To read the full report on Tucson’s industrial activity in Q4, click here.

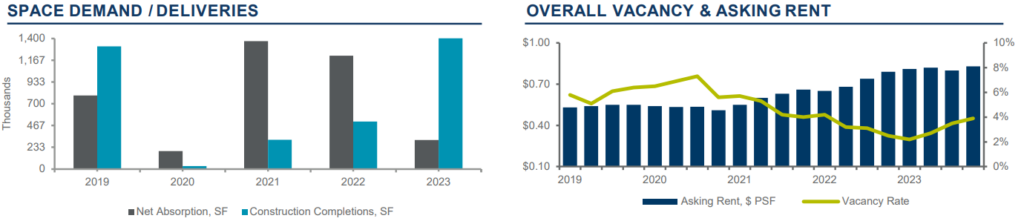

In 2023, the Tucson industrial market experienced a significant surge in supply, witnessing the addition of nearly 1.9 million square feet (sf) primarily delivered by Flint Development. Despite this substantial supply boost, the Q4 vacancy rate remained tight at 5.9%. The year also showcased a positive year-to-date net absorption of 309,926 sf, underscoring the Tucson market’s resilience.

Leasing activity remained robust, with expectations for gradual rental rate increases throughout 2024. Landlords sought longer lease terms, even for smaller incubator industrial products. Warehouse and logistics users, along with growing interest from manufacturing and mining users contributed to the market’s strength. The Airport submarket stood out as the strongest submarket driven by new deliveries of available space.

Construction highlights included the completion of Flint Developments final building at Tucson Commerce Center, 244,889 sf building, in the SW/Airport submarket in Q4. Their Southern Arizona Logistics Center project is still underway, with two buildings totaling 946,435 SF estimated to be delivered in 2024. Additionally, the four Campbell Landing buildings are anticipated to be delivered in Q1 2024, adding over 10,000 sf.

Major lease transactions included NEFAB Packaging West leasing the 81,050 sf at 2020 W Prince Rd, an online resale shop securing 60,000 sf at 300 S Toole Ave, and Artisan Design Group Investments leasing 33,311 sf on Lisa Frank Ave. Noteworthy sales included Gen Digital acquiring a 136,235 sf building at 3701 E Columbia for $13 million and Ventana Medical Systems acquiring a 112,500 sf building at 2090 E Innovation Park for $25 million.

Lease rates reflected gradual increases driven by low inventory and high demand. Despite the climb, Tucson remained affordable compared to larger cities, with an average lease rate of $0.83 psf per month. The demand for investment sales remained strong, but limited supply drove price hikes. Higher interest rates have led to increased yield requirements from buyers, yet property owners are enjoying significant net operating income growth, making them inclined to retain their properties. User buildings also saw an increase in prices.