To read the full report on Tucson’s multifamily activity in Q4, click here.

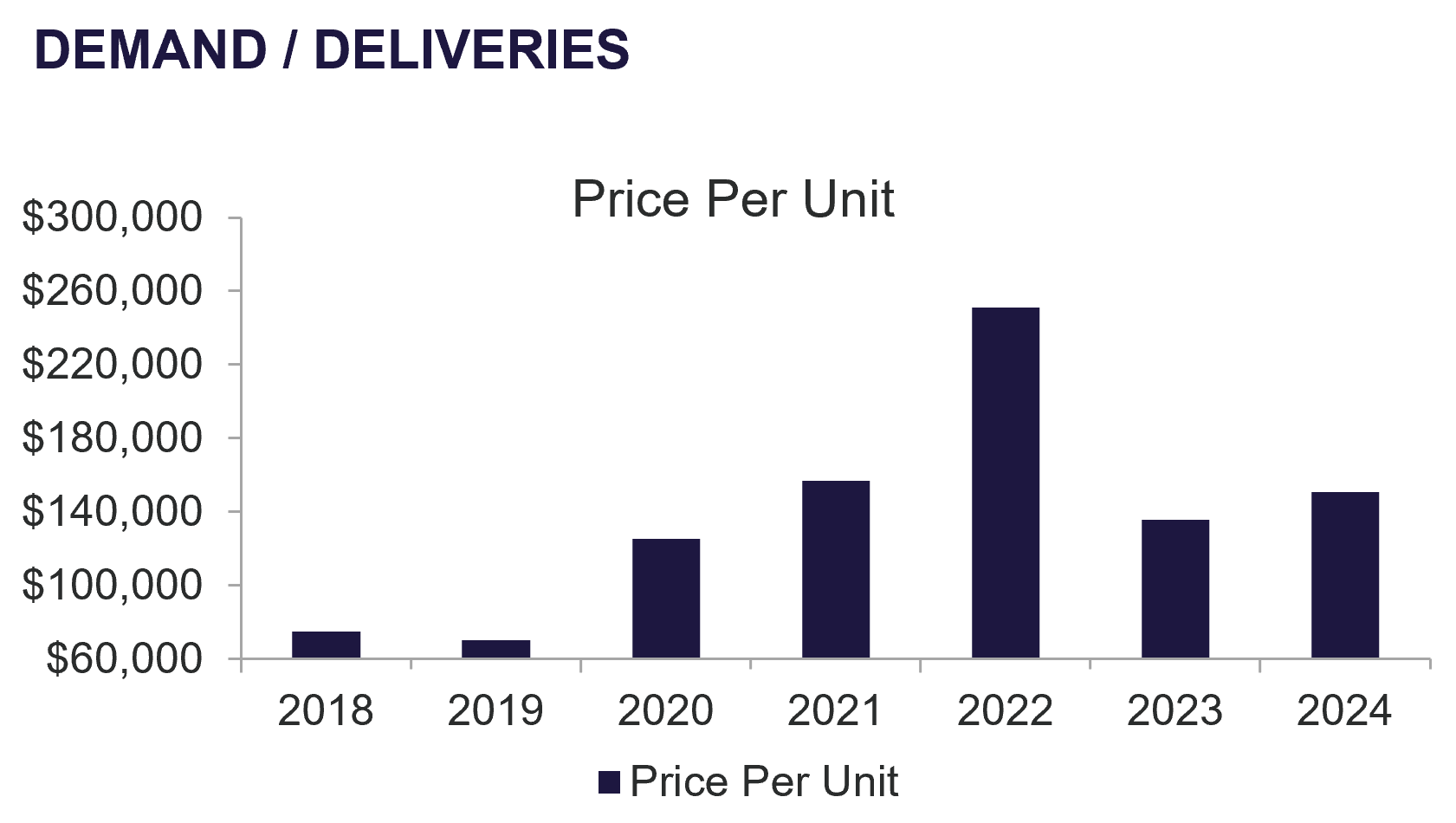

Tucson’s apartment vacancy rate held steady at 8.4% in Q4 2024, exceeding the previous year’s average of 6.54%. The Northeast submarket maintained the lowest vacancy at 6.34%, while Tucson Mountain Foothills reached 10.18%. Overall occupancy improved by 512 units, with Northwest Tucson leading gains (+296 units) and East Tucson showing the largest decline (-71 units). Average rents decreased to $1,178 per unit. Oro Valley/Catalina commanded the highest rents at $1,611, while North Central Tucson averaged the lowest at $980. South Tucson/Airport posted the strongest rent growth (+$52), contrasting with Catalina Foothills’ decline (-$35). Concessions increased to $32 per unit quarter-over-quarter. Investment activity included two major property sales averaging $150,777 per unit, showing quarterly softening but annual appreciation, with newer properties dominating 2024 transactions.

Q4 2024 presented significant challenges in the rental market. Property managers increased concessions and rent discounts to attract tenants. While seasonal softness is typical during holidays, elevated vacancy levels suggest broader market weakness. Management priorities have shifted to tenant retention and enhanced marketing strategies. Leasing activity and rent stability are expected to improve in early 2025.

“PFCU exceeded Q4 2024 loan production targets, closing 10 transactions including seven purchase requests. Average interest rates declined to 6.420% from the Q3 peak of 7.16%, below the year-end average of 6.665%. This rate environment stimulated investor activity, resulting in $15.14MM in total loan production. Purchase loan-to-value ratios ranged from 56.73% to 68.52%, averaging 62.71%.The challenging 2024 market saw elevated expenses, sluggish rent growth, and increased vacancies impacting proformas and limiting loan availability. However, these stabilizing conditions create a stronger foundation for 2025, enabling more precise expense forecasting and transaction underwriting.” – Robert Motz, Pima Federal Credit Union

The Tucson Multi-Family market outlook for 2025 largely mirrors 2024, with continued strong demand exceeding supply, though rent growth may slightly compress, and concessions may reappear in some submarkets. Financing challenges persist due to conservative lenders and high interest rates. The investment sales market will see limited inventory, with strong demand for value-add assets. Stabilized investments may face difficulty aligning buyer and seller expectations. 2024 saw a “wait-and-see” approach, with brief market activity spurred by slight interest rate declines. Unexpectedly, rising insurance costs and a softening leasing market significantly impacted the market. Leasing timelines have lengthened, and concessions are returning, impacting both buyer expectations and lender underwriting. In 2025, we anticipate a similar market in terms of volume and transactions, with potential opportunities arising from debt maturities and refinancing difficulties faced by investors who acquired properties in late 2022 and early 2023.