To read the full report on Tucson’s Multifamily market activity in Q4, click here

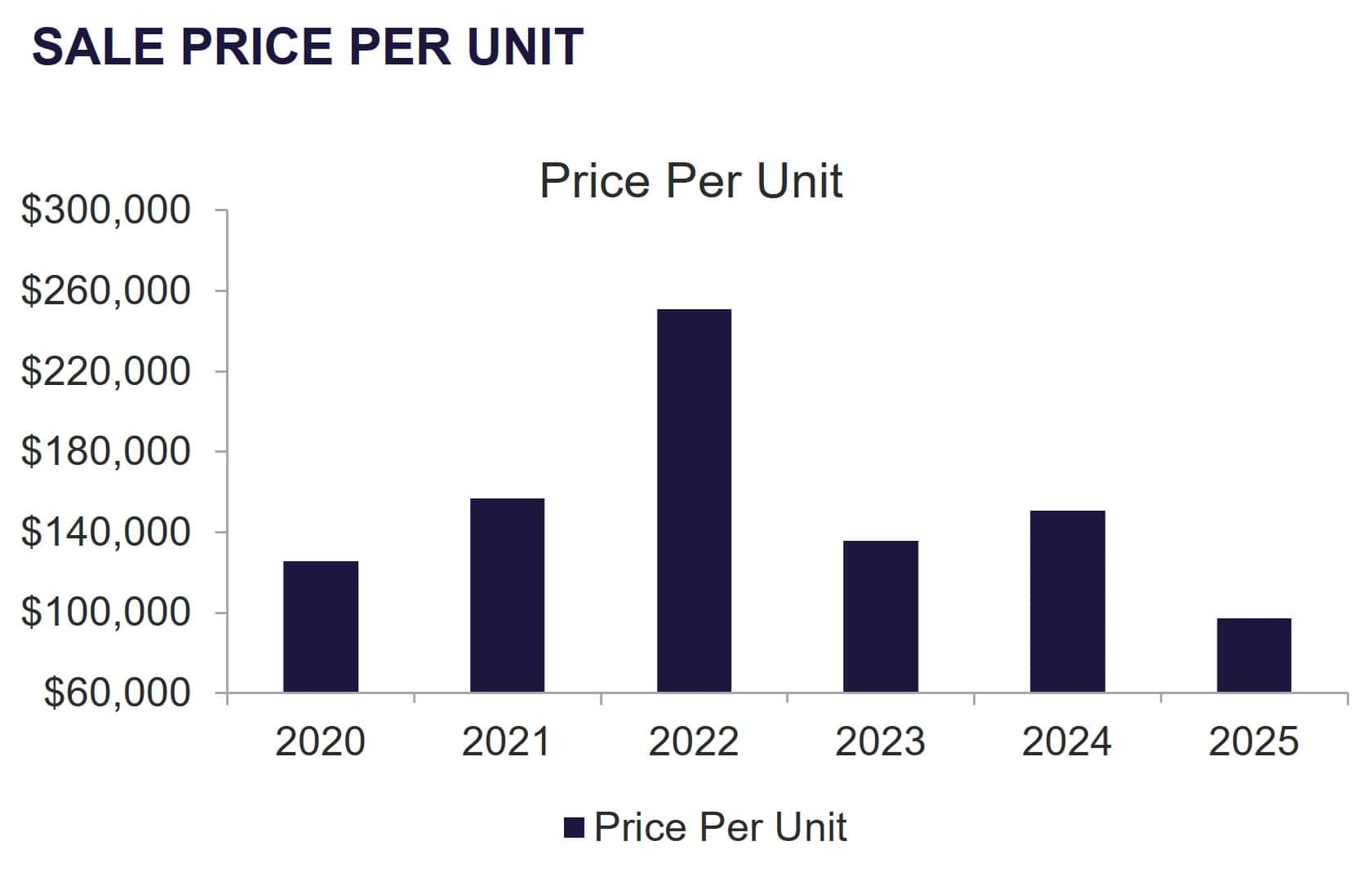

Tucson’s multifamily market demonstrated an increasingly cooling trend across the region. Vacancy rose to 9.56% driven by a measurable expansion in available units across multiple submarkets, with Southeast Tucson posting the highest vacancy (14.23%). C and D class assets faced difficulty in maintaining occupancy in a more competitive leasing environment. Investment activity remained slow, as buyers and sellers showed a continued struggle to bridge pricing expectations; valuations continued to trend downward with conservative underwriting standards. Average pricing declined to $96,992 per unit and $148.74 per square foot, reflecting ongoing downward pressure on values. The average built year for properties traded this quarter was 1983, reflecting investor focus on older, value-add assets.

