To read the full report on Tucson’s office activity in Q2, click here.

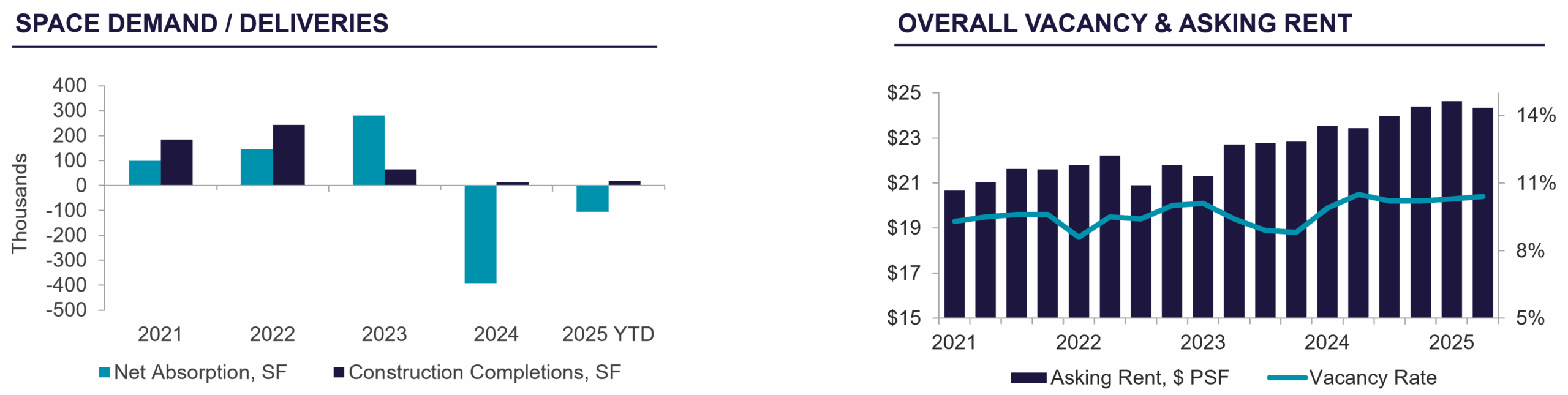

In Q2 2025, Tucson’s office market experienced a modest increase in vacancy, reaching 10.4%. However, occupancy rates remained stronger than the national average of 14.2%. The absence of new office construction reinforced limited supply, especially for smaller, well-located spaces. Demand was primarily driven by strong activity in the healthcare and behavioral health sectors, the latter of which saw renewed office needs as therapists returned to in-person care following years of telehealth experimentation.

Medical leases included 10,222 square feet (sf) at 2424 N Wyatt on the TMC Hospital Campus and 9,199 sf at 2856 E Fort Lowell. Most other occupiers this quarter leased spaces under 2,500 sf, continuing the trend toward smaller suite activity.

Suburban markets—especially those near healthcare hubs—performed best, while Downtown Tucson’s higher vacancy and slower absorption persisted, except in certain historic neighborhoods like Barrio Viejo and El Presidio. High interest rates and limited financing options continued to delay new construction, with developers favoring pre-leased and medically-oriented projects. Average lease sizes remained around 2,700 sf, with large blocks facing slower interest and activity.

Lease rates averaged $24.34 per square feet (sf) in Q2 2025, up slightly from last quarter, driven by inflation and ongoing buildout costs. Top-tier medical and Class A spaces commanded rates near $30 sf. Tenant improvement costs remained elevated but began to level off. In this climate, landlords are as aggressive and creative as possible to structure deal terms that work.

Low inventory has pushed sale prices higher, especially for small office condos, which remain in high demand. Notable sales this quarter included 5411 E Williams and 6130 N La Cholla. High interest rates and uncertainty around the impact of new, significant federal legislation tempered broader investment activity, though owner-users remained active.