To read the full report on Tucson’s industrial activity in Q2, click here.

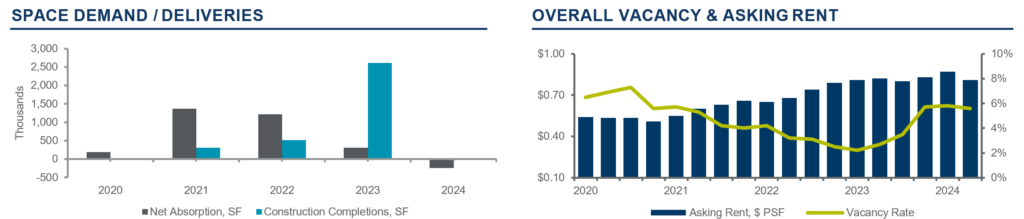

During Q2 2024, Tucson’s industrial vacancy rates rose to 5.6% from a historic low of 1.8% in Q1 2023, driven largely by the completion of four large speculative warehouses. Despite this increase, demand for logistics and warehouse space continued to be high; even with these new deliveries, demand still outpaced existing inventory.

Leasing activity continued to be active, driven by logistics occupiers and businesses seeking space near Tucson International Airport and in the Northwest submarket. Noteworthy transactions this quarter included an undisclosed tenant leasing Flint Development’s new 129,637 square feet (sf) building at 3780 E Valencia in the Tucson Commerce Center and a sublease of 60,000 sf at 300 S Toole in Downtown Tucson. In terms of investment sales, Flint Development closed significant transactions with the sale of 3610 E Valencia for $39 million to W.P. Carey Inc., 3780 E Valencia for $40 million to Tucson Bridge Investment Group, and 6690 S Alvernon for $38 million.

Tucson industrial construction activity remained relatively restrained, with only one notable project underway, a 20,900 sf industrial building at 4736 S Butterfield, scheduled for completion by September 2024. The Southwest Tucson/Airport submarket continued to lead in growth, supported by distribution centers for Amazon, FedEx, and HomeGoods, contributing to a 20% increase in inventory since 2019.

The average lease rate in Tucson, at the highest level, was $0.81 per square feet (psf) per month, significantly lower than rates in California where rents may exceed $1.50 psf per month. Tucson’s affordability, coupled with its strategic location near key trade routes such as the U.S./Mexico border and Ports of Los Angeles and Long Beach, enhances its appeal to new tenants and investors alike. Overall, Tucson’s industrial market remained healthy with active leasing activity, sustained demand for space, and ongoing investor interest. Tucson’s outlook for the next quarter remains positive, driven by demand and strategic developments in key submarkets.