To read the full report on Tucson’s multifamily activity in Q3, click here.

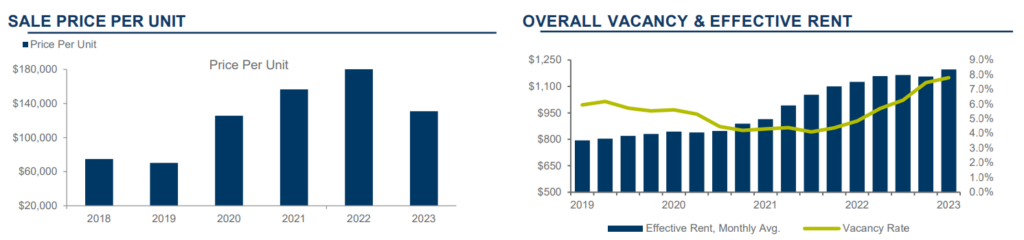

The Tucson multifamily market continued to display dynamic trends throughout Q3. The vacancy rate notably grew to 7.76%, marking a significant 1.61% YOY increase. Moreover, the Tucson MSA’s inventory increased measurably by 233 units during this period, indicating a growing demand for housing in the region. On the rental front, monthly gross apartment rents in Tucson climbed to $1,167 per unit or $1.58 per square foot, registering a $14 uptick or a 1.18% increase from Q2 2023. These statistics reflect the robust activity in the Tucson housing market, suggesting an attractive investment landscape for both renters and investors in Q3 2023.

Tucson’s rental market saw adjustments this quarter due to rapid rent inflation impacted by increasing operational expenses. The Tucson MSA saw a $31 (2.66%) average gross rent increase with the average rising to $1,167 per unit. Southeast Tucson reported the highest rent at $1,599, while South Central Tucson recorded the lowest at $1,000. 12 submarkets experienced rent hikes, with the South Tucson/Airport submarket leading with a 3.57% increase of $38. The Southeast Tucson submarket displayed the largest gain of $180.

In Q3 2023, Tucson’s apartment market experienced shifts in supply and demand. The construction pipeline remained active with 8,367 units in progress. Occupancy increased by 223 units, driven by 68 units in the Oro Valley/Catalina submarket in Q3 and Southeast Tucson’s year-over-year gain of 189 units. Northeast Tucson saw a decline of 52 units in Q3. The Tucson MSA maintained competitive vacancy rates, favoring renters, with expected rent increases in Q4. While Q3 2022 had a larger difference between the supply and demand, this gap is decreasing every quarter and is advancing closer towards equilibrium.