To read the full report on Tucson’s Retail activity in Q4, click here.

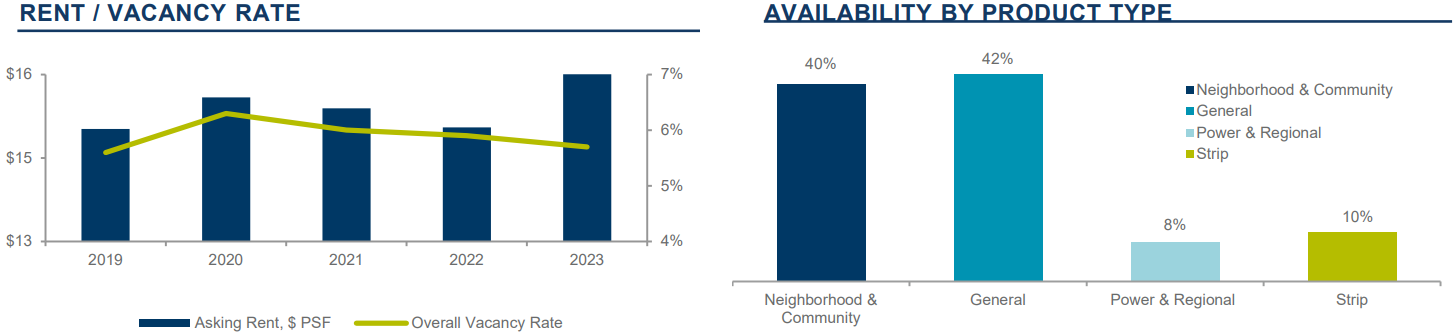

The Tucson retail market in Q4 continued to demonstrate resilience, maintaining a vacancy rate of 5.7%. Similar to the previous quarter, the market exhibited stability, with positive net absorption reaching 310,000 square feet (sf) for the year. Consumer spending and employment growth continued to support the retail sector, along with the limited supply available in the market.

Key contributors to demand included expansions of gyms, entertainment, restaurants, healthcare, and auto stores. Limited store closures also played a role in sustaining tight market conditions. Growth areas continue to be the outer edges of the market, including Oro Valley, Marana, Vail, and Sahuarita.

Top leases in Q4 included a 12.79 acre ground lease by Bass Pro Shop at The Bridges development, the building delivery date is still to be determined. Rail Yard leased 36,518 sf in Crossroads Festival Shopping Center, Parts Authority leased 13,300 sf at 4491 E Speedway Blvd, and Petco renewed their lease at 5355-5455 E Broadway Blvd for 13,010 sf.

Top sales included transactions such as 70,949 sf at Oracle Wetmore Shopping Center which were purchased by Acacia Real Estate Group Inc. for $13 million, indicating continuing demand for quality, well-positioned real estate, despite increased debt costs.

Although no construction projects were completed this quarter, several projects are underway for 2024, totaling 45,329 sf. The construction activity remains at an all-time low, primarily attributed to high construction costs. Despite this challenge and the ongoing supply constraints, there is a sustained and robust demand in the market.

The average lease rate for Q4 stood at $16.58 per square feet (psf) maintaining a gradual increase, which still makes Tucson more affordable compared to larger markets. Oro Valley remained the submarket with the highest rent, averaging $22.48 psf, followed by the Southwest submarket at $20.35 psf. Similar to the previous quarter, construction costs and debt challenges affected the investment market.