To read the full report on Tucson’s office activity in Q3, click here.

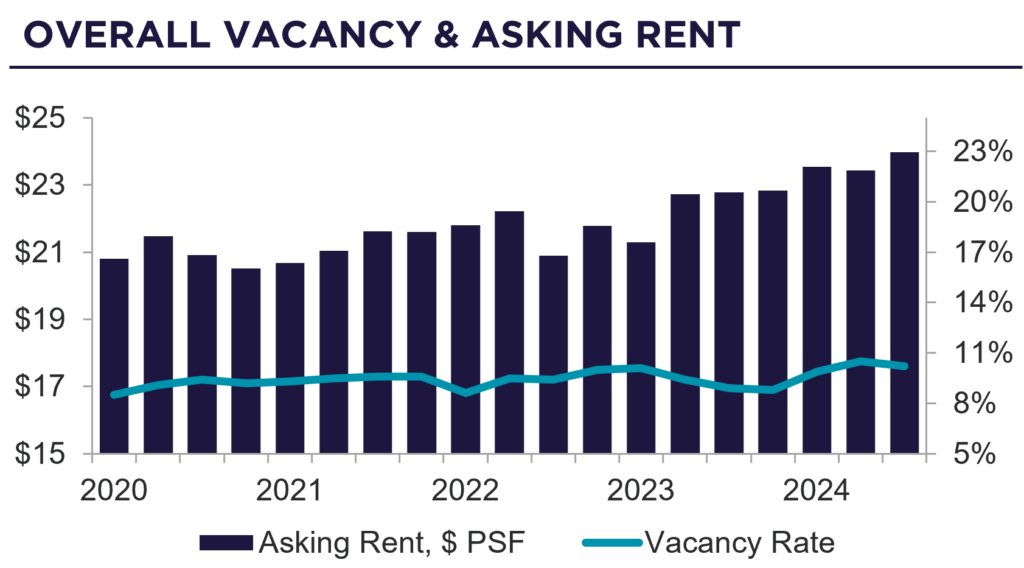

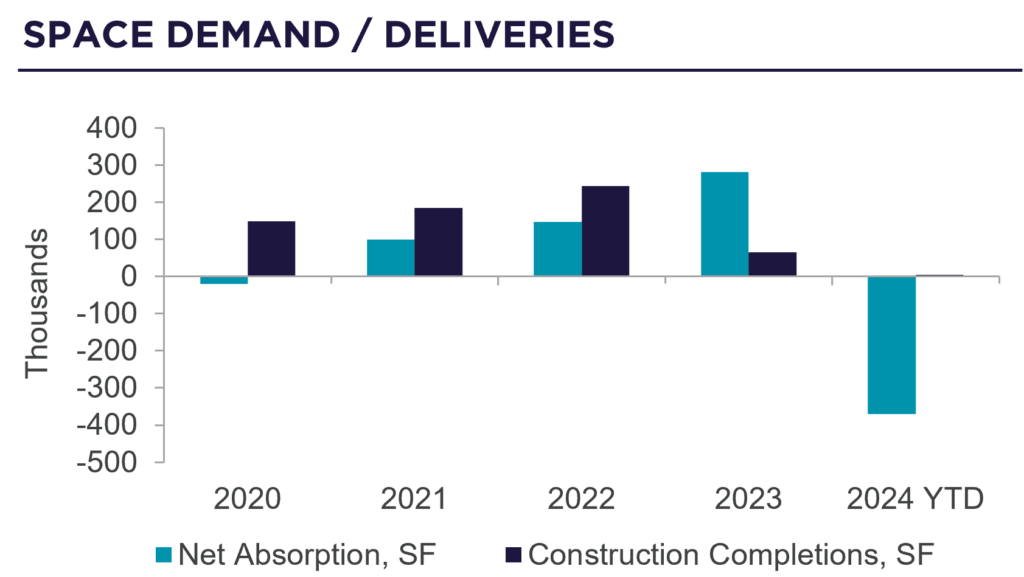

In Q3 2024, Tucson’s office market remained stable with a 10.2% vacancy rate, while cap rates averaged 10.7%. This alignment has shifted the focus to owner-user transactions as investors gain comfort with an improving interest-rate environment. The Federal Reserve’s projected 50 basis point cut is expected to improve the lending environment and stimulate commerce, including sales and leasing activity. Larger leasing requirements are emerging, particularly in the 10,000-20,000 square feet (sf) range for call centers and other large office users, with tenant confidence reflected in extended lease terms of three to five years. Notable transactions included IMS leasing 15,000 sf at 333 E Wetmore and Tohono O’odham Nation leasing 10,301 sf at 250 S Craycroft.

The medical sector continued to dominate activity and pricing, alongside behavioral therapy, legal services, and engineering. The Northwest submarket is increasingly sought after for medical space. Top sales include 5501 N Oracle Rd (15,947 sf for $1.7 million) and 3900 E Broadway (9,116 sf for $2.6 million).

The Tucson office market’s highest asking rental rates were in the Foothills and North/Oro Valley submarkets. The Northwest submarket led in performance and achieved rates due to strong demand and limited new construction. While activity is steady, continued Federal Reserve rate cuts positively impacting commercial lending may stimulate the market and increase competitive pricing and transaction volume, leading to a cautiously optimistic outlook.