To read the full report on Tucson’s retail activity in Q2, click here.

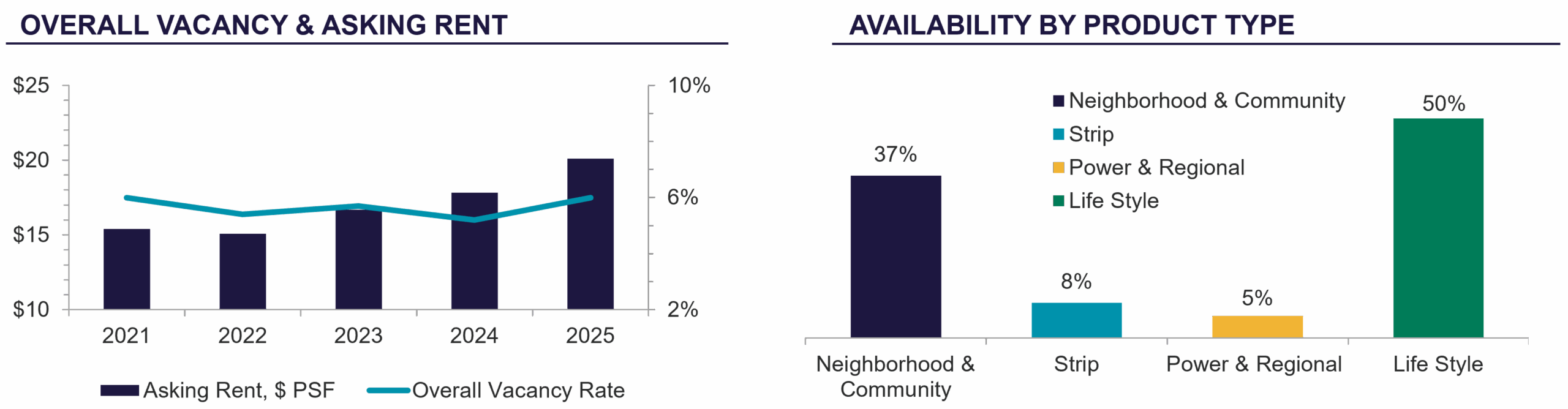

Retail vacancy rose to 6.0% in Q2 2025, up from 5.3%, due to several large-store closures. While elevated, the rate aligns with Tucson’s 5-year average and reflects a correction following strong recent performance. Discount retailers, fitness users, and entertainment concepts continued to expand. Late last quarter, Planet Fitness leased 28,000 square feet (sf) in East Tucson, while The Picklr signed 30,150 sf in Oro Valley, with a grand opening set for August 2025. Restaurants and medical users remained active, with adaptive reuse common for former big-box and pharmacy sites.

Hot submarkets included Oro Valley, Catalina Foothills, and the I-10 corridor, where high-income demographics drive demand. Experiential retail users remained active with Lava Island, an indoor playground, leasing 40,018 sf in the Foothills, and Slick City, a waterless indoor slide park, leasing 36,454 sf in East Tucson. Recent construction totaled 187,000 sf delivered over the past year and 290,000 sf underway—over 96% preleased. High costs of new builds are driving redevelopment along major arterial corridors.

Average lease rates rose 4.3% year-over-year to $20.10 per sf, outpacing the national increase of 2.0%. Premiums of 20–25% remain in high-demand areas like Oro Valley and key eastside arterials.

Investment volume reached $331M over the past 12 months, led by private capital. Average sale pricing held steady at $246 per sf, with cap rates around 6.3%. User buildings saw modest price growth and remained in demand among local buyers.

Notable Q2 sales included Plaza Escondida’s investment purchase for $23M at 90,721 sf, a 19,538 sf strip center at 1702 E Speedway, and Costco’s 14,519 sf purchase at 3821 W Costco. Montesa Plaza also sold for $13M in the Eastside corridor. While rent growth supported investment values, high interest rates and macro uncertainty continued to weigh on transaction volume.