To read the full report on Tucson’s Office market activity in Q3, click here

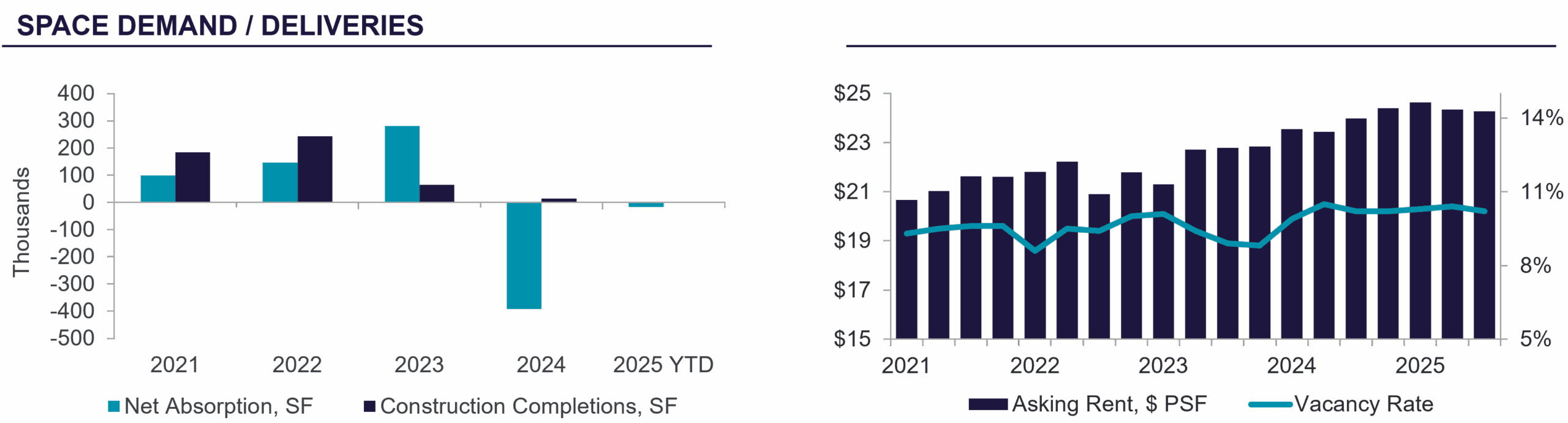

In Q3 2025, Tucson’s office market concluded the quarter with an overall vacancy rate of 10.2%, reflecting stable conditions. Healthcare remained the primary demand driver, with Tucson Medical Center (TMC) accounting for two of the quarter’s largest lease transactions. TMC’s activity included new leases supporting cancer care and other medical services, underscoring the sector’s ongoing role as the leading source of office absorption. Medical leases included 77,971 square feet (sf) at 1400 North Wilmot Road and 30,757 sf at 603 North Wilmot Road.

Submarket dynamics varied. The Foothills and Northwest Tucson continued to demonstrate strong performances, with limited availability contributing to sustained demand. Downtown Tucson, by contrast, experienced relatively stable occupancy with modest leasing momentum. Suburban areas near healthcare hubs demonstrated resilience and remained attractive to medical users. Construction activity was limited, as the abundance of available space reduced the need for speculative projects.

Average lease rates remained consistent at $24.28 per square foot (psf), with tenant demand continuing to focus on well-located and smaller suites. In comparison, larger contiguous blocks of space are experiencing slower activity. Class A average lease rates were slightly higher at $25.15 psf.

Sales activity was limited as investors remain selective. Transaction volume slowed as high construction and financing costs kept many buyers on the sidelines, with only value-add opportunities attracting interest. 5320 North La Cholla Boulevard was the most notable sale at $1,134.56 psf.

The cost of new construction continues to be a barrier to new projects. Instead, adaptive reuse has become a trend: former call center spaces are increasingly being repurposed for industrial use, reflecting a persistent lack of demand in that segment. Looking ahead, a potential decline in interest rates may improve office investment activity, although no significant near-term absorption gains are expected.