s 13,952-square-foot deal. Palo Verde, on the other hand, is feeling the pinch as tenants seek out newer digs, leading to negative absorption. It’s a classic case of “out with the old, in with the new”—and a reminder that even in a steady market, not all boats rise at the same rate.

Investment: Waiting for the Next Green Light

If the investment market feels a little sleepy, blame the high interest rates. Nationally, transaction volume dropped 31% year over-year, and Tucson’s Q1 sales totaled just $8.7 million—a drop in the bucket compared to the $2.1 billion U.S. total. Still, there were bright spots: FJM’s $2.5 million buy in NW Tucson/Oro Valley and AC Pro’s $2.1 million purchase downtown show that well-located properties are still drawing interest. Land sales are slow, but the logistics and distribution sectors—fueled by e-commerce and near-shoring—are keeping the wheels turning.

Tucson’s Secret Sauce: People, Place, and Possibility

What keeps Tucson humming along while other markets hit speed bumps? It’s a mix of steady population growth (1.1% year-over-year, outpacing the national rate), rising median household income ($74,400, up 4.5%), and an unemployment rate (3.9%) that’s lower than the U.S. average. In other words, Tucson is quietly building a foundation for long-term stability.

Three sectors to watch:

- Advanced Manufacturing: Defense and aerospace firms are eyeing Tucson’s lower costs.

- Cross-Border Logistics: Infrastructure upgrades are setting the stage for a near-shoring boom, dependent on the shakeout of tariffs.

- E-Commerce: Last-mile delivery is still driving demand for smaller, flexible spaces.

National Backdrop: A Market Catching Its Breath

Zooming out, the U.S. industrial market is recalibrating after a wild ride. Absorption forecasts for 2025 have been trimmed to 156.4 million square feet—less than half the 2021 peak. Cushman & Wakefield reports that 69% of markets still saw rent growth in Q1, but the gap between in-place and new lease rates is narrowing, giving tenants a bit more leverage. Developers are shifting to build-to-suit projects to avoid sitting on empty buildings.

For Tucson, this national “pause and reset” is an opportunity. As high-cost coastal markets like Los Angeles and the Inland Empire wrestle with double-digit rent declines, Tucson’s affordability and proximity to Mexico make it a compelling alternative for companies looking to stretch their dollars.

Looking Ahead: Tucson’s Playbook for 2025

So, what’s next? Tucson’s industrial sector isn’t aiming for fireworks—it’s playing the long game. With 341,842 square feet under construction and a vacancy rate well below the national average, we’re sidestepping the oversupply headaches facing Phoenix and Dallas-Fort Worth.

The key areas to watch:

- Interest Rates: A Fed rate cut could wake up land deals and speculative building.

- Policy Shifts: Election-year trade policies could shake up cross-border logistics.

- Submarket Moves: Expect the Northwest and Airport areas to keep leading the charge, while older properties in Palo Verde may need a facelift to stay competitive.

In a world where uncertainty is the only constant, Tucson’s industrial market is proving that slow and steady really does win the race. As Jason Price, Cushman & Wakefield Senior Director of Global Research put it, “The market is recalibrating— balancing new supply with modest demand.” For Tucson, that balance feels just right.

SOURCES: Cushman & Wakefield PICOR, NAIOP, Cushman & Wakefield Research, CommercialEdge, Deloitte

Alex Demeroutis joined Cushman & Wakefield | PICOR’s industrial sales and leasing team in 2020. She is an Industrial Specialist focusing on the leasing, acquisition, and disposition of warehouse, distribution, logistics, manufacturing, and research and development properties in the greater Tucson region. Alex can be reached at ademeroutis@picor.com.