The Trend Report, October 2025 Edition

Telecommuting is out and collaboration is in. Occupiers want more private spaces within their offices rather than open work areas. The average space leased across the nation is between 3,200–3,400 square feet (SF); here in our metro area 2,200 SF is the average space leased. Only 10% of leases signed were for more than 4,000 SF1 which means workplace densities are changing. The medical office market remains tight and competitive and will grow in its share through the foreseeable future as the fundamentals for medical office demand were not negatively affected by the past five years. The health emergency and associated lockdowns significantly increased the need for medical space. The Baby Boomer generation coming to retirement will increase medical demands even further as the Gray Wave meets the shores of the medical office market.

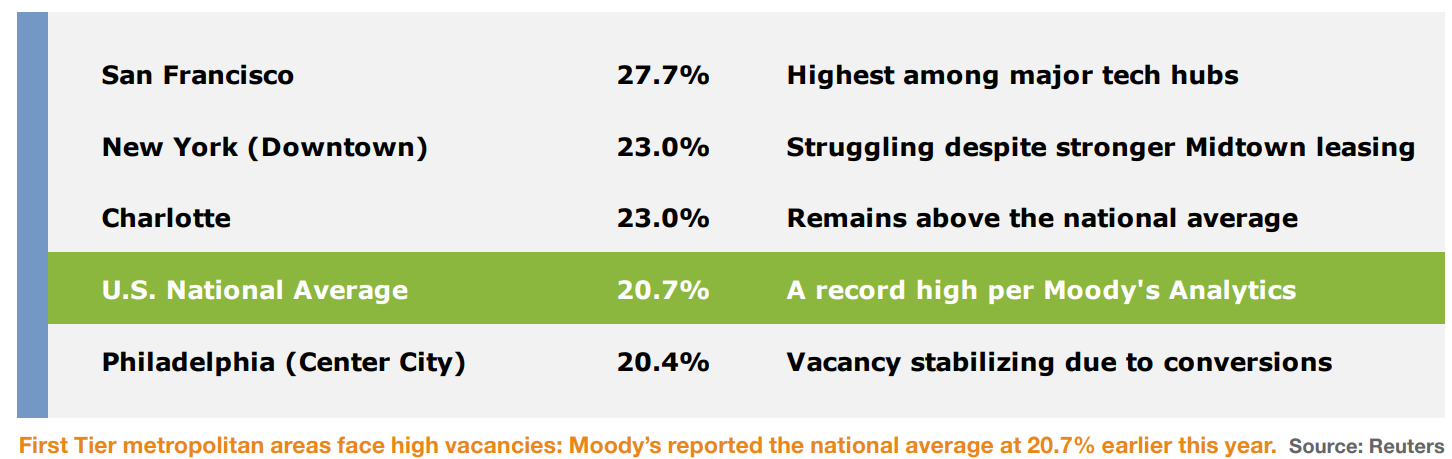

First Tier metropolitan areas face high vacancies: Moody’s reported the national average at 20.7% earlier this year.2