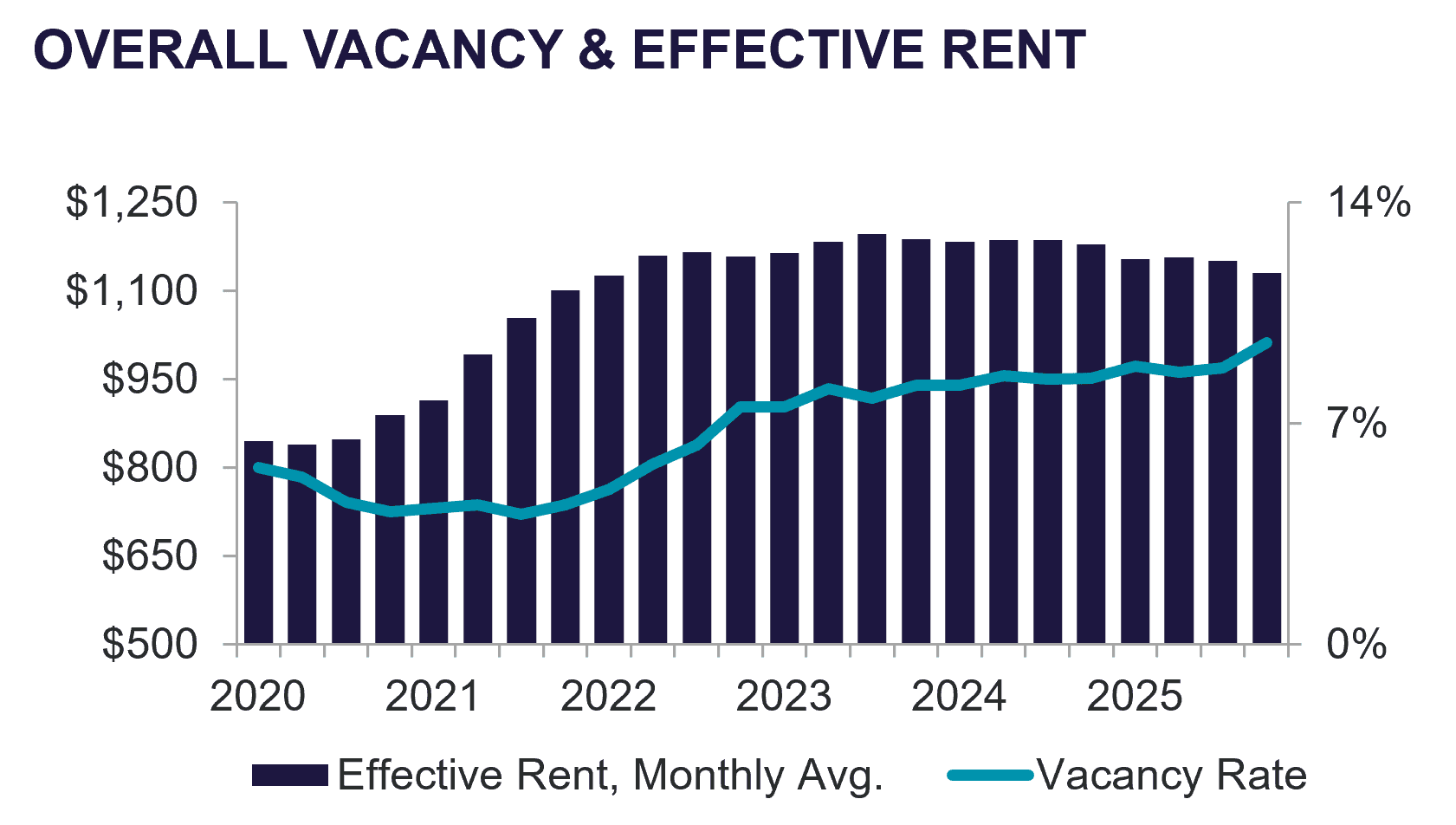

Vacancy continued to trend higher, creating increased competition among properties and a more tenant-driven leasing environment. Average rents declined to $1,130 per unit with concessions climbing to $61 per unit—the highest incentives offered in more than fifteen years—highlighting the increased pressure on owners to attract new residents and retain current ones. Leasing performance became uneven across the market, with properties slower to adapt facing longer lease-up times and greater incentives. At the same time, operating costs increased, particularly for insurance, maintenance, and utilities, placing additional strain on margins. In this environment, disciplined expense management and proactive asset strategies are increasingly critical for preserving long-term value.

“In Q4 2025, Tucson multifamily lending improved incrementally as market volatility cooled and more lenders leaned back in. The Fed’s December 25-bps cut helped reinforce a steadier rate backdrop, with the 10-year Treasury closing the year around the low-4% range. Credit unions and banks remained the workhorse capital for stabilized deals, typically pricing over the 5-year treasury for more aggressive rates in the high 5’s to low 6’s. Value-add opportunities had been split between a handful of strong relationship based banks and credit unions, and lower cost, hyper competitive debt funds. As debt funds price closer to conventional debt, the differentiator becomes structure – recourse, reserves, extension fees, cash management, and exit tests. For serious, sophisticated borrowers, surgically aligning the debt to the deal is critical to increasing probability of investment success. Tucson’s long-term demand story remains supported by the UA and the I-10 corridor, with overall continued lender optimism.” – Matthew Poulton, 520-202-0672, Debt Broker

As we closed the book on 2025, the Tucson multifamily market demonstrated notable resilience amid an uneven economic backdrop. Transaction volume increased in Q4, with many buyers positioning themselves ahead of Q1 2026 to complete 1031 exchanges. The market largely adjusted to new norms, including flatter rent growth projections, modestly higher cap rates, and rising insurance costs. On the financing front, growing optimism around potential interest rate reductions improved investor sentiment. Even a modest downward trend in rates could meaningfully increase investment inventory while simultaneously attracting a fresh wave of capital ready to transact. Property managers, however, express concern around longer rental lead times, extended vacancy periods, and slower lease-up velocity. As a result, concessions and tenant retention strategies will be key themes in the coming quarters.