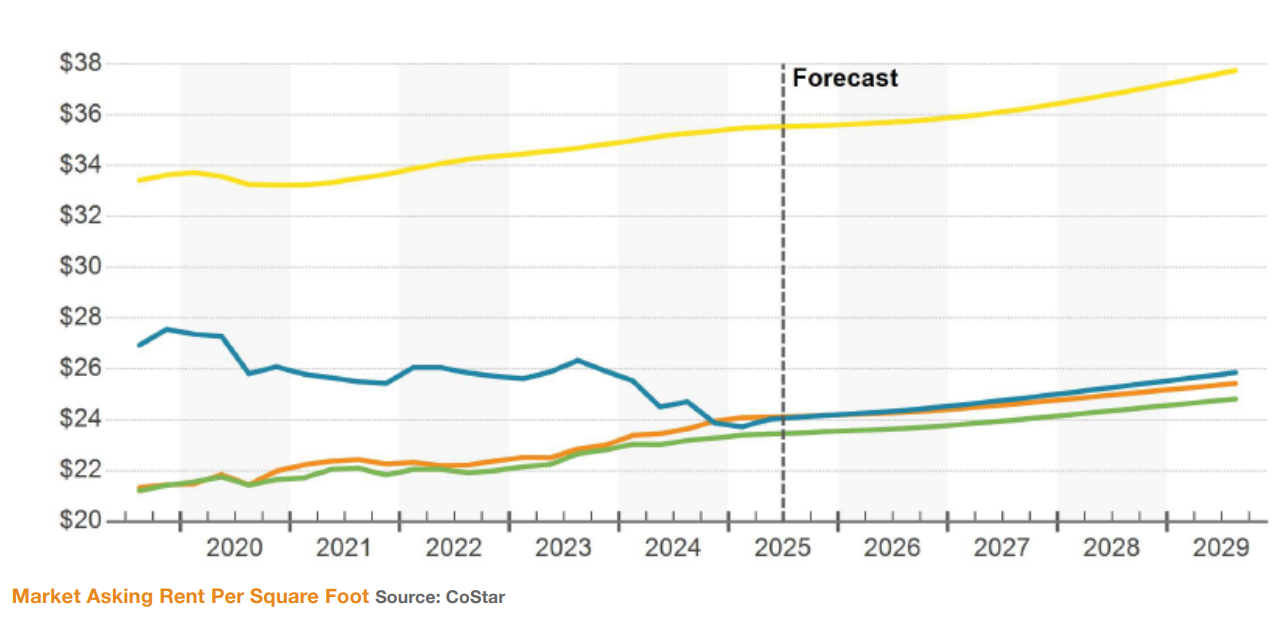

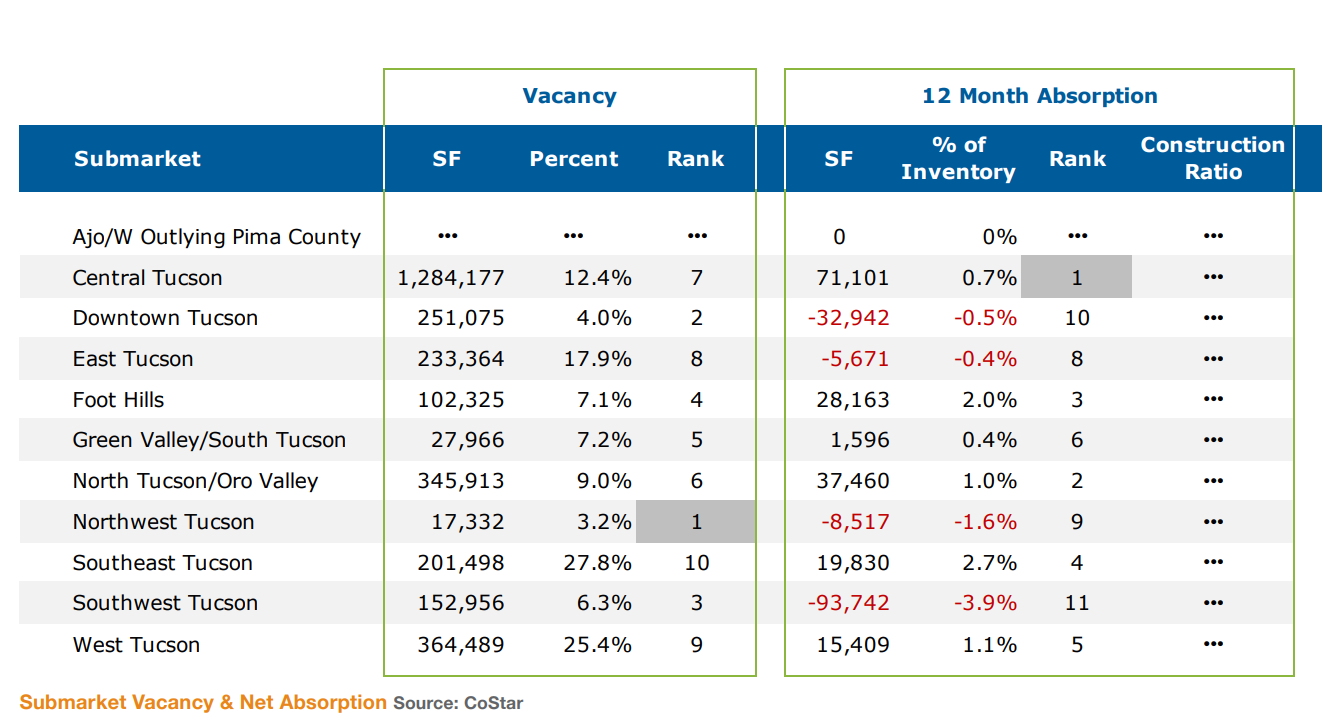

The Flight to Quality morphs into the Flight to Value here in Tucson. You’ll find winners and losers in the hunt for the new “in” amenity: sparkling gyms in larger office projects are currently underutilized though it’s anticipated that tenants will fill them up; to my delight, gourmet coffee is just about everywhere in the Class A buildings in town. Owners offering quality space at affordable rates with solid amenity packages are enjoying lower vacancy, especially in our metro area where vacancy averages 10.4% or just about half the national number. Lease rates are on the rise locally, a modest 1.4% annual increase versus the national 0.9% average.1

The push for return to office helped Tucson’s positive absorption with 32,700 SF of space coming off the market over the last twelve months. The lack of construction supply, while concerning, is what continues to bolster our market vacancy and lease rates. Tucson bucks the national trend for office building construction: speculative office building is not and does not happen. When was the last significant building built under speculative conditions by a private developer? 1 South Church in the 80’s? Some high demand submarkets with low vacancy rates—the Northwest, Southwest, Downtown and the Foothills—could really benefit from a supply boost.

Important to note, the office market is reaching an inflection point with the advent of AI and the associated robust data needs. The possibility of workforces slimming down is more than very real; it is imminent as employers find more innovative ways to automate and streamline business processes and functions with AI technology. Predictions are being made that a one-billion-dollar company will soon exist, run by one person.3 Such an occurrence would bring tectonic shifts to the professional office market.

A recent local example of the AI/big data trend made national headlines over the last month: Project Blue. The proposed Amazon-linked data center campus seemed to be dead on arrival—after two years of closed doors negotiating—but, AZPM reports an energy supply agreement was filed with the Arizona Corporation Commission at the end of August related to the project. This data center appears to be moving forward, though where it will be built is yet unknown.4 A viable project includes the local populace being assured that water and power supply shall be increased, with prices staying the same or better yet, dropping rather than put under further strain and demand. And while not a specific endorsement, Amber Smith wrote much truth in her August 23rd Arizona Daily Star opinion piece.5

Finding a middle ground will be critical. Tucson’s office market is performing well, in large part because our community has resisted unchecked sprawl. That restraint has insulated our core from the vacancy and blight plaguing larger metros. At the same time, the same cautious mindset can make it difficult to embrace transformational projects like Project Blue. Tucson’s challenge, then, is to preserve the qualities that keep our market healthy while recognizing when an opportunity has the scale and long-term value to merit community support.

Pima County may find a viable path, where the city of Tucson rejected the project, despite representing the most significant economic development project the region has seen. A project such as this doesn’t immediately impact office needs, though a few out of the region/state companies may find value in locating themselves near to such a data center; housing and retail demand could increase around such development and importantly, could attract more quality business ventures which develop under sound stewardship by our citizens confidently and respectfully guiding the local ships of government.

A Northern California Bay Area native and visitor to Tucson since 1989, Ryan McGregor moved to the Old Pueblo in 2003. He has been active in commercial real estate in Tucson since 2004, after beginning his career with a top-producing luxury residential team in the Northern California East Bay. Ryan joined Cushman & Wakefield | PICOR’s office division in the summer of 2017. He enhances value for his clients through a background in a wide variety of closed transactions in the Office, Industrial, Retail and Multi-Family markets including Landlord and Tenant Representation, Investment and Owner/User sales and Property Management. He can be reached at Rmcgregor@picor.com.

SOURCES:

[1] – Costar Report – Q2 2025

[2] – https://www.moodyscre.com/insights/cre-trends/cre-monthly-update-april-2025/; https://www.reuters.com/press-releases/us-commercial-real-estate-crisis-office-vacancy-record-highs-2025-08-25/

[5] – https://tucson.com/opinion/column/article_d8412240-53b5-4929-978f-9dcfc09dc521.html